Diamond in the rough (PNC:ASX)

3x FY26 P/E, 0.3x conservative liquidation value with multiple near-term catalysts on the horizon.

Welcoming all new Tenva Capital readers!

Below I present you an off the beaten path idea with asymmetric upside potential.

If you find my work valuable, please share it with a friend or colleague and subscribe below for more in-depth research on overlooked and undervalued stocks across the globe. Your support is very much appreciated!

Thesis Overview

Having emerged from an extended period of difficulties, Pioneer Credit is today on the cusp of a major step-change in their earnings profile; with bottom line earnings expected to grow at triple digit rates over the next 2 years as the industry undergoes a sustained multi-year expansion.

Cumbersome regulatory and compliance hurdles have led to major consolidation of the industry. As such, the business today faces less competition than ever before in a market that is rapidly growing supply.

Pioneer Credit is the largest Australian player that does not directly compete with its suppliers; enabling them to become a partner of choice and to rapidly take market share from competitors.

The business is building a nice moat around them in the Australian retail debt purchasing space, as compliance and regulatory hurdles have made it next to impossible for any new competitors to emerge at scale.

This step-change in industry dynamics and impending earnings growth has seemingly gone unnoticed by the market to date; with the company trading at an astounding 3x normalized P/E multiple and 0.3x conservative wind-up liquidation value.

With multiple near-term catalysts on the horizon, I believe Mr Market is offering investors a rare opportunity to purchase shares in a company on the cusp of a major step change in their earnings, at a deeply discounted multiple; all whilst boasting a gargantuan margin of safety between today’s market price and the company’s intrinsic value.

Let’s dig in.

Historic Trading Dynamics

In 2014, Pioneer Credit listed on the Australian Stock Exchange (ASX) under the ticker PNC with a valuation of $60M. By 2017, PNC’s market cap soared above $100M and the company’s equity was mostly valued between $150-200M throughout 2017 to 2019.

However, in mid-2019, a string of issues hit the company that would depress its equity price for the next few years.

Accounting issues, financial covenant breaches, a long-term trading suspension and a messy but failed takeover attempt by their financiers precipitated a horrible time for shareholders. By April 2020, the stock was 92% down from levels traded at 7 months earlier; with a market cap of just $12.5M at the lows.

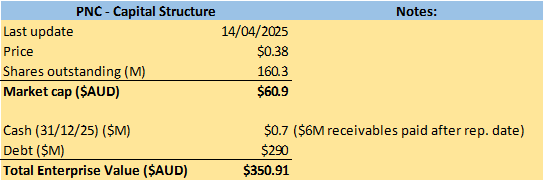

Capital Structure

Today, Pioneer Credit has a market cap of $60.9M; with its stock trading at $0.38 per share. Liquidity is thin, with average daily volume of approximately $85K AUD. There are 160.3M shares outstanding.

PNC has a highly leveraged capital structure; a function of its operating model.

As at 1H FY25, the company had $290M in borrowings.

The company’s debt facilities comprise of:

$34M mid-term notes: Bank Bill Swap Rate (BBSW) + 10.5% interest payable; December 2028 maturity

$272.5M Syndicate facility: BBSW + 5.5% interest payable; June 2028 maturity

Covenants for the debt facilities are closely tied to the carrying value of the company’s Purchased Debt Portfolios (PDPs) held on the Balance Sheet.

Background

Pioneer Credit (ASX: PNC) is an Australian retail debt recovery specialist business.

Pioneer purchases baskets of unpaid retail debts called Purchased Debt Portfolios (PDPs) from Australia’s big 4 banks, other financial institutions and nonbank lenders. These are bad debts which Pioneer purchases at a fraction of their face value. Pioneer then attempts to recover on these debts and has achieved a net IRR of above 15% on every PDP vintage they have invested in since inception.

Free cashflows are then recycled into the purchasing of more PDPs, and the cycle repeats.

In essence, PNC are investors who underwrite impaired debts and profit from recovering these debts at higher prices less the cost to collect.

Managing Director Keith John has been in the debt collection and purchasing industry since 1988. In the 1990’s, Mr John established Pioneer Credit Management Services in Perth, Western Australia. The company began as a private receivables management firm, focusing on debt collection services and purchasing PDPs at a discount from banks and financial institutions.

In the early 2000s, Pioneer Credit Management Services was acquired by Receivables Management Group (RMG), a fledgling national operator aiming to consolidate the Australian debt collection industry.

In 2003, Mr John restarted independently as Pioneer Credit before selling up in 2006 to Credit Corp Group Limited (ASX: CCP), the largest debt collection company in Australia.

