Sanuwave Health: Q2 Update

Continued Execution.

Oftentimes significant alpha lies where there’s a clear line of sight such that today’s qualitative insight will translate into tomorrow’s quantitative outcome.

I was reminded of this prescient notion at Sanuwave’s Q2 earnings call on Friday.

The numbers were clearly fantastic with the stock responding accordingly.

However, the standout for mine were these touched upon qualitative insights and what they could mean for the company over the next 12-24 months.

Let’s dig in and review.

For new subscribers who missed my original Sanuwave Health write-up, you can find it here:

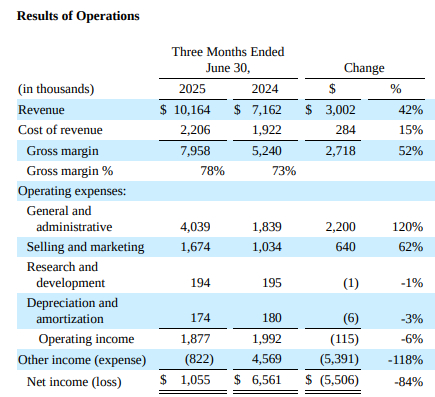

Results Recap - The Numbers

Revenues were up 42% YoY to $10.2M in line with guidance of a 40-50% YoY increase.

For the full 1H25, revenues were up 51% YoY.

UltraMIST systems sold in Q2 were 116, a 61% YoY increase and an 18% sequential increase from Q1.

Sanuwave now have a total of 1,261 UltraMIST systems in the field, of which 38% have been sold just in the last 12 months.

Applicator/Consumables revenue came in at $6.4M, growing 37% YoY with 10% sequential growth from Q1.

Customer concentration is at mouth-watering levels; with only 1 customer today exceeding 5% of revenues and barely doing so.

Gross Margins came in strong at 78.3%, up 530 basis points from Q2 FY24.

Opex and Net Income comps are noisy as Q2 FY24 had no non-cash stock-based compensation expenses and had a one-off historical accrual of $579K.

Hence, Statutory Opex looks more bloated without putting these one-offs into context.

Q2 FY24 Net Income also had a onetime non-cash gain of $5.3M related to the payoff of legacy debt.

Source: 10Q.

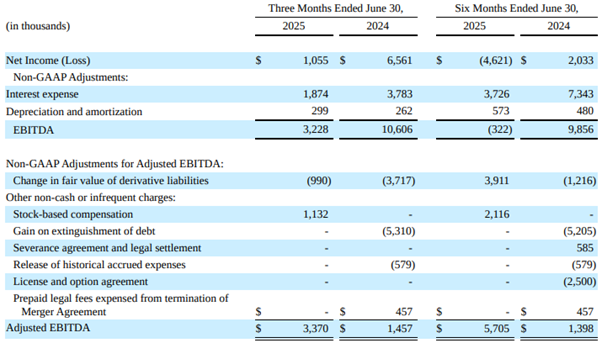

Hence, in terms of assessing progress, adjusted EBITDA is what really tells the story here.

Q2FY25 Adjusted EBITDA came in at $3.37M, a whopping 131% higher YoY.

Source: 10Q.

With guidance reaffirmed for $48-50M in FY25 Revenues, we are more than on-track to reach $12M Adjusted EBIT this year as Sanuwave continues to power ahead with its fantastic growth execution.

The Qualitative

Growth amidst Disruption

A key takeaway for me was how well the company was able to execute despite how disruptive 1H25 really was.

The monumental YoY revenue growth of 50.6% came as Sanuwave only recently achieved full national sales coverage for the first time with 12 sales reps.

Additionally, the company only added its full-time national and key accounts manager to focus specifically on larger accounts in the 2nd week of July.

This is a lot of disruptive change from Sanuwave’s 9 sales reps leading into 2025 – many of whom were different than the 12 of today.

This essentially represents an entirely different organizational unit from that of just 18 months ago when the company had only 2 sales reps.

The bottom line: Sanuwave’s new and refreshed sales team has yet to ramp.

“If Q1 and Q2 were the quarters of “max disruption” Q3 is expected to be the quarter of “max construction” as the Company builds up momentum around our new sales and marketing practices (including the launch of our first concerted marketing program) with an aim to set us up for breakout performance in Q4 2025 and 2026.”

“Internally, we've been using the metaphor of taking apart the airplane and putting it back together while flying it really fast. And the team has more than risen to the challenge.” – CEO Morgan Frank.

Larger Accounts Potential

Sanuwave’s newly established “elephant hunter” for larger accounts is barely a month into his newfound role.

This role is fundamentally dedicated to pursuing accounts with “several hundred locations” across the U.S.

Critically however, FY25 guidance does not include any wins on this larger accounts front.

This, despite the reality Mr Frank noted on the call that Sanuwave had been “recently added to the approved vendor list on one of the largest hospital chains and networks in the U.S.”

“So moving on to guidance. As we stated in our press release, we're guiding to $12 million to $12.7 million in Q3 revenues. Obviously, Q3 is a tough comp for us as it's up against the pigs or python quarter last year in which we had one really large sale sort of tipped the scales and drive a surge to an 89% year-on-year growth rate. Pigs seem to be somewhat difficult animals to forecast. And while we're certainly out looking for them and see a fair bit of potential, we're not including any of that in the guidance above.

We're really still in the learning phase on how to time forecasting with these bigger customers and how they ramp up when they do say yes. I think we'd rather err on the side of conservatism. So -- but our annual guidance remains unchanged.” – CEO Morgan Frank.

