Challenger Gold (CEL:ASX)

2.6x NTM EV/EBITDA. 75% of Today's Market Cap to be Generated in FCF Over Next 3 Years.

Welcome back Tenva Capital readers!

I have a new idea in store for you today with highly compelling near-term upside potential.

The stock is dirt cheap with material impending catalysts on the horizon that I believe will lead to a nice re-rating.

If you find my work valuable, please share it with a friend or colleague and subscribe below for more in-depth research on overlooked and undervalued stocks across the globe.

Thesis Overview

Challenger Gold (CEL:ASX) is on the cusp of a critical transition from a dual-asset explorer to a de-risked, fully funded, near-term gold producer.

From January 2026, the company will commence production via the Toll Milling of 3% of its high-grade Hualilan flagship asset in San Juan, Argentina.

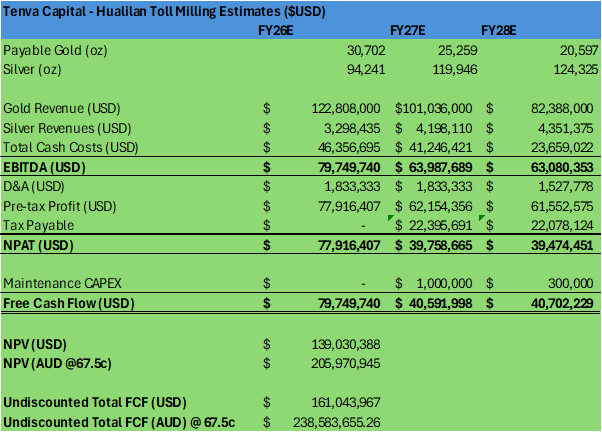

At US$4000/oz gold, Challenger should generate ~75% of today’s market cap alone in Free Cash Flows over the next 3 years.

Critically, this will enable a large bulk of the financing for the remaining 97% standalone Hualilan project which I believe the market is ascribing very little if any value to today.

Moreover, the market seems to be completely ignoring Challenger’s active engagement in monetizing its’ Ecuador assets.

These represent a massive, yet-to-be-realized source of value backed by CMOC’s recent takeover of Lumina Gold’s adjacent Cangrejos project – with look through valuation that implies AU$170M – 54% of today’s market cap - for CEL’s attributable resources.

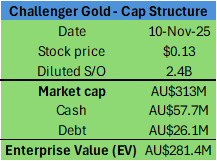

Despite being on the cusp of production from January 2026, Challenger today trades at a meagre 2.6x NTM EV/EBITDA, assuming US$4000/oz gold.

At US$3000/oz gold, Challenger is still far too cheap at 4.2x NTM EV/EBITDA.

Upon the commencement of robust Free Cash Flow generation from January 2026, I believe the market will rapidly wake up to the Challenger Gold story with the stock quickly re-rating to at least 0.4x P/NPV, implying 46% near-term upside from the last traded price of $0.13.

Let’s dig in.

Core Thesis Drivers

De-Risked Pathway to Near-Term Cash Flow: Challenger has executed a strategic Toll Milling Agreement for its Hualilan project, positioning the company to become a producer in early 2026 with minimal upfront capital. This initial stage is forecast to generate approximately AU$238M in after-tax cash flow, providing substantial non-dilutive funding for the project’s larger, standalone development.

World-Class, High-Grade Resource: The Hualilan project hosts a globally significant Mineral Resource Estimate (MRE) of 2.8 million ounces of gold equivalent (AuEq). Crucially, this resource contains a substantial high-grade core of 8.1 million tonnes at an impressive 5.0 g/t AuEq, which underpins the robust economics of both the initial toll milling phase and the long-term standalone operation.

Significant Latent and Strategic Value: The El Guayabo Project in Ecuador represents a profoundly compelling source of value, with a maiden MRE of 9.1 million ounces AuEq, of which 6.9M AuEq are attributable to CEL. A clear monetization strategy, underscored by a direct corporate precedent in the adjacent Cangrejos project, positions El Guayabo and Colordo V as tangible, non-dilutive funding instruments for Hualilan’s full-scale development.

Exceptional Leadership in a Highly Favourable Jurisdiction: The Board provides unparalleled in-country expertise, featuring a former Secretary of Mining for the San Juan province, a former Australian Ambassador to Argentina, and one of the Argentina’s most prominent businessmen, Mr. Eduardo Elsztain, who is also a major shareholder of the company. This team offers exceptional social and political de-risking in Argentina, a jurisdiction rapidly undergoing significant pro-mining reforms that reduce taxes, remove currency controls, and guarantee fiscal stability.