In 2009, today’s Pioneer Credit was born with Mr John starting over once again. The business was privately operated for its first 5 years, before listing on the ASX to raise further capital to fuel its growth. The listing provided PNC with the financial resources to expand its PDP acquisitions and compete with larger players like CCP.

Since inception in 2009, PNC’s raison d’être has always been to selectively invest in retail PDP portfolios. Pioneer does not offer any further credit to its customers; a key differentiator for its suppliers who have a strong preference to sell to players they don’t compete with. Today, Keith John is PNC’s Managing Director who also owns 11% of the company.

A troubled history

Pioneer has experienced 2 major industry setbacks since listing on the ASX in 2014.

These now resolved, rear-view mirror setbacks saw the company on the receiving end of multiple negative reports in the press.

I believe the negative sentiment surrounding these historic yet resolved issues is still largely baked into today’s lowly share price; sentiment that I posit is on the verge of a turnaround with imminent events set to catalyse a re-rating.

In 2019, the Australian government slapped down its final report on its Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

The findings exposed widespread incompetence, misconduct, regulatory and compliance failings as well as mistreatment of customers across the banking industry, a key focus of which was on unethical debt collection practices. The big 4 Australian banks – who happen to be PNC’s largest PDPs suppliers - faced intense regulatory scrutiny and public backlash as a result.

The banks became hesitant to sell more impaired retail debt, turning their attention to remediating customers, enhancing compliance and ensuring they responded to tightening regulatory scrutiny around lending and debt collection procedures.

This inevitably resulted in a slowdown of PDP sales, including to Pioneer Credit, affecting their capacity to make meaningful PDP investments and subsequently hurting their bottom line.

This pain was compounded by the effects of the COVID pandemic; a time where generous debt relief programs and massive fiscal stimulus heavily affected both debtor and supplier behaviour, further deteriorating Pioneer’s capacity to conduct business.

Around the same time, PNC started to deal with what at first seemed a relatively innocuous accounting issue over how they reported their PDPs. PNC was reporting its PDPs at fair value, but was required to transition to amortized cost as per IFRS 9.

The issue quickly spiralled out of control for the group. Shares were suspended for months as they got their accounts in order, covenant breaches on their debt facilities were struck, a going concern warning was issued and back and forth legal spats with their financiers The Carlyle Group unfolded as they attempted a messy yet failed takeover.

In surviving this nightmare chain of events for PNC’s shareholders, management was left with little choice but to take on highly punitive financing arrangements with their new set of financiers.

Today, PNC allege they were wrongly advised by their auditors at the time, PwC. As such, in October 2023, the group filed a claim against PwC in the supreme court for damages of up to $32M (including interest accrued).

Unsurprisingly, the share price was completely and utterly beaten down throughout this period:

Today’s environment – a step change

Despite this string of issues, PNC was able to survive. In July 2024, management refinanced their debt facilities on much more favourable terms; 300 bps lower than the previous facility and expected to save $8M a year.

On top of this, massive increases in regulatory and compliance standards due to the fallout from the 2019 Royal Commission findings have notably changed the nature and make-up of the retail debt purchasing industry in Australia. Today, this change represents a huge tailwind for PNC.

Specifically, the industry has undergone mass consolidation; with many of PNC’s competitors simply unable to survive the industry downturn and the huge yet costly uplift in regulatory and compliance standards.

As such, many of PNC’s former competitors exited the industry, entered administration or were acquired by larger firms that could better handle the costly increased compliance burden.

Hence, there are only 2 publicly listed players still standing today in the Australian PDP arena: Pioneer Credit, with 25% market share and rapidly growing, and the larger, more US focussed Credit Corp (ASX: CCP).

To make matters better for PNC’s impending prospects, today we are seeing rapidly increasing PDP supply as banks re-enter the market post the Royal Commission fallout, since adapting to the step-change in compliance standards.

The industry grew from $325M in FY24 to $400M in FY25, as a result of a large supplier re-entering the market. It is expected that this pattern will continue further over the coming years. As MD Keith John noted on the 1H25 earnings call:

“Demand from vendors to partner with Pioneer has exceeded our capacity to absorb the volume of customer accounts available for acquisition… This supply dynamic has continued to improve in Pioneer’s favour during 1HY25 as other participants in the market have pulled back from investing in PDPs with the restriction of credit to some, and a significant competitor entering Administration.”

Hence, as a result of a severe downturn, the industry backdrop today has never looked better. There are fewer players than ever before in a now rapidly growing market. Despite, low consumer confidence in Australia, there is full employment, which is the most important metric in determining the impending health and viability of any debt collection company. To quote Mr John again:

“This environment is as good as I've seen it in my years in this business. And again, just like our vendors, I mean, I think the most important thing is not to take these things for granted. It's not to make assumptions and make easy choices but remaining incredibly disciplined (and) working exceptionally hard.”

