Matrix Composites & Engineering (MCE:ASX)

~1.9x EV/EBITDA, Operating Leverage, Near-term Earnings Catalysts and Major LT Growth Optionality.

Welcome back readers!

This write-up will be more brief than usual as this is a rapidly evolving situation with contracts that could inevitably land any day now.

The company I touch on today is a very low-quality microcap with extremely high working capital requirements. It also has a very lumpy and unpredictable contract stream and one of the ugliest long-term charts I think I’ve ever seen.

If I haven’t scared you off yet, feel free to keep reading!

Thesis Overview

Matrix Composites & Engineering (MCE:ASX) is a small-cap ASX listed microcap.

At a high-level, Matrix designs and manufactures specialized syntactic foam buoyancy systems tailored to specific subsea applications.

Matrix’s Henderson facility in Western Australia is the largest and most sophisticated composite syntactic foam manufacturing plant in the world.

The facility is currently majorly underutilized with capacity to generate $200M in annual revenues, despite MCE only generating $84M in FY24 and expected to do roughly the same in FY25.

The stock has been smashed off the back of delayed contracts being pushed out to FY26.

The company has recently surpassed a critical inflection point in their subsea umbilicals, risers and flowlines (SURF) buoyancy offering which should result in meaningful revenue growth, flexed operating leverage and a doubling of EBITDA in FY26 to $20M.

At $20M FY26 EBITDA, today’s share price of $0.21 implies an EV/EBITDA multiple of merely ~1.9x on a growing earnings base.

The company also has extremely attractive long-term opportunities with the impending major growth in offshore wind markets. This opportunity is historically unparalleled and would completely change the nature of what is today a highly cyclical, low-quality business.

Lastly, a premium bid for the company tabled by much larger competitor AIS was just recently knocked back by MCE’s board due to disagreements around valuation and a large capital raise insisted on by AIS.

However, AIS are now set to IPO on the ASX themselves in August, and I believe there are meaningful incentives for them to re-bid and ultimately merge with Matrix within the next 12-18 months.

Upon the market gaining comfort around the FY26 earnings inflection and absent any consummated merger, I believe the stock will re-rate in line with its historical 4-5x EV/EBITDA multiple implying between 88-130% upside from the last traded price of $0.21.

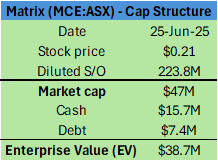

Capital Structure

MCE IPO’d on the ASX in 2009.

The company raised $15M at a $64M market cap or $1 per share.

Funds from IPO were predominantly used to invest in and develop its gargantuan Henderson facility in WA – which later became fully operational in 2011.

Despite a great first couple of years, the stock has pretty much been on a one-way downward trajectory ever since.

Today, Matrix has an EV of $38.7M and net cash of $8.3M.

Average daily traded volume over the last 3 months is approximately $60k AUD.

The facility

Matrix’s Henderson facility is the largest and most sophisticated composite syntactic foam manufacturing plant in the world.

The facility spans an 80,000 m² site, with a 22,000 m² operational area dedicated to production.

The plant became operational in 2011.

The decision to locate in Henderson, a key industrial hub near Fremantle, was strategic, leveraging the infrastructure of the Australian Marine Complex and proximity to maritime and defence industries.

The plant was designed with cutting-edge manufacturing concepts, including lean production and one-piece flow principles, emphasizing efficiency and waste reduction.

These highly automated state-of-the-art processes were integrated from the get go.

The technology at Henderson enabled Matrix to produce high-quality products at extremely competitive prices with much shorter lead times, ultimately setting a global benchmark for syntactic foam composite manufacturing.

Matrix has since continued to reinvest in and upkeep this world-class, state-of-the-art facility, despite its heavy underutilization in recent times, which we will soon touch on.