Clear, Self-Funded Growth Trajectory: Challenger’s two-pronged growth strategy is clear and logical. First, leverage the cash flow from the toll milling operation to finance and construct a major standalone mine at Hualilan. Second, systematically explore the district-scale potential at Hualilan, where the current resource remains open and represents only a fraction of the prospective geology under the company’s control.

Recent Unexpected AU$30M Equity Raise to Ensure Full Funding as well as Recent Gold Price Scare resulted in a temporary price dislocation from underlying value for CEL.

Capital Structure

The Flagship Asset - Hualilan

The 100%-owned Hualilan Gold Project is CEL’s strategic centrepiece and engine for near-term cash flow and long-term value creation.

Hualilan is one of Argentina’s oldest gold mining sites. The geology is backed by extensive historical data as well as 240,000 meters of diamond core drilling.

The project has fantastic infrastructure including transportation access via a double lane sealed highway as well as pre-existing energy and water infrastructure.

Hualilan is only 1.5 hours by road from San Juan City, Argentina’s main mining hub, which provides access to a deep pool of experienced local mine workers and high-quality service providers.

Hualilan has a JORC compliant MRE of 2.8Moz AuEq with 60.6Mt @ 1.4 g/t AuEq.

More than 75% of the 2.8Moz AuEq resource falls within the Indicated Category.

The resource starts from surface, remains open in multiple directions, and is characterized by a significant high-grade core (9.9Mt @5.0g/t AuEq for 1.6Moz AuEq).

Intersections outside the current resource include 13.0m at 15.5 g/t AuEq (600 metres south of the MRE) and 4.0m at 5.8 g/t AuEq (600 metres below the MRE with the hole ending in mineralisation).

Challenger controls a district scale footprint of 600 square kilometres surrounding Hualilan that contains approximately 30 kilometres of untested strike.

The location of the project has low environmental sensitivity, and the company has purchased 20,000 hectares’ surrounding the project with all mine infrastructure to be located on Challenger owned land.

Hualian’s dual revenue model

Post FID, junior mining companies are often faced with daunting up-front CAPEX bills in order to bring their flagship assets to production. Much of the time these are funded with massively dilutive equity raises.

To avoid this, Challenger is strategically employing a shareholder friendly hybrid revenue model designed to solve this classic CAPEX funding dilemma.

This involves:

Toll Milling – From January 2026, Challenger will monetize a high-grade, close to surface portion of the resource. This makes up only 3% of the total resource at Hualilan yet assuming a US$4000/oz gold price should deliver them approximately 75% of today’s market cap over the next 3 years with imminent Free Cash Flow generation from January 2026.

Development of the Standalone Hualilan project – Challenger will utilize the robust Free Cash Flows generated from the toll milling to significantly de-risk the targeted production of the standalone Hualilan project whilst financing the vast bulk of the up-front CAPEX requirements in a non-dilutive fashion.

Phase 1 – Toll Milling

Challenger has secured a de-risked, low-capital intensity pathway to production via a toll milling agreement with ASX-listed Austral Gold to use its nearby Casposo processing plant. This strategy allows the company to monetize high-grade, near-surface oxide material with minimal upfront investment.

A 2025 Pre-Feasibility Study (PFS) on this phase confirms its compelling economics assuming just a $US2500/oz gold price:

Forecast EBITDA: US$195 million.

After-tax Cash Flow: US$130 million.

Forecast All-In-Sustaining-Cost (AISC): ~US$1,454/oz AuEq, which while higher than a standalone operation, provides a robust margin at current gold prices and serves as a strategic bridge to the far lower-cost Stage 2.

Rapid Payback: < 3 months from the commencement of mining.

Resource Utilized: Uses only 3% of the total Hualilan MRE.

Crucially, this first stage of production is fully permitted. The company is on track to commence processing in January 2026, marking its transition to a cash-generating producer.

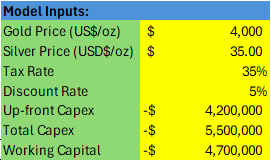

Utilizing the data from Challenger’s PFS, my estimates imply an NPV5 of AU$206M at a US$4000/oz gold price.

Why Casposo?

Casposo was previously on care and maintenance because it was losing money due to lower than budgeted realization of metal prices and worse-than-expected production (lower grades and less tonnage).

