Case Study: A Clark Square Capital beauty

Major selling pressure with no regard for fundamentals trading at an absurdly cheap valuation.

“The days of finding the fattest of fat pitches in the stock market are over.”

“Buffett just got lucky he came up prior to the advent of modern technology. It’s impossible to find those sorts of bargains in today’s world. Efficient Market Hypothesis theory baby. There really is no point in being an active inves… ”

Let me stop Mr.Doomsday right there.

In every generation, you’ll find these exact same individuals who spout their “what’s the point” diatribe. The “it’s all over” nonsense.

And in every generation… they are plain and simple proven wrong.

A major purpose of this publication is to showcase who, how and when individuals from all over the world, from all walks of life have been able to find and exploit value situations gifted by Mr. Market on a silver platter.

These situations are sometimes hiding in the backwaters of public markets. Whilst other times, they are hiding in plain sight for all to see.

The only pertinent question to ask is who was willing to do the looking?

The good news is that today, I tell you of the escapades of one such brilliant investor.

His pseudonym is Clark Square Capital.

Lets Dig in.

Intro

Clark Square Capital (CSC) has time and again uncovered and exploited incredibly attractive value situations across the spectrum of global markets. I have been a subscriber of his for years and have gained immense value out of his work. (If you haven’t yet subscribed to his publication, you can do so here: https://www.clarksquarecapital.com/)

Below, we’ll delve into an incredibly attractive investment opportunity CSC identified involving L’Occitane.

Brief background

L’Occitane is a global manufacturer and retailer of beauty and personal care products focussing on natural and organic ingredients.

The company traded under the ticker 973 on the Hong Kong stock exchange.

L’Occitane’s major brands at the time included:

L’Occitane en Provence (LEP)

Sol de Janeiro (acquired in 2021)

Elemis (acquired in 2019)

It’s important to consider a few key dynamics unique to L’Occitane’s equity before we move ahead.

A happy hunting ground for the astute investor

L’Occitane was a European company trading on the Hong Kong stock exchange. This meant that a lot of European fund managers were restricted in their capacity to buy L’Occitane due to EU regulations.

A low free float

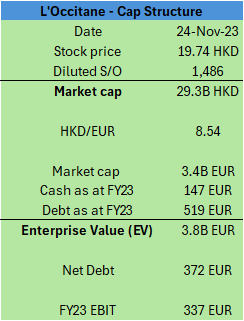

The chairman Reinold Geiger owned 70% of the company. Despite having an EV of 3.8B EUR, only 30% of shares were in the free float. Average daily traded volume was ~1.85B EUR. Therefore, a lot of the bigger players were kept out of the arena.

Poor Corporate Disclosures

Earnings transcripts weren’t available on any news service. Hence, those unwilling to go fishing for these - via L’Occitane’s website or contacting IR - were unable to retrieve key qualitative insights into some recent ugly earnings prints.

The situation

Allow me to take you back to November 2023.

Two major events just took place leading to a significant mispricing in L’Occitane’s equity.

The event set-up

In early August 2023, rumours were swirling that L’Occitane’s chairman was ready to take the remainder of the company off the board at $35HKD per share, representing a large 37% premium to the previous closing price: https://www.bloomberg.com/news/articles/2023-08-09/l-occitane-boss-is-said-in-advanced-talks-on-6-5-billion-buyout).

However, 3 days later the company confirmed Geiger was only interested in taking the company private for “no less than $26 HKD per share.”

Then by September 2023, it was announced Geiger was no longer interested in proceeding with the deal whatsoever.

This preceded a mass selling onslaught with the exit of event investors who’d only taken positions anticipating a premium take-private bid from the chairman. As such, the stock was dumped, collapsing by over 30% down to $19.74HKD per share.

These deal break scenarios are often an extremely fertile hunting ground for fundamentally oriented investors willing to adopt a longer-term investment horizon. CSC knew this perfectly well.

Next, L’Occitane had recently announced a gargantuan marketing spend in FY24 of 100M EUR, mostly to be directed towards its’ core LEP segment. This meant operating margins were being guided down by 400 basis points from FY23's level, to just 12% in FY24. To illustrate the significance of this, consider that FY23 EBIT was 337M EUR at a 16% margin. Hence, this proposed spend represented close to a third of just the previous years’ operating earnings!