Does PNC have an artificially created moat?

In today’s ‘post Royal Commission’ stringent regulatory/compliance environment, consider how incredibly challenging, if not impossible it is for new entrants in the impaired retail debt collection space to form and nurture meaningful relationships with the major suppliers of PDP’s – the big 4 Australian banks.

Today, any bank sales of PDP’s rely heavily on a deep sense of trust and goodwill with its customers. It’s important to remember the banks have recently been through the ringer regarding their former compliance missteps and subsequent regulatory scrutiny. As such, their major priority today is to ensure the ethical treatment of their customers and to have confidence in the compliance procedures of any firm they offload PDPs to; such that they can maximize their chances of avoiding the wrath of the federal regulator; and the inevitable costly undertaking associated.

Relationships between purchasers and sellers of sensitive products like PDP’s are simply not built overnight, and in reality, take years to form.

As the major suppliers of retail PDPs, in what world would the big 4 banks risk forming a new relationship with some unproven operator in today’s highly scrutinized regulatory environment?

As such, it’s not difficult to see how an artificial moat is being built around the lone survivors in this space; given the all but shut-off barriers to entry.

And yet, the market is completely asleep at the wheel when it comes to this major-step change in the operating environment. But we will get to that more later in the write-up.

PDP Economics

A typical PDP portfolio is acquired at cents in the dollar. For PNC, a standard PDP vintage has a front-loaded 10-year collection curve, with the bulk collected within the first 4 years. PNC sets itself a Net IRR hurdle of 15% for every vintage it invests in, one that it has always achieved in excess of.

The Money Multiple on any PDP investment is a byproduct of the Net IRR hurdle rate (which must be set at inception upon investing), and has historically fallen between 2.2-2.6x Pioneer’s cost base for any yearly PDP vintage.

PNC aims to recover its cost base within the first 18 months of investing and to deliver a 2x money multiple - and therefore the bulk of its Estimated Remaining Collections (ERC) on any vintage - within the first 4 years, with the remainder collected over a 6-year tail.

The bulk of Pioneer’s ERC comes from impaired retail Credit Card and Personal Loan debts. These investments usually fluctuate between 70-80% of Pioneer’s total ERC.

Evidence of Pioneers’ underwriting talent and recent conservative bookings

As previously discussed, FY19 - FY21 were the toughest years of Pioneer’s history to date. Despite the tremendously difficult period, PNC was still able to consistently collect ~$100M in cash each year, as can be seen in the chart below. The fact that their cash collections did not drop off throughout this period clearly highlights their solid cash collection procedures and underwriting skills.

On top of this, the chart below clearly depicts evidence of disciplined PDP investing in bad markets. Whilst lower PDP investments negatively affect reported earnings, it also ensures that you don’t blow up in bad markets. Throughout this period, it is clear PNC did not overpay for higher risk portfolios (which cannot be said about many of its competitors); with management instead biding their time in FY20 and 21; waiting for supply to come back online. Whilst this disciplined approach negatively affected their bottom line, it inevitably ensured their survival in a tumultuous time for the company as well as the industry.

On top of this, Pioneer Credit have consistently outperformed their booked forecasts on PDP vintages.

Under the amortized cost accounting method an Expected Interest Rate (EIR)/gross IRR on each vintage must be set at inception upon investing. This rate translates to a forecasted money multiple that the company expects to achieve on its investments, shown below as the “U/W M.M”. This should be compared against the actual Money Multiples PNC has been able to achieve on its PDP investments (“M.M”). As can be seen below, it is abundantly clear how much PNC has been outperforming their initial booked rates.

On the cusp of an inflection point

Since 2022, Pioneer Credit’s yearly PDP investments and cash collections have stepped up in a big way.

Moreover, PNC has recently executed a significant recap, on much better terms via a $272.5M facility with Nomura which is a material 300bps lower than the previous facility and will result in $8M savings per year from FY25 onwards. Crucially, the facility is termed out until December 2028.

In FY24, PNC took an impairment of $18M on their PDP portfolio, whilst assuring investors this was strictly precautionary:

The company also has significant NOL’s and was able to recognize a deferred tax asset (DTA) of $21.4M in FY24, with management estimating that an additional $13M should be available for use in upcoming periods. In reality, Pioneer shouldn’t have to pay taxes for at least the next few years due to the significance of their NOLs.

Below are the FY24 results:

Excluding the reported DTA, PNC’s Normalized NPAT in FY24 was -$2.5M. (-13.6+6+2.2+2.9). This does not include the expected $8M in annual interest savings on the refinanced debt package.

