Pioneer Credit: FY25 Update

Earnings Beat. Inflection on Track.

Pioneer beat their FY25 NPAT guidance by 17%, delivering a normalized NPAT result of $10.5M.

The company is set up nicely to beat its $18M Statutory NPAT target for FY26.

Despite the stock being up ~58% since written-up in April, the company still trades at a meagre 5.4x FY26 P/E multiple, as they continue to take share in a recovering market.

Below I will unpack some fresh insights and ascertain the likelihood of achieving FY26 guidance >$18M.

For new subscribers who missed my original Sanuwave Health write-up, you can find it here:

Impairment Gains

In my original write-up, I highlighted the likelihood we should see material impairment gains shine through in FY25 and FY26.

Whilst we did see $4.8M of impairment gains in FY25 which were mostly from accounts with no further carrying value – a significant uplift when compared with years past – I was expecting more than delivered in 2H FY25.

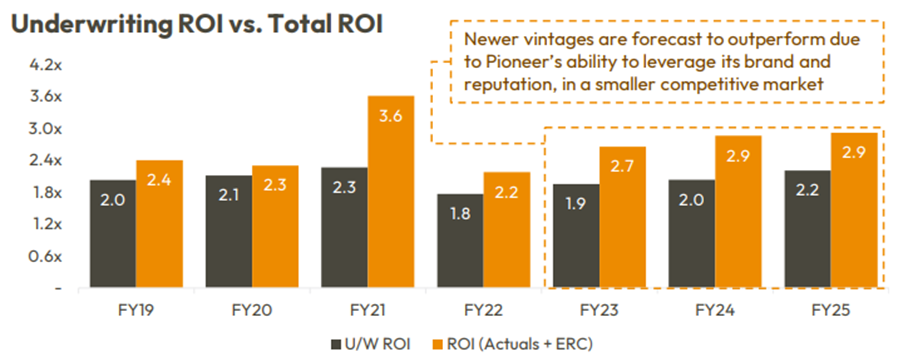

Given these lower impairment gains, it seems highly probable that Pioneer is booking this outperformance of their “Actual M.M/ROI” over their “U/W M.M/ROI” towards the latter end of their collection curve; recalling that the Actual M.M./ROI represents historic collections as well as future ERC.

The CFO’s comments on yesterday’s call that the company doesn’t expect material growth in impairment gains in the short-term further supports this notion.

However, it’s important to remember that the Actual M.M/ROI which has been reported well in excess of the U/W M.M since FY23 will have to come through impairment gains on the Income Statement eventually.

The back-ending of these gains along the latter part of the collection curve is something to stay aware of and keep a firm eye on moving forwards.

PDP Investment surprise

Given the company had guided to >$90M in PDP investment, I was no doubt surprised to see a lighter $69.1M number come through for FY25.

However, reading between the lines, it appears the company purposely held off on making other investments in 2H to ensure they had capacity for Westpac upon their re-entry to market.

This was all but confirmed by Mr John who reiterated that Pioneer have already “substantially done” their FY26 $80M PDP investment guidance in just the first two months of the Financial Year combined with the announcement that Pioneer are now the only company to have PDP agreements with all Big 4 Australian banks.

Strong Collections / Growing ERC

Cashflows never lie and Pioneer once again demonstrated their capacity to collect consistently on its PDP investments with steady collections of $142M in a year PDP investments reduced by 26.5% YoY from $94M in FY24 down to $69.1M in FY25.

Despite this, Estimated Remaining Collections increased 9% to ~$702M.

Attractive Purchasing

More good news came through via the announcement that Pioneer had booked a 2.2x U/W M.M/ROI in FY25 – higher than historic - due to securing “a number of meaningful forward flow agreements at significant discounts to the last prices (Pioneer) were paying.”

Given these pricing levels continue, this crucially means the company needn’t rely on impairment gains for revenues to inflect in FY26, given Pioneer executes on its $80M PDP investment guidance throughout the year.

$18M NPAT Guidance

I don’t believe the market has fully digested Mr John’s assertion that $80M of PDP investment guided for FY26 has been “substantially done already.”

This information is important in ascertaining the likelihood Pioneer can achieve a statutory NPAT of >$18M in FY26.

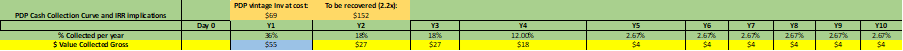

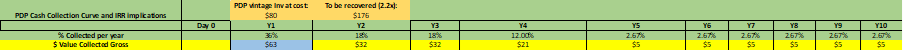

The images below highlight the gross uplift in interest income within the first 12 months of investment on $69M of PDP investments versus $80M invested at the same 2.2x FY25 booked U/W M.M. given hypothetical 36% collection within 12 months (in line with historic collection patterns).

Crucially, this alone leads to an incremental $8M of interest income (63M-55M) that would flow straight to the bottom line.

Note that this is without consideration of any potential impairment gains.

In saying this, timing is of the essence for the majority of this $8M excess to fall within FY26.

As such, the 1H26 earnings result– specifically the size of the PDP investments made within the half - will tell the story as to the likelihood Pioneer will indeed reach or exceed its $18M Statutory NPAT guidance.

Summary

Pioneer appears on track to beat and potentially exceed its $18M Statutory NPAT guidance for FY26.

Moreover, its newfound agreement with Westpac upon their re-entry to market serves as further evidence of Pioneer’s capacity to take market share as they continue to enhance efficiencies via a lowered CTS.

Longer-term, a recovering PDP market combined with increasing market share leaves the company in prime position to continue along this outsized earnings cadence into FY26 and beyond.

At 5.4x NTM P/E, I remain long and believe this name still has plenty left to run.

Disclaimer

Tenva Capital, its associates and/or entities controlled by its associates hold shares in the company referred to in this post.

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

Thanks! Good write up and result!

Clearly the story is getting more positive & the PNC team are turning the ship around/gearing up for a big FY26

When do you think the board should start thinking about shareholder returns?

I didn’t pick up anything in the call about this, but it’s clearly cheap and the hard work turning around is done. Just hoping for this to be reflected in the share price isn’t good enough IMO, I’d love to see some real movement on this (maybe a capital allocation policy at 1HFY26 results that shows how the board thinks about future returns)?