This meant that Austral had a fully permitted asset in their Casposo mill but were faced with the absence of economic ore to feed it and therefore had no incentive to restart the mill.

Enter Challenger Gold.

The toll milling agreement with Challenger provided the economic incentive and the cash flow for Austral to refurbish and restart their idle plant, whilst enabling CEL to commence production of high-grade gold and silver at Hualilan in a capital-light manner, and without needing to finance a much larger project initially envisaged in the 2023 Scoping study to achieve first cashflow.

Importantly for Challenger the Casposo mill is a known entity with historical production of over 323,000 ounces of gold and 13.2 million ounces of silver.

During previous operations Casposo achieved average annual production of 40,000 ounces of gold and 1.6 million ounces of silver at recoveries of 90% for gold and 79% for silver.

The mill is located 170km from Hualilan via established roads and infrastructure.

The agreement ensures toll processing of 150,000 tonnes per annum of Hualilan material over three years, with total secured capacity of 450,000 tonnes for Challanger’s ore.

Key operational contracts have been executed with ORICA and THOR S.A. for explosives and drill and blast respectively.

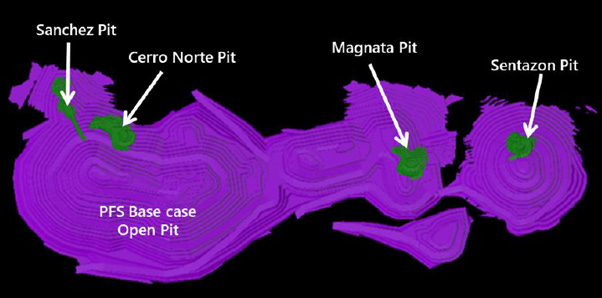

This allows the company to commence open pit mining from early December 2025 with first gold production from the toll milling project in January 2026.

Source: CEL announcements

Challenger plans to mine the Cerro Norte, Sanchez and Magnata pits whilst leaving the Sentazon pit as a reserve source for optionality.

Casposo will run campaigns that batch treat Challenger’s ore in 75,000 tonnes over rolling 3 month on - 3 month off periods commencing from January 2026. The off months for Challenger allow Austral’s lower-grade stockpiles to also be processed.

The tolling arrangement will provide valuable data insights on mining and metallurgy to be utilized in the upcoming and refreshed 2026 PFS and Bankable Feasibility Study (BFS) for the standalone large-scale Hualilan operation.

Phase 2: Standalone Hualilan

Prior to the toll milling strategic shift, Challenger conducted a 2023 Scoping study on the entire Hualilan project which indicated an NPV5 of US$409M (AU$630M) at a conservative US$1,750/oz gold price.

Since then, the company has announced it will conduct an updated PFS for the standalone Hualilan project that reflects its newfound toll milling cash generative strategy.

The company has identified clear opportunities to enhance these robust economics, including heap leaching lower-grade material and producing gold-silver doré on-site, which will be incorporated in the forthcoming PFS in Q1 2026.

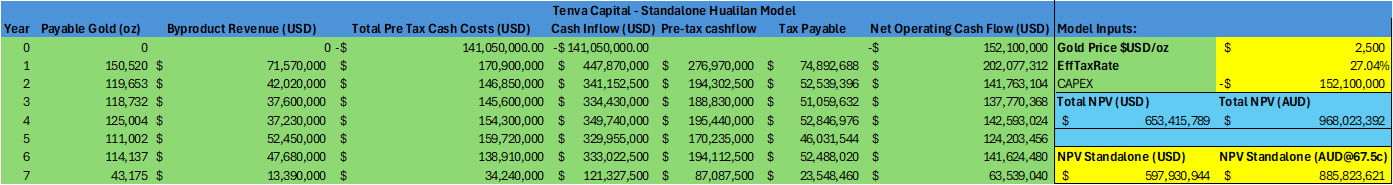

For now, the best approach to value standalone Hualilan is to conduct an NPV under the pretence of the 2023 Scoping study and subtracting the Toll Milling NPV.

In this manner, at just US$2500/oz of gold, standalone Hualilan’s NPV5 is $886M.

Hualilan’s District-Scale Potential

Beyond the defined resource, Hualilan presents significant exploration upside. Challenger controls a district-scale tenement package of over 600 square KMs, covering 18 KMs of the prospective Hualilan geological trend.

The current 2.8 Moz MRE is defined over just 2.5km of this trend, implying that less than 15% of the primary prospective strike has been systematically drill-tested. This presents a clear and substantial pathway for multi-generational resource growth.