Now here is where things get interesting:

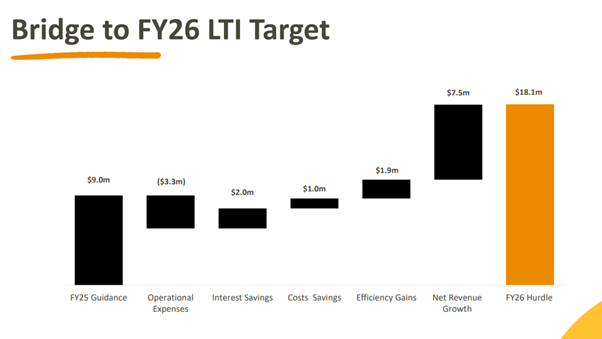

Management has no Short-Term Incentive (STI) program. However, they do have a multi-million-dollar Long-Term Incentive (LTI) package aligned with achieving underlying NPAT of at least $9M in FY25 and a Statutory NPAT of at least $18M in FY26, a far cry away from results of previous years.

The LTI package stipulates that hurdles must be achieved each year from FY22-FY25. Upon achievement of these hurdles, management will only see their performance rights vest if they achieve an FY26 NPAT in excess of $18M.

If PNC does not achieve its FY26 NPAT target, management will receive $0 in LTI compensation from FY22-FY26.

Below are the number of rights granted just for FY24 (only subject to vest upon achieving the FY26 hurdle):

MD Keith John has explicitly stated on numerous occasions that these targets do not include any benefit from any future DTA recognition, any impairment gain from the FY24 precautionary impairment or any favourable outcome in the pending PWC litigation procedure.

In other words, there will be no financial engineering associated with hitting these targets.

These targets will be achieved primarily via increased revenue growth associated with the much-improved operating environment.

On the FY24 earnings call, MD Keith Join pointed out that for a 2.4x money multiple, the breakeven PDP investment needed to capture flat interest income year on year would be ~$56M for FY25.

As such, any additional investment on top of this no growth $56M base throughout FY25 is gravy in the form of future revenue growth.

And indeed, the company has guided to at least $90M PDP investment over the course of FY25.

Given a $6.5M FY24 normalized NPAT incorporating the $8M in interest savings, it doesn’t take a rocket scientist to see where they make up the extra $2.5M on normalized earnings to achieve an FY25 NPAT of at least $9M; given the growth FY25 PDP investments.

As for FY26 guidance, here is the bridge provided by management:

Given the nature of Pioneer’s outsized PDP investments since FY22, and how much greater these vintages are performing in reality when compared to the rates they were booked at, this is a readily achievable target.

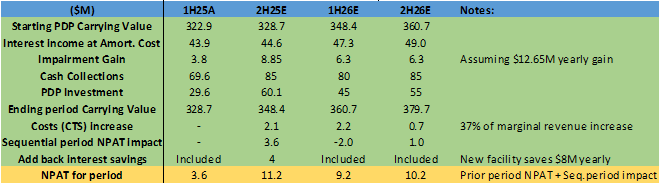

For the sake of understanding how readily achievable the guided uplift in Pioneer’s bottom line truly is; it’s markedly important to understand how amortized cost accounting works before we proceed with understanding revenue dynamics and their subsequent effect on the bottom line. If you already understand this, feel free to skip to the next section:

Under IFRS 9, which Pioneer follows, PDPs are to be carried on the Balance Sheet at amortized cost. This means that:

For any new vintage of PDPs invested in, Pioneer must record these at COST on the Balance Sheet (i.e Not at fair value).

An Effective Interest Rate (EIR)/gross IRR must be set ONLY at inception upon investing in any PDP and the average EIR of Pioneer’s entire book of PDPs is then multiplied by the carrying value of PDPs on the Balance sheet as at the beginning of the period to calculate Interest Income at amortized cost (the revenue item that gets booked on the Income Statement). This line item is only reflective of Pioneer’s investing assumptions upon inception; rather than the economic reality of how the PDPs are performing. This then gets added to the carrying value of the PDP on the Balance Sheet.

Any cash collections on PDPs reduce the carrying value of the PDPs on the Balance Sheet.

If Pioneer believes there is a reasonable probability that their PDP portfolio has become irrecoverable, they must take an impairment charge (expense on Income Statement) and write down the carrying value of the PDPs on the Balance Sheet, recording the impairment expense on the Income Statement.

If Pioneer ends up collecting more than the EIR/gross IRR set at inception for any given PDP, this is recorded as an ‘impairment gain’ (revenue item) on the Income Statement, but crucially the carrying value is NOT marked up on the Balance sheet.