While most investors feared this huge incremental spend was now a permanently baked in cost of operating, CSC recognized the major likelihood this spend would only prove one-off in nature.

There were a few notable reasons for this inference:

Firstly, core LEP had been performing well. It wasn’t as if this proposed spend was off the back of any earnings weakness. In fact, when peeking under the hood, core LEP still grew in FY23.

Secondly, the timing of the announcement was peculiar. Lowering margins to just 12% in FY24 whilst still maintaining a medium-term target at 16% sent a strong signal to the astute investor that this move was more about resetting investor expectations to enable a potential takeover at a lower price.

Combined, CSC was taking a well-informed bet that margins would likely rebound from these trough FY24 levels in the medium-term.

In sum, these events set the scene for Clark Square Capital’s November 2023 L’Occitane write-up.

While most investors were myopically focused on the enormous increase in L’Occitane’s FY24 OPEX, CSC was focussed on top line growth and a medium-term margin rebound.

The growth kickers

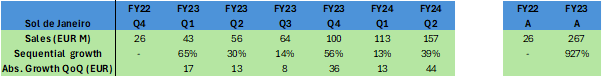

Sol De Janeiro (SDJ) was the hidden crown jewel asset for L’Occitane.

SDJ had grown quarterly sales by 6x in just 1.5 years.

In its most recent print (Q2 FY24), SDJ did over 600M EUR annualized in sales, a far cry from levels it achieved just 12 months prior!

While it was difficult to forecast SDJ’s future growth with clarity, the runway was abundantly clear when you consider the following:

Prior to FY24, SDJ had no presence in travel retail. However, SDJ had recently launched into this market in both Europe and North America. Travel retail represents a key channel for any Beauty and Personal Care business. Even better, SDJ planned further expansion into the greatest travel retail market in the world, the Asia-Pacific region, in the back half of FY24.

SDJ was rapidly improving its product mix. When acquired by L’Occitane in 2021, 50% of SDJ’s sales were derived from a single product, its’ bum bum cream. However, by Q2 FY24, this mix had improved substantially, with its recently introduced fragrance mists already becoming the brands’ top seller, providing much needed product diversification.

In the U.S., SDJ’s exclusivity contract with Sephora was about to end, presenting an opportunity for the company to partner with a much larger network of retailers.

The greatest margin of safety oftentimes may be found in a rock-solid earnings trajectory. You didn’t have to be a rocket scientist to have understood the likely path of SDJ’s future earnings and margins as they went about scaling their cost base.

What about the other major brands?

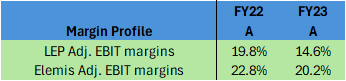

In FY23, both Elemis and L’Occitane en Provence (LEP) had experienced temporary issues.

Elemis

Elemis had recently lowered promotional product placement within its e-commerce channel in a bid to transition towards more premium offerings. This transition had weighed on growth in prior quarters.

However, management were guiding for growth to trend towards a mid-teens constant currency rate in the medium term.

Core L’Occitane en Provence (LEP)

LEP divested its Russian operations in June 2022 due to the war. The top line was negatively impacted as a result. However, these negative YoY earnings prints were on the cusp of being lapped from Q3 FY24.

Also, their Chinese and APAC markets had come in soft in prior quarters. Yet evidence of a turnaround had begun with the most recent quarter of Q2 FY24, showcasing double digit growth in its Chinese business.

Management reaffirmed their guidance of medium-term, mid-single digit (MSD) growth.

Elemis and LEP Takeaways

There were undoubtedly more question marks on the trajectories of Elemis and LEP when compared with the robust growth profile of SDJ.

However, despite Elemis’ recent issues, its operating earnings remained steady, depicting the segments’ resilience. Earnings were higher margin, and the rollout of its premium offerings represented a decent call option on the resumption of strong growth.

The fate of LEP was even lesser known than that of Elemis. Sales had been growing but margins were compressed. Who really knew what was to come?

As investors we must consistently focus on what truly matters.