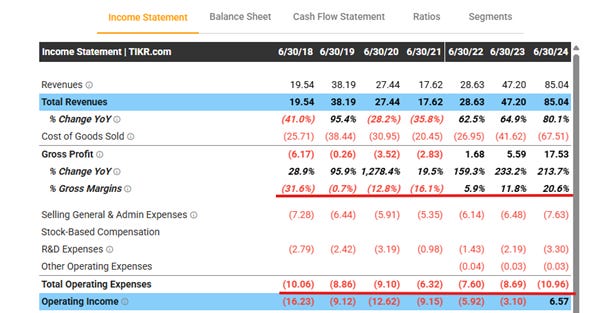

Earnings profile

Most of MCE’s revenues are generated by providing specialized syntactic foam buoyancy solution technologies to the oil and gas subsea market.

Its subsea segment made up 88% of its FY24 revenues.

70% of revenues were generated via subsea buoyancy work specific to the oil and gas sector.

Matrix has two other smaller segments: Corrosion Technologies and Advanced Materials which made up 7% and 6% of FY24 revenues respectively.

In the specialized syntactic foam buoyancy space, there are only 3 key players: Matrix (an Australian headquartered company) as well as AIS and Balmoral Comtec (both private UK headquartered companies).

Brief euphoria into a nightmare downturn

From 2009-2011, Matrix enjoyed soaring revenues and earnings.

The share price followed suit, reaching as high as $8.78 in 2011.

However, the good times were short-lived.

In 2012, the order book precipitously declined as the company failed to secure meaningful work with the backdrop of a very strong AUD.

Matrix then briefly got itself back on track in FY14 and 15.

However, the oil crash of 2014-2016 preceded a prolonged, nightmare of an 8-year downturn from FY16-FY23, as can be seen below.

Catch-22

For the first few years after its IPO, Matrix successfully positioned itself as a leading player in providing subsea buoyancy solutions for oil and gas explorers. In 2011, Matrix delivered record production of its riser buoyancy modules – a tool supporting the drilling process by managing the weight and stability of the pipe in deepwater environments.

Matrix developed its Henderson facility to continue its focus on dominating the O&G drilling space.

And up until 2011, dominate it did.

Its syntactic foam competitors were ultimately pushed into providing buoyancy solutions tailored to oil and gas producers. In particular, their focus was on ancillary products for the subsea umbilical risers and flowlines (SURF) domain.

What presented as an initial blessing for Matrix in its early years inevitably turned into their worst nightmare upon the oil crash of 2014-2016 and subsequent prolonged downturn.

Ultimately, there was far less O&G exploration which meant far less buoyancy solutions were required.

This left Matrix in a particularly dire situation as can be seen in the above image of their revenues and operating income throughout FY16-23.

On the other hand, the SURF segment was supported by long-term production from established fields; a more resilient end-market as producers sought to maximize output from existing assets.

As such, AIS and Balmoral had an easier go of it than Matrix during the downturn.

Recent times

Matrix had made the major capital investment into their Henderson facility but the downturn meant it was highly underutilized.

They therefore commenced a multi-year process in pivoting the facility such that they had capacity to service the SURF buoyancy market.

Their first meaningful breakthrough occurred in 2023 and it has only continued to grow since.

Matrix have taken SURF revenues from almost $0 in FY20 to $60M in FY25.

The company has secured over $120M in SURF projects in just the last 2.5 years alone.

They have now deployed more than 1000 Distributed Buoyancy Modules (DBMs) in ultra deep water and have approximately 35% SURF market share for syntactic buoyancy solutions.

As such, Matrix have recently surpassed a critical turning point whereby they have demonstrated widespread proof of concept to prospective clients.

Having reached this critical turning point, Matrix now presents as the clearcut lowest cost buoyancy solutions supplier given its monumental incremental capacity alongside its highly automated, lean manufacturing principles adopted at the Henderson plant. This capacity is simply unmatched by AIS and Balmoral.

Given this ability to manufacture products in the most efficient, low-cost and scaled manner, Matrix are now being contemplated for even larger SURF contracts.

On their progress in SURF, CEO Aaron Begley had this to say at the FY24 earnings call:

“So we've got very good visibility of this market, which is excellent. We're building a track record. We've now got an installed track record, which is important. So we've got products in the water that has been successfully installed and that track record will open up the market to new contractors and operators.