Only the combination of the ‘interest income at amortized cost’ and the ‘impairment gain/loss’ account reflects the economic reality of how Pioneer’s PDPs are performing relative to how they were booked at inception.

As such, it is important to understand that the nature of amortized cost accounting means that PNC’s earnings stream is directly tied to any strengthening or weakening in PDP investment, even if cash collection procedures remain completely on track.

Amortized cost accounting means that as long as our ‘interest income charged to amortized cost + the cost of PDPs throughout the period’ is greater than ‘cash collections received + any impairments of our PDPs’ then we have a growing carrying value period-on-period from which interest income at amortized cost is calculated and is subsequently growing from, creating optics of tremendous operating leverage and growth in the bottom line.

Notably, Pioneer have been setting conservative EIRs on their PDP investments at inception. Yet in reality Pioneer has been collecting a materially higher multiple on their investments; therefore boosting their actual gross IRR achieved on the collection of its PDPs.

This dynamic is even more amplified when considering the last 4 years of PDP vintages, as can be seen below from FY21 onwards:

I stress that there are 2 revenue items to watch out for here which capture these differing realities:

The first is ‘interest income at amortized cost’ – which is purely tied to the EIR set at inception. This rate set at inception translates to the ‘U/W M.M’ shown above.

The difference between this EIR set at inception and the Gross IRR achieved in reality (which translates to the ‘M.M’ above) is captured via the other revenue item: ‘impairment gain,’ such that ‘interest income at amortized cost + impairment gain’ represents Pioneer’s total income revenue for any given period.

Here is the average cash collection curve on Pioneer’s PDP investments in recent times:

It’s important to now consider how slight tweaks in the money multiple lead to a huge step-change in the gross IRR. Highlighting this notion below, we have an example of 2 PDP portfolios with similar cash collection characteristics to Pioneer’s. The tables show the differing gross and net IRRs achieved on PDP investment with a 1.8x money multiple versus a 2.4x money multiple, given Pioneer’s front-loaded collection characteristics.

Other assumptions baked into these PDP portfolios are:

$100 cost of PDP at inception

37% cost to collect on each cash flow – in line with Pioneer’s upper end of its Cost to Service (CTS) guidance

Cash flow collection characteristics similarly in line with Pioneers: 36% collected in the first year, 18% in the 2nd and 3rd years, 12% in the 4th year and 2.67% (rounded) for the remaining 6 years.

Hence, a 1.8x multiple gives us a gross IRR of 29% whereas a 2.4x multiple results in a 48% gross IRR given the same collection patterns (in line with Pioneer’s).

Given the average actual money multiple achieved (M.M) over the previous 6 years has been 2.65x or 2.44x if we exclude the outlier of FY21, I am comfortable in underwriting a 2.3x money multiple akin to a 44% gross IRR given the cash flow collection characteristics highlighted above.

The underwriting of this 44% IRR is further reinforced when you consider Pioneer’s underwriting throughout the FY20 and FY21 periods; when the PDP industry was on its knees, yet management was still able to achieve actual M.Ms of at least 2.4x on these vintages.

Hence, in an operating environment where the industry has since consolidated significantly and Pioneer today have more suppliers approaching them than they know what to do with, I underwrite a 44% gross IRR on Pioneers actual cash collection profile.

One could quite easily bake in more, but for the purposes of conservatism and uncovering how much of a margin of safety we have in the step-change in Pioneer’s earnings profile, I stick to 44% gross.

The effect on earnings

Below, I assume an EIR of 29% for calculating interest income at amortized cost – in line with Pioneers’ previous bookings.

To isolate for just the expected impairment gains, I am assuming the difference between 44% less 29% (the actual vs booked IRR differential) to accrue on the average PDP investment over the last 3 years.

This is a reasonable and likely conservative assumption considering how front-loaded the cash collection curve is for Pioneer’s PDP investments combined with the gargantuan yearly disparity between Pioneers’ U/W M.M’s versus their Actual M.M’s for each of the last 3 years:

FY22: 1.8 U/W M.M vs 2.2 Actual M.M

FY23: 1.9 U/W M.M vs 2.8 Actual M.M

FY24: 2.0 U/W M.M vs 2.5 Actual M.M

Each one of these are materially outperforming vintages, with a large part of the IRR discrepancy not yet booked in earnings!

If you then take the average % premium of Actual M.M vs U/W M.M. for the 3 vintages, you land at an average 31.5% premium to the U/W M.M. The average U/W M.M. over the last 3 years is 1.9:

1.9*1.315 = an average 2.5x Actual M.M. for the FY22-FY24 vintages.

If we chose to underwrite this, we would be baking in a gross IRR of ~51%.