Challenger’s Strategic Asset Base in Ecuador

The El Guayabo project in southern Ecuador is a bulk-tonnage gold-copper system that represents a substantial source of latent value.

Strategically located 5km along strike from the Tier-1 Cangrejos project that was acquired by CMOC Group in April 2025, El Guayabo shares a similar geological setting and scale, positioning it as a globally significant asset.

Challenger’s strategy for its Ecuadorian assets is clear: monetize the project’s value through a strategic sale or spin-off, with the proceeds intended to fund the full-scale, standalone development of Hualilan.

The recent acquisition of the adjacent Cangrejos project by CMOC at US$25/ resource oz provides a direct strategic precedent that establishes an implied valuation benchmark of AU$170M for Challenger’s Ecuadorian asset base. It also identifies a logical corporate acquirer, significantly de-risking this monetization pathway.

Despite this, there remains large jurisdictional risk in Ecuador and as such I assume 0.4x this look-through valuation at AU$68M in the name of ensuring a wide margin of safety.

Valuation

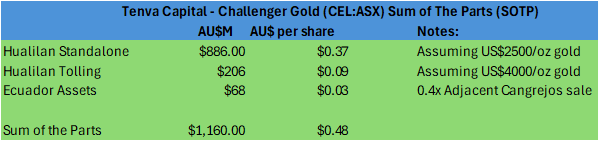

Given the various projects are all at different phases of their life cycles, a Sum of The Parts (SOTP) valuation makes the most sense for Challenger.

For standalone Hualilan, I assume US$2500/oz gold price.

For the Toll Milling at Hualilan, I assume US$4000/oz gold price.

For the Ecuadorian assets I assume a gargantuan margin of safety at 0.4x the look-through valuation of CMOC’s recent purchase of Lumina’s adjacent Cangrejos project.

My view is that upon Challenger executing the toll milling, the stock should rapidly re-rate in line with at least 0.4x EV/NPV ($0.19 per share) to reflect the de-risking of both the toll milling project and the capacity to finance the larger standalone project.

0.4x NPV is highly conservative when compared with global peers rapidly fast tracking and de-risking the financing of taking their flagship assets to production.

Moreover, at US$4000/oz gold, the company should generate ~AU$120M in EBITDA in FY26, implying a meagre 2.6x NTM EV/EBITDA multiple!

Even at US$3000/oz gold, the toll milling should generate ~AU$75M in EBITDA in FY26, implying a still very cheap 4.2x NTM EV/EBITDA multiple.

With gold producers currently trading at around 8-12x EV/EBITDA - noting that growing gold producers trade at the top of this range - there is a plethora of latent value still to be unlocked in the CEL share price from today’s levels.

Step-change in Argentina’s Operating Environment

Operating success in the mining sector is intrinsically linked to geopolitical stability and strong community support.

Challenger is exceptionally well-positioned on both fronts in Argentina, operating in a rapidly improving political landscape under the Millei government and benefiting from a deeply embedded social license.

Argentina’s Pro-Mining Transformation

Recent political and economic reforms in Argentina have created a significantly more attractive environment for investment in the mining sector. The new government has legislated the Regime for Large Investments (RIGI), which provides a stable and competitive framework for projects like Hualilan.

Key benefits include:

Tax Reduction: The corporate tax rate is reduced from 35% to 25%.

Currency Freedom: The requirement to convert US dollar sales revenue into Argentine Pesos has been removed.

Dividend Repatriation: The regime allows for unlimited repatriation of dividends.

CAPEX Savings: Projects are exempt from import taxes on capital goods, lowering development costs.

Guaranteed Stability: The framework guarantees legal and fiscal stability over the life of the project.

Board and Management Team

CEL’s leadership team represents a key competitive advantage, blending proven mine-finders with executives who possess deep and influential political and commercial experience within Argentina.

Eduardo Elsztain (Non-Executive Chairman): One of Argentina’s most prominent and influential businessmen, providing unparalleled commercial and political connectivity. Mr Elsztain owns 12.8% of the company. Mr Elstain’s March 2025 appointment as Non-Executive Chairman served as a significant de-risking event for Challenger given that he is also a director and major shareholder of Challenger’s toll milling partner Austral Gold.

Sergio Rotondo (Executive Vice Chairman): Founder of Golden Mining SA - the original owner of Hualilan. Mr Rotondo possesses deep in-country development and operational relationships.