We continue to build our accessible market and our market share. So that's been quite significant. So very good results there. We do have a high degree of differentiation compared to competitors, so we expect to continue to be able to build and grow that market share over the coming years.”

As such, I expect Matrix to continue its SURF market penetration and continue to gain further share.

It’s also worth noting that strong industry spend is expected until at least the end of the decade.

The stock has been smashed due to delayed SURF (and O&G) contracts that were expected to land in FY25. Yet, so far they haven’t.

For context, at the FY24 earnings call CEO Aaron Begley mentioned that of their $300M competitive bids submitted in the SURF market that “four key projects with a value of $100 million (are expected) to be awarded over the next six to eight months, including two by the end of this calendar year.”

However, only 1 SURF project landed in FY25 valued at $21-23M. The remaining ~$77-79M in quotes have been pushed back.

Yet the company has sustained no material project losses and still has their $300M of competitive quotations in the SURF market.

“But what we've seen is that the size of some of these projects are so large that a small engineering delay upfront, for example, if a client needs to reconfigure a field or something like that; just results in our inquiries being pushed down the road a bit.”

As such, these ~$80M SURF contracts which Matrix expected to land in FY25 should inevitably land in FY26, absent any stuff-ups on the operational front.

Matrix have the ability to meet this increased capacity due to their largescale Henderson facility - a key competitive advantage which results in majorly embedded operating leverage.

As a reminder, Matrix doesn’t need to make any incremental capital investments to generate up to at least $200M in buoyancy product revenues at Henderson.

“So we've -- over the last few years, we've been talking about our three business pillars in the business and they're subsea, corrosion technologies and advanced materials.

And the way we view this is that our subsea business is really a service by our installed capacity at Henderson. We have the ability to produce over $200 million a year of buoyancy out of that facility with no further capital injection or upgrade.” – CEO Aaron Begley - FY24 earnings call

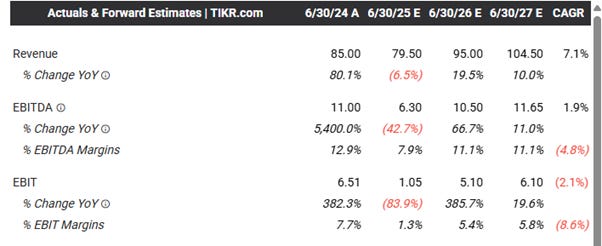

Because of this delay, FY25 revenues and earnings are expected to be largely flat YoY but if you look ahead 12 months things start to look really attractive.

Note the dynamics of scaled COGS and flat OPEX as underlined above and you start to wrap your head around how attractive the operating leverage dynamics truly are.

Having delivered 30% incremental gross margins in FY24, I am comfortable in underwriting 35% incremental gross margins moving forward as MCE continue to leverage their automation and lean manufacturing principles.

I.e. in the event MCE plays catch up on its FY25 SURF delays and delivers just $11-13M in new SURF contracts on top of these delayed ones, then the company should generate $90M in SURF revenues for FY26. Assuming flat drilling revenues of $11M and flat $10M revenues for advanced composites and Corrosion technologies, then we’re already looking at $110M in FY26 revenues.

Note this implies 0 growth in offshore drilling buoyancy solutions and 0 growth in advanced materials and corrosion technologies.

At 35% incremental gross margins and flat opex, we are staring down the barrel of $20M EBITDA in FY26.

At the last traded price of $0.21, an investment in Matrix today is being made at ~1.9x FY26 EV/EBITDA.

Dirt. Cheap.

As you can see, consensus forecasts have most certainly not priced this dynamic in.

Heaven forbid MCE’s other segments also begin to show any signs of growth…

A quick note on O&G Drilling

Global offshore O&G markets demonstrated strong growth across most major basins in 2024 across the globe.

In 2025 however, offshore spending was limited due predominantly to rising spending costs and supply chain challenges resulting in longer than expected lead times.