The Adoption Threshold

“Once you get enough practitioners using UltraMIST and they have seen others use the product, seen the results, seen the opportunity, we get a profound spike in interest” with “very promising increases in inbound inquir(ies).”

“We seem to have crossed the… adoption threshold.” - CEO Morgan Frank.

With the potential to throw these much larger accounts into the mix, there remains monumental potential for gaining share in this $45B wound care market – noting Sanuwave have yet to penetrate just 1% of this.

Moreover, Sanuwave are on the cusp of engaging their first ever targeted outbound marketing campaign, with the expectation for launch in October 2025.

Refinancing of Debt

Pleasingly, it seems all but confirmed that Sanuwave will not tap equity markets to clean up their $26.7M in debt which currently falls due in September 2025 and will instead roll this out on seemingly much greater terms.

“We ran an internal process to look at what our debt options were. And we received several term sheets that we thought were very attractive. And we chose one and are currently in the process of working to close it.

So I can't really get into too much more detail right now. Like I can't name the counterparty, but I think people will be favourably inclined towards both the lender and the terms. It's a significant improvement over what we have.” – Morgan Frank.

Implications

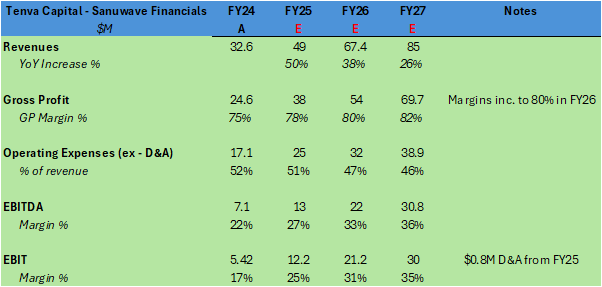

Guidance for Q3 revenues is $12-12.7M. For the full year of FY25, guidance is $48-50M.

If we take the Q3 midpoint at $12.35M then Q4 revenues should fall between $16.1-18.1M.

Recall that 50% of any incremental revenue growth is expected to trickle down to EBIT moving forwards, that there are over $200M in NOL’s and very minimal incremental capex requirements. Thus, upon debt paydown over the next 12-18 months, EBITDA will convert to FCF at an extremely high rate, assuming CAPEX of ~$0.8M annually.

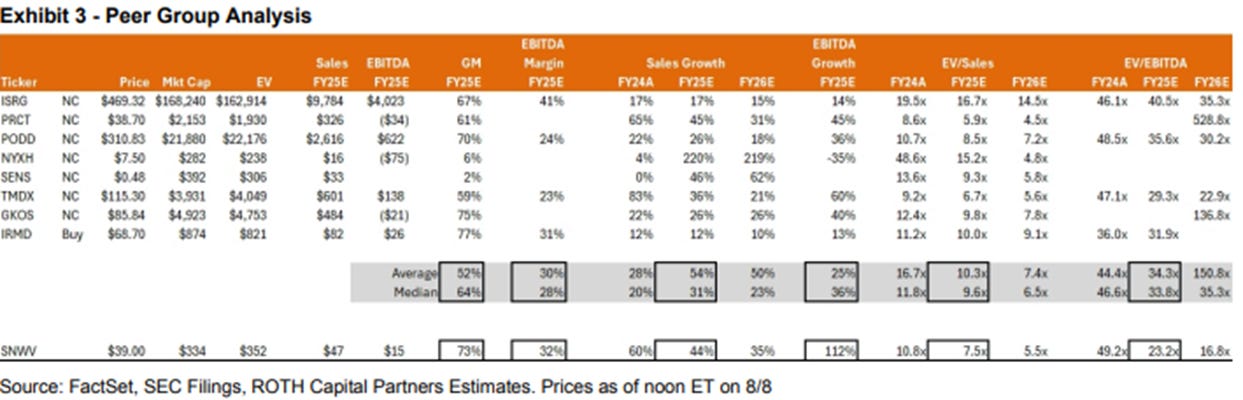

Interestingly, the company’s peers trade at premium multiples despite their far inferior growth profiles:

Assuming the market gains confidence Sanuwave will grow its’ top line at 35-45% in FY26, we can assess a few scenarios:

At a highly conservative 20x FY26 EV/EBITDA multiple, Sanuwave would trade at $47.39 (noting this multiple is lower than peers with far inferior growth profiles).

At 25x FY26 EV/EBITDA, Sanuwave would trade at $59.75

At 30x FY26 EV/EBITDA, Sanuwave would trade at $72.11.

Note this scenario assumes 8.9m shares outstanding to account for dilution from SBC as well as no change in current net debt of $18.3M.

As SNWV continues to execute on its incremental growth trajectory in 2H25 and beyond, I expect the market will re-rate FY26 earnings in line with a minimum 20x FY26 EV/EBITDA multiple – commensurate with Sanuwave’s astronomical growth profile that is backstopped by more proven execution to date.

Disclaimer

Tenva Capital, its associates and/or entities controlled by its associates hold shares in the company referred to in this post.

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

Thank you Tenva for your work on SNVW, it is an interesting story.

Robert posted a question in your first piece that I also wonder about, and it seems to me is still unanswered. In Q2 there were ~1200 UltraMIST systems in the field, but applicator revenue was only $6.4 million. That implies ~$59/day/machine of consumable revenue. How can it possibly be so low? Even if they discount the applicator $100 unit price all the way to $50, they're still only selling barely more than 1 applicator per system per day.

Thanks for the great read. Really appreciate the summary, but also the valuation part.