Kris Knauer (Managing Director): Geologist and experienced CEO with a track record of value creation, including building and selling Citadel Resource Group for $1 billion.

Sonia Delgado (Executive Director): Former Secretary of Mining for the San Juan province, providing direct regulatory and permitting expertise that has proven critical.

Brett Hackett (Non-Executive Director): Served as the Australian Ambassador to Argentina (2018-2023), offering important diplomatic and commercial connections.

Critically, the Board and management are significant shareholders, collectively holding approximately 24% of the company, and as such are highly aligned with ensuring realization of value for shareholders.

Institutional Alignment

It’s important to note that the shareholder register has matured and attracted significant institutional dollars in recent times.

Renowned Australian funds management business L1 Capital as well as London-based hedge fund and asset management firm Helikon Investments each respectively own 8.8% of the company.

Other large undisclosed North American, European and Asian long-only gold funds also recently joined the register.

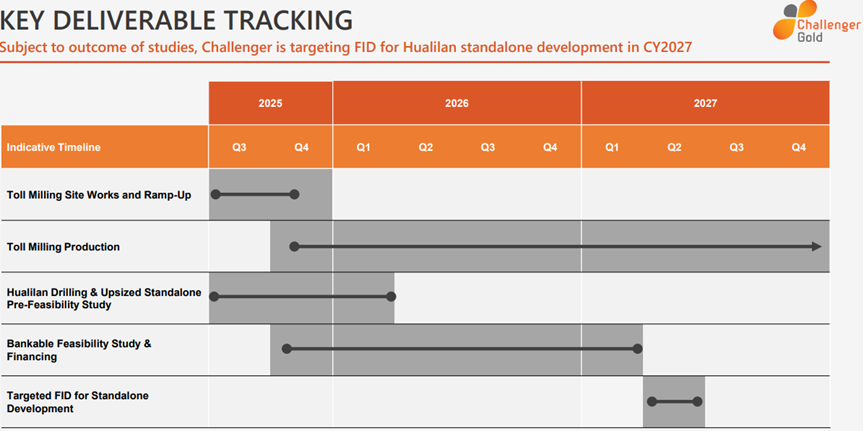

Catalyst-Rich Pathway Forwards

Investors can anticipate a steady stream of news flow over the coming year, with several key catalysts on the horizon:

Q1 2026: Commencement of Toll Milling processing and generation of first cash flow.

Q1 2026: Release of the updated Hualilan Pre-Feasibility Study (PFS) for the large-scale standalone operation.

H1 2026: Ongoing progress updates on the strategic monetization of the El Guayabo and Colorado V Projects in Ecuador.

2026: Commencement of the Bankable Feasibility Study (BFS) for the Hualilan standalone project, funded by toll milling cash flow.

2027: FID target for the large-scale standalone Hualilan project

Source: Company Announcements

Risks

Further delays with the ramp of Casposo.

Problems with Casposo’s capacity to recover gold and silver at historic recoveries.

Any sudden or sustained drops in the gold price.

Inability to sell the Ecuadorian assets would mean there is an equity funding gap of between US$50-70M to ensure standalone Hualilan gets to production.

CAPEX blow outs in toll milling and/or the upcoming studies.

Conclusion

Challenger Gold is today significantly undervalued.

At US$4000/oz gold, Challenger should generate ~75% of today’s market cap alone in Free Cash Flows over the next 3 years.

Challenger trades at a meagre 2.6x NTM EV/EBITDA, assuming US$4000/oz gold. At US$3000/oz gold, Challenger is still extraordinarily cheap at 4.2x NTM EV/EBITDA.

Upon the commencement of significant Free Cash Flow generation from January 2026, I believe the market will rapidly re-rate Challenger in line with at least 0.4x EV/NPV at $0.19 per share, implying at least 46% near-term upside from the last traded price of $0.13.

Thanks for reading! Let me know if you have any thoughts, pushback or questions in the comments below.

Also, if you have any suggestions on other names I should look into, drop me a line at info@tenvacapital.com or @TenvaCapital on X.

This is a reader-supported publication so if you enjoyed this write-up, please consider subscribing below, sharing this with a colleague or friend and hitting the like button. Your support is always appreciated!

Disclaimer

Tenva Capital, its associates and/or entities controlled by its associates hold shares in the company referred to in this post.

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

Great write-up.

Why use NPV5 though? I feel like you should use at least NPV8%.

And when are you expecting first gold from the standalone project? Late 2028 possibly?