However, there is clear visibility into a meaningful rebound in deepwater global offshore capex spend in 2026 and 2027.

For context, only 13% of Matrix’s FY24 revenues – roughly $11M – were derived from buoyancy in O&G offshore mining.

Given the imminent step-change in CAPEX spend, I expect Matrix to meaningfully grow its revenues in this segment over the next 2 years.

However, as touched on above, we don’t need this uptick to win from here.

The major long-term opportunity – Offshore Wind

The quote below sums up the astronomical long-term opportunity for buoyancy solutions in deepwater offshore wind.

“If it's 50 wind turbines, it means there's 150 mooring lines with the 150 large inline buoyancy modules on them, plus lots and lots of distributed buoyancy for supporting cables, power cables that is. So it's a big opportunity for us. We're actively quoting into that market.” – CEO Aaron Begley – FY24 Earnings call.

Lets unpack this by comparing it to the O&G drilling market:

The entire buoyancy drilling market is $2B with a global fleet of approximately 200 rigs and drillships.

This $2B represents the installed base and replacement demand.

Assuming a 10-year life cycle, this gives us an annual buoyancy market of approximately ~$200M.

Now turning our attention back to offshore wind: 150 mooring lines and 150 buoyancy modules.

Assuming, one module and one mooring line cost $50,000 each (conservative estimate based on industry trends) and not accounting for any of the additional distributed buoyancy for supporting cables we land at $15M generated for just one project ($100,000*150) – or approximately 7.5% of annual demand for buoyancy solutions in the entire global offshore O&G drilling market.

7.5% for just one deepwater offshore wind project!

Syntactic foam solutions completely dominate the deepwater and ultra-deepwater buoyancy space due to its durability, high pressure resistance and cost effectiveness.

As such, this is an extraordinarily unprecedented opportunity for the specialized syntactic foam players.

As a reminder, there are only 3 key players that produce syntactic foam buoyancy solutions at scale around the world.

The below provides a glimpse into the expected new floating wind installations out to 2033:

Source: GWEC Market Intelligence, June 2024

You don’t need to be a rocket scientist to understand just how quickly capacity in this space will be reached – a supply/demand imbalance that bodes perfectly well for the only 3 scaled syntactic foam buoyancy specialists across the globe to dictate pricing in a very favourable manner.

Another critical aspect to understand is that despite the fact offshore wind projects are set up to last 20-30 years, the buoyancy solutions have much shorter lifespans and need to be replaced every 10 years.

Therefore, if you sign a contract with an offshore wind installation partner, you now have the possibility of a visible and repeat revenue stream 10 years out.

The terminal value equation therefore becomes that much more attractive in what is today a mediocre, cyclical, lumpy-contract-stream business where you essentially start from $0 each year.

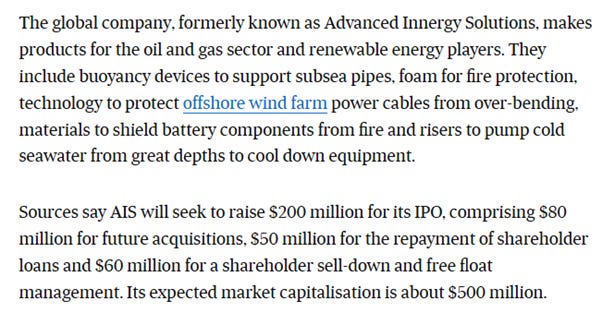

The merger?

With this highly attractive growth opportunity on the horizon, it makes sense for AIS – a much larger UK-based competitor- to merge with Matrix.

This is after all a dream opportunity to potentially corner a market with immense growth prospects over the next 10 years.

On top of this – the Henderson facility and its current underutilization can be tapped into straight away by AIS.

A recent reverse takeover offer tabled by AIS was rejected by the Matrix board – who cited valuation and contingent capital injection as the main reasons for rejection.

Crucially however, AIS are now about to raise the capital themselves via an IPO on the ASX.

Syntactic foam buoyancy solutions are highly specialized offerings.