The average PDP investment made during FY22-FY24 was $84.33M. Using our conservative 44% gross IRR on the actual cash collections, we therefore calculate ~$12.65M in ballpark expected yearly impairment gains (calculation: (0.44-0.29) * 84.33 = ~12.65).

The maths above shows that it is probable management is somewhat sandbagging guidance for FY25 of at least $9M in normalized earnings and a Statutory NPAT result of $18.1M in FY26.

This makes sense when you consider that as discussed above, they have been through the absolute ringer historically; surviving by the skin of their teeth; and therefore, very understandably want to ensure they under promise and over deliver. This combined with the fact that up to 4 years of their compensation package hinges upon achieving the FY26 guidance.

Given everything else above is held constant, it’s important to note that even if PDP investment was a meagre $30M in both 1H and 2H of FY26, FY26 NPAT would still reach managements’ said guidance of $18.1M.

However, this notion of only having $60M to invest in PDP’s in FY26 is something which appears highly doubtful, given today’s environment of growing supply and less competition, unless of course we have a deep global recession.

Today, the average Australian consumer is fully employed, meaning a myriad of PDP portfolios are available for Pioneer to selectively choose from in what management are coining as their bread-and-butter operating environment. As per MD Keith John:

“We've never seen the volume of vendors coming to market. And certainly, the volume is increasing all the time.”

“It's a great market. There's not a lot of competition, consumers fully employed. We've got funding. We've got exceptional free cash flow. This environment is as good as I've seen it in my years in this business.”

Even if FY25 happens to present lower impairment gains than in the table above; the difference will likely still contribute to FY26 and 27 earnings albeit in a smoothed manner.

Given the obvious limitations outsiders have as to true amortization rates and adjustments to the EIR rate changes that are booked against the Carrying Value of PDPs, the model above should not be taken as gospel. Despite this, it is useful for understanding the directional step-change in the bottom line that Pioneer is on the cusp of achieving.

It also clearly highlights the embedded leverage associated with increased PDP investment and how this adds to the base of the carrying value from which interest Income at Amortized cost is calculated.

Valuation – How cheap is PNC?

Some of the best opportunities to compound capital at gargantuan risk-adjusted returns occur when investors are more concerned with scars endured from past fires than with recognizing any latent step-change in operations, industry structure and earnings power.

By the time the “all-clear” sign is self-evident to consensus, the horse has usually already well and truly bolted.

Thankfully, I believe we are fast-approaching this re-rating tipping point upon the release of FY25 results.

On both an absolute and relative valuation basis; Pioneer is today trading at an astounding discount to its intrinsic value.

Absolute Valuation

Lets recap Pioneer’s portfolio and debt outstanding. Pioneer has:

A Performing Arrangements (PA) portfolio of $431M today (i.e. high-quality debt with consumers paying weekly, fortnightly or monthly agreed upon sums).

Estimated Remaining Collections (ERC) of $673M.

Total debt outstanding of $290M (termed out until 2028).

Total PDP face value of $1.9B (including PAs).

In a liquidation scenario, Pioneer would undoubtedly be able to sell their higher quality PA portfolio almost instantly to a swathe of willing buyers on the private credit side; even if we punitively assume a significant haircut on the portfolio and arrive at just a $300M sale price. These funds could immediately payoff the $290M in debt.

Pioneer then has another ~$260M in ERC remaining that it would either sell off at a discount or collect on themselves.

And after all that, it would still be left with ~$1.2B in face value of PDP’s that it could offload to a willing buyer at say a punitive fire sale price of 10 cents on the dollar, yielding another $120M.

Given these conservative assumptions, PNC’s equity liquidation value comes to: 300M – 290M + ~200M + 120M = $330M.

The point here is that we don’t need to get this down to a precise science when we have a downside conservative liquidation value of between $200-330M (depending on how punitive your assumptions are); one that is absolutely lightyears away from the ~$60M market cap ascribed to Pioneer’s equity by the market today. At today’s levels, this serves a monumental margin of safety for investors.

Relative Valuation

When valuing companies that invest in and collect nonperforming consumer debt, the market primarily values these companies on a P/E basis due to “too hard” issues given the vastly different and constantly changing capital structures amongst the industry’s players.

Prior to 2019 and the issues which then ensued, Pioneer consistently traded at a 12x to 15x P/E multiple. Today, Pioneer is trading at a ~5.5x FY25 multiple and a meagre ~3x FY26 multiple.

Today, Pioneer is a lot more leveraged and will always have the overhang of a potential cyclical downturn affecting its earnings profile. As such, I am by no means suggesting a premium multiple for Pioneer Credit.