Are we able to separate the signal from the noise?

In this vein, LEP’s uncertain earnings trajectory was clearly buffered by the higher margin, faster growth profiles of SDJ and Elemis. The kicker here was that the bulk of the exorbitant 100M EUR marketing spend was being directed towards LEP, offering a potential catalyst for reinvigorating the sales machine beyond the MSD guided growth.

In other words, recognizing the trajectory of L’Occitane’s overall growth didn’t require any specialized or intimate knowledge. Any Joe Blow from down the street could have seen it had they undertaken the all-important process of separating signal from noise; a process CSC flawlessly executed as you will see below.

Valuation

A backdrop

Historically, L’Occitane’s all time low P/E multiple was 12x. On average however, it traded at around a 20x P/E.

At the time, beauty peers were regularly trading above 30x EPS or at 20x EV/EBIT.

M&A transactions also validated these premium multiples with Naturium and Aesop both recently taken off the board for >20x EBITDA.

How L’Occitane was trading

Despite the historic 12x floor multiple, at the time of CSC’s write-up L’Occitane was trading at just 10x FY25 P/E. This was an insanely low multiple relative to both peers and its own history.

Even on FY24’s projected trough EPS of $1.37HKD– a figure severely dampened by the one-off marketing spend – L’Occitane was trading at just a 14x P/E multiple; insanely cheap and offering an extremely attractive entry point.

The reality is CSC didn’t reinvent the wheel on this one. He just used common sense. A 20x P/E on FY25 expected earnings was CSC’s target multiple, resulting in a $40HKD price target. Noting the expected earnings growth for FY26, rolling this multiple would have implied a $50HKD share price.

The likely path and the big risk

One couldn’t ignore the possibility of another opportunistic bid from the Chairman. After all, the equity was trading at all time low multiples. Management had just tanked the stock price down to ~$20HKD by announcing an exorbitant one-off marketing spend, conveniently timed just after Geiger extracted his original low-ball interest at “no more than $26HKD per share.”

At the time, a valid thesis may have been that Geiger’s intention was to embark on a long-winded campaign to reset market expectations and exacerbate investor fatigue such that he could later take the company private at an extremely attractive price that would now very likely go unchallenged.

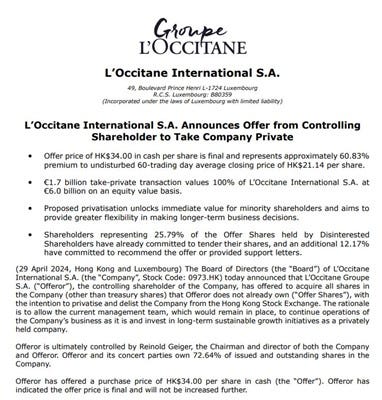

The (great?) take-private

Lo and behold, by late April 2024, this is exactly how it played out. Geiger took the company off the board entirely. Most would argue he got an insanely good deal, paying just $34HKD per share.

As for CSC, he sold his shares at a price of $33HKD straight after the market opened following the deal announcement, not wanting to risk any further deal breaks. With months until the take-private would go on to officially close, CSC clearly took the most prudent path.

This take-private transaction would no doubt have frustrated many investors who felt the company was materially undervalued by Geiger’s offer. However, this reality didn’t stop Clark Square Capital from returning 67% on his investment over just a 5-month time-horizon.

CSC’s execution depicts the importance of staying focussed on what truly matters. As investors, we are all sometimes guilty of succumbing to the emotive pulls of the panic master’s seemingly more concerned with the trivial and inconsequential unknowns rather than the all-important separation of signal from noise. CSC ignored the panic and focussed on the opportunity created by Mr. Market’s pessimism. He was able to pounce when most were fearful. And in the end, his 67% 5-month return was the only thing left to do the talking.

If you’re interested in checking out Clark Square Capital’s original L’Occitane write-up, click here:

Disclaimer

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

Credit to CSC for the flagging + running with the idea (I saw the idea from him and was nice winner for me so am definitely appreciative!)... pretty sure though his thesis was borrowed from somebody else who wrote it up on VIC a few weeks earlier (CSC is a VIC member)