It would take an immense amount of capital for any new entrant to prove themselves to clients in a manner where they could genuinely scale and erode share of the 3 key players.

The capacity to dictate price and fundamentally dominate an emerging industry bound to have highly favourable supply/demand dynamics in the deepwater offshore wind industry is majorly propelled in the event of a merger between AIS and Matrix.

The ability to position yourself as the only large-scale player in APAC markets providing syntactic foam deepwater buoyancy solutions is another big factor.

Consider that AIS have done previous work with Woodside and are manufacturing these solutions from the UK when they could be doing so next door at the Henderson facility in Western Australia.

As such, there are numerous powerful incentives to merge.

And whilst the thesis doesn’t hinge on this, I would be very surprised if we don’t see AIS come back for another bite of the cherry within the next 12-18 months, offering a nice control premium to Matrix shareholders in the process.

Defence optionality

Herein also lies attractive optionality in the currently minute Advanced Materials segment.

Matrix were one of 10 Australian suppliers shortlisted for the Anduril Ghost Shark Unmanned Undersea Vehicle (UUV) program in 2024. Matrix is also exploring potential scale and mass manufacture opportunities with other UUV players.

Whilst this may go nowhere, it is another angle that could lead to high quality, repeat revenue opportunities.

In saying that, for the sake of this thesis, I assume nothing from this angle and will leave it at that for now.

Other key Investors

The CEOs father Mr Maxwell Begley owns ~6% of the company.

Esteemed value investors Samuel Terry Asset Management have a much higher cost base than the last traded price and have been invested since 2019. They own ~12% of the company.

A convertible note is due in December with Collins Street Asset Management with a strike price of $0.3. I expect them to work with the company on this given the working capital constraints of the business and if needed expect them to extend the term. As of 1H25, $7.35M was left outstanding.

Risks

Inability to manage working capital appropriately such that the company misses out on key contracts in SURF and O&G drilling buoyancy end-markets.

Potential to tap equity markets in the event Matrix are unable to strike a deal with Collins Street Asset Management or in the event they are unable to tap debt markets (I view this as highly unlikely given Matrix’s cash generative nature).

Conclusion

Matrix trades at ~1.9x FY26 EV/EBITDA with near term inflections in their SURF and offshore O&G buoyancy end-markets as well as major long-term growth optionality in deepwater offshore wind buoyancy solutions.

Upon the market gaining comfort around the FY26 earnings inflection, I believe the stock will re-rate in line with its historical 4-5x EV/EBITDA multiple implying between 88-130% upside from the last traded price of $0.21.

There is also a non-zero chance Matrix merges with AIS within the next 12-18 months at a material premium to the last traded price of $0.21.

With profound operating leverage at its Henderson plant and deepwater O&G CAPEX expected to pick up again from 2026 onwards, Matrix today serves as one compelling pitch indeed.

Thanks for reading! Let me know if you have any thoughts, pushback or questions in the comments below.

Also, if you have any suggestions on other names I should look into, drop me a line at info@tenvacapital.com or @TenvaCapital on X.

This is a reader-supported publication so if you enjoyed this write-up, please consider subscribing below, sharing this with a colleague or friend and hitting the like button. Your support is always appreciated!

Disclaimer

Tenva Capital, its associates and/or entities controlled by its associates hold shares in the company referred to in this post.

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

Thanks for another good piece.

I think there are risks to those offshore capex numbers.

2025 has repeatedly disappointed, eg: https://x.com/EnergyRealist25/status/1928741306597257309

Could this be at least part of the reason why those contracts expected last year haven't happened yet?

If oil stays under pressure, I would expect to see 2026 capex get pushed to the right again.

Is it odd that AIS is listing on the ASX? I can't imagine why a UK-based company servicing the global energy sector would do that.

Very interesting...

What do you think happens to the convertible note at maturity? + potentially higher WC on growth + potential delayed CAPEX as per the above discussion (first comment I believe)? If PX stays below conversion, would they refinance easily? if higher and Collins St converts, would likely cause drop in PX for dilution? thx!