However, a 3x multiple is certainly not anywhere near right. Reinforcing this notion, Pioneer is now entering the greatest operating environment in its history, one with consistent and growing PDP supply and much less competition than ever before.

I believe a $1 stock price for PNC, an 8x FY26 P/E multiple, or 163% upside from today’s levels of $0.38 per share, is a conservative initial price target. At 8x, PNC will still be trading well below historical levels of 12-15x. Despite today’s higher leverage, I believe this multiple is justified as the market wakes up to the reality that PNC are entering a sustained multi-year industry expansion; one that will likely last well beyond FY26. On top of this, Australian unemployment rates are at all-time lows, despite the reality that people are still doing it tough; exemplified by low consumer confidence numbers. This environment favours selective operators like Pioneer, who inevitably have more serviceable debt packages to choose from.

Given this backdrop and continued execution, I struggle to see how Mr Market will continue to value this at 3x FY26 earnings; and believe upcoming earnings prints will serve as catalysts for a major re-rating in the stock price.

It is also important to consider that this 8x multiple still falls well below Pioneer’s conservative liquidation value. In other words, despite representing a 150% return on investment from today’s levels, an equity value of $160M would still not be pricing in any implied future growth in PNC’s equity.

Takeout optionality?

International Private Equity firm Bain Capital Credit showed interest in Pioneer Credit in 2019, running the ruler over the company amidst a 32% share price tumble. Further, Pioneer walked away from a scheme bid from The Carlyle Group in 2020 for $120M; a messy termination which led to Pioneer taking the group to court after they issued a 27-page default notice calling on $141M in debt it had extended the company.

Whilst no acquisitions materialized, this interest highlights the capacity for international firms to step in and realize value if the markets will not correctly price this entity.

MD Keith John overtly hinted to this possibility in PNC’s 1H25 earnings call:

“The majority of my family's wealth is invested into this business and certainly, we believe that the share price should be materially higher than where it sits today. To that end, we are working with the institutional funds, and we're working with the brokers that support this stock and making sure that we're spreading our message and putting it in front of people. I think the other part to recognize is this business is recognized across the world and across the Northern Hemisphere as being materially undervalued.

Certainly, as the year goes on, I will be exploring options around how we unlock that value. It's pointless continuing to go through equity markets where it's not recognized when there are other avenues to do that. And if we don't start getting appropriate recognition, appropriate share price appreciation in the near to medium term, we'll seek to change that and to unlock it in other ways.”

Competition

The Australian debt collection industry has undergone significant consolidation in recent times, with many former players acquired by larger firms like Credit Corp or liquidated due to financial difficulties. This consolidation was driven by regulatory pressures, economies of scale and the need for operational efficiency in an increasingly capital-intensive industry.

Credit Corp serves as Pioneer’s ‘last-man-standing’ major competitor in what is now essentially an oligopoly situation. Smaller Australian debt collection firms lack the scale and resources to challenge the market position of the two major players: Credit Corp and Pioneer Credit.

Credit Corp today has a market Cap of ~$825M.

Recently, they have been ceding PDP market share to Pioneer due to distractions surrounding their entry and subsequent underperformance in U.S. markets.

Credit Corp offers high interest credit products to their clients; offerings which present a bunch of conflicting moral hazard issues; whilst Pioneer does not extend any further credit to their customers. As such, Credit Corp have ceded institutional support, with AustralianSuper (one of the biggest Australian superfunds) departing from the register last year.

These issues serve as key points of difference for Pioneer and largely explain the recent market share gains the company has enjoyed. Inevitably, PDP suppliers want to avoid incurring any unnecessary risks whilst ensuring they minimize selling to customers that compete with them. A PDP sale to Pioneer is fundamentally less risky for the big 4 banks as Pioneer does not extend any further credit to its customers. Pioneer also doesn’t buy any controversial Payday or SACC loans. As such, Pioneer presents as a less risky customer for its PDP suppliers.

Furthermore, Pioneer have recently become a more efficient enterprise; having lowered their Cost to Service (‘CTS’) from 44% in FY22 to 36% in FY24. On the other hand, Credit Corp’s CTS has been steadily rising in Australian PDP markets since FY22, and is projected to be around 45% in FY25.

Credit Corp today trades at a depressed 8x P/E multiple; having historically traded between 16 and 20x pre–Royal Commission in 2019.

Pioneer have successfully eaten into Credit Corp’s lunch. So much so that in FY25, we may see Pioneer overtake Credit Corp as the country’s leader in PDP investment. The first image below shows Credit Corp’s recent PDP investment and the second shows Pioneers:

Alignment

Founder and Managing Director Keith John holds 17.2M shares, controlling approximately 11% of the company, ranking as the second largest shareholder.

Renowned value investing fund Samuel Terry Asset Management holds 26.7M shares, controlling 16.62% of the company. They were adding to their position as recently as late March this year.

With the recent $10M cap raise to fund further PDP’s, esteemed value investing firm NGE Capital were pushed just under substantial – but their monthly NTA updates show that ~7.1% of their FUM was held in Pioneer shares as at 31 March 2025.

Lastly, Pioneer’s LTI plan aligns management with shareholders even further as significant performance rights granted will only vest upon meeting FY23-25 hurdles. If these are achieved then management must achieve an FY26 NPAT of at least $18M for any of these rights to vest.

PWC Claim – Further Optionality

Pioneer are pursuing a claim against PwC for $32M including for interest accrued in the Australian Supreme Court. Whilst I assume no favourable outcome from this angle in my price target, herein lies further optionality. A settlement at 50 cents on the dollar would be greater than 25% of Pioneers’ market cap today. The matter will return to court in Q1 FY26.

Risks

This is a highly levered entity. As such, a breach of financial covenants poses a tangible risk factor. All we are told on the covenants via the annual report is: “The Syndicated Facility, MTNs and Other loans contain covenants which are closely linked to the carrying value of the PDPs and are highly sensitive to the level and timing of PDP acquisitions, cash collections, and sales.”

As such, any unexpected industry turbulence could result in covenant breaches. In the event of a breach, Pioneer have the option to raise equity or more than likely would sell off parts of its PDP portfolio – possibly at a significant haircut.

The impact of Trumps’ ‘Liberation Day’ tariffs on the global economy is widely unknown. Recently, yields at the medium to long end of the curve have been extremely volatile. The U.S. and China could both fall into a deep recession as their ongoing trade war unfolds in real time. Whilst the Trump minimum tariff of 10% was slapped onto Aussie goods, these exports only make up 4-5% of total Australian exports. As such, it is highly unlikely they have any material impact on the Australian economy.

However, there is a possibility where Australia’s economy gets punished as an indirect result of Trump’s tariff policy, due to global economic interconnectedness; specifically, if China falls into a deep recession. As such, a Chinese recession could have negative spillover effects into the Australian economy, resulting in potential mass layoffs of Australian workers and subsequent collection issues for Pioneer. This could lead to further impairments of Pioneers’ book, covenant breaches and/or fire sales of their PDP portfolio.

Whilst Pioneer are fully funded and have indicated they expect to conduct no further equity raises, it is possible management taps equity markets unexpectedly, leading to further shareholder dilution.

Australian recession resulting in mass layoffs and much tougher conditions for Pioneer to collect on their PDPs.

Worse than expected PDP markets where Pioneer are unable to capitalize on the expected multi-year industry uplift, noting that a slowdown in PDP investment is a headwind against growth in the bottom line.

Further impairments of Pioneer’s PDPs.

Unethical treatment of customers.

Summary

Pioneer Credit has successfully emerged from extremely challenging times and today finds itself in an oligopolistic market environment. Trading at a 3x FY26 P/E multiple and 0.3x conservative liquidation value, the business is materially undervalued on both a relative and absolute basis. Pioneer is also on the verge of a meaningful step-change in their earnings profile. FY25 and FY26 earnings execution should alert the market to the structural industry changes that have occurred and serve as catalysts for a re-rating to a more appropriate multiple. Despite assuming no favourable outcome, optionality in the PwC case serves as a potential further catalyst for a re-rating.

Thanks for reading! Let me know if you have any thoughts, pushback or questions in the comments below.

Also, if you have any suggestions on other names I should look into, drop me a line at info@tenvacapital.com or @TenvaCapital on X.

If you enjoyed this write-up, please subscribe below. Thanks for reading!

Disclosures / Disclaimer

Tenva Capital, its associates and/or entities controlled by its associates hold shares in the company referred to in this post.

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

You say that PDPs are "acquired at cents in the dollar". Can you be more specific? In a liquidation scenario, you are estimating they are sold for 10 cents/dollar. How much of a haircut is that? If the market is practically a duopoly now, who would be the buyer? If it is only CCP, they would be in a position to demand a very good price. Does the same logic apply to PAs?

Part of your thesis is the banks only want to deal with PNC or CCP. I would expect contractual constraints on those being sold on, or the banks' desire/efforts for safe counter-parties would be gamed. Is there anything in the contracts that limit on-selling? Would that constrain the sale of those assets in a liquidation?

Hi Jesse,

Excellent write up, really insightful!

While I understand most of your points, there is one thing that I'm struggling to understand. If the company has consistently outperformed its underwriting money multiplier over the last few years, shouldn't we be seeing material impairment gain for these past few years?