Sanuwave Health (SNWV:NASDAQ)

Is this the Fastest-Growing, Profitable Medical Device Company in U.S. Wound Care?

Welcome back Tenva Capital readers!

Below I present you a new under-the-radar investing idea with immense upside potential.

If you find my work valuable, please share it with a friend or colleague and subscribe below for more in-depth research on overlooked and undervalued stocks across the globe. Your support is very much appreciated!

Thesis overview

Sanuwave Health is a profitable American medical device company growing 50% year-over-year.

Previously plagued by a burdensome capital structure and too many shares outstanding, the company recently recapitalized and conducted an extremely favourable reverse stock split.

The company markets UltraMIST in the wound care space, a medical device making waves for favourably aligning the interest of patients, physicians and payors.

Despite its’ gargantuan long-term growth runway, Sanuwave today trades at only ~13x FY26 EV/EBIT.

With a recent uplisting to the NASDAQ from OTC markets, Sanuwave is ripe for discovery to enable a re-rating which appropriately reflects its incredible profitable growth profile.

Background

Up until very recently, Sanuwave’s capital structure was outright disastrous.

Listed on the OTC markets, the company had 1 billion shares outstanding and another 2 billion impending from warrants and convertibles. On top of this, the company had a large chunk of debt in forbearance.

However, in October 2024, this was cleaned up and the company suddenly became highly investable.

Sanuwave successfully executed a 1-375 reverse stock split. Warrants and convertible notes were converted into common stock and the company was able to raise money without a bank from its CEO and other institutional players.

Post this set of transactions, the company paid down some of its debt and regained compliance with the covenants of its remaining loans.

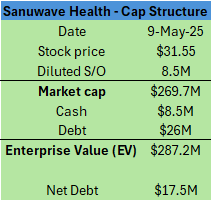

Today, Sanuwave has a highly simplified capital structure with 8.5M shares outstanding and a $26M Senior Secured Note due in September 2025. The company expects to imminently recapitalize this remaining portion of its debt and aims to pay it down entirely within the next 12-18 months.

In March 2025, the company uplisted to the NASDAQ Global Exchange and trades under the ticker SNWV.

Sanuwave markets a product called UltraMIST, a non-contact ultrasound device it acquired in 2020 which is used in the treatment of late-stage wounds.

Average Daily Traded Volume over the last 3 months is ~$1.5M USD. As such, this is liquid enough for private investors and small funds.

People

Sanuwave’s CEO is Morgan Frank, a capital markets expert and founder of life sciences investment firm – Manchester Management.

To protect his investment in Sanuwave, Mr Frank became Chairman in 2022 and stepped in as CEO in 2023 as the company was on the verge of bankruptcy. He negotiated extensions on the debt and replaced all the C-suite and a large portion of the company’s employees.

As of Q1 25’, Mr Frank’s entities control ~13% of the company’s shares outstanding.

Despite his initial plan of only serving as a transitional CEO, today Mr Frank intends on staying on as CEO into the foreseeable future.

UltraMIST – What is it?

UltraMIST is a low frequency, non-contact and non-thermal ultrasound system used in the treatment of complex and non-healing wounds.

The device never touches the wound surface and treatment is pain free for patients.

UltraMIST is clinically proven to reduce wound size, speed the healing process, aid in killing bacteria and biofilms and promote blood flow and revascularization to the wound site.

UltraMIST is FDA cleared and has nationwide Schedule 1 ‘Centers for Medicare and Medicaid Services’ (CMS) reimbursement under a unique and specific code set 97610.

The company operates under a classic razor-razorblade model whereby they sell an UltraMIST system and consumable applicators which are needed for each procedure. One consumable applicator is used per procedure.

Sanuwave sells UltraMIST into hospitals, physicians offices, wound care centres, mobile wound care providers, nursing homes and skilled nursing facilities.

A procedure takes between 3-20 minutes and averages 6 minutes.

The device is highly portable and only weighs 7 pounds / ~3 kilograms.

UltraMIST is FDA approved for the treatment of:

Diabetic foot ulcers

Pressure Ulcers

Venous Leg Ulcers

Deep Tissue Pressure Injuries

UltraMIST works via a process called mechanotransduction. This is the cellular process of converting mechanical stimuli, like pressure or tension, into biochemical signals that affect cell behaviour and function. This process plays a crucial role in various biological processes, including tissue repair, development, and disease.

For a greater understanding of its mechanism of action, see the below from the company’s most recent investor slide deck:

Market Opportunity

In the United States alone, the wound care industry is a $45B market.

Annual treatment costs for Venous Leg Ulcers, Diabetic Foot Ulcers and Pressure Ulcers are $18B, $15B and $12B respectively.

Despite Sanuwave rapidly growing at 50% for each of the past 2 years, the company has yet to even penetrate just 1% of this massive global market.

Sanuwave operates in a rare industry environment whereby their product can rapidly penetrate this enormous market with an incredible amount of white space to be tapped into.

Unit Economics

Anytime a company sells a medical device, they have 3 primary constituents – the patient, the physician and the payor.

Clearly the needs of the patient are a pre-requisite. However, if the device’s use only makes commercial sense for one of the 2 other players, the ability to scale becomes increasingly difficult if not outright impossible.

The magic occurs when all 3 constituents are completely aligned, as is the case with UltraMIST.

Lets go through this one by one.

The patient

The patients only goal is to get better and get their life back.

By the time someone is being treated with UltraMIST, they have a complex non-healing wound.

The example above is of CEO Morgan Frank’s uncle who had a systemic Staph infection and was admitted to hospital in the ICU with a Wagner Stage 4 wound (Wagner Stage 4 means you don’t have any skin left and can see the underlying bone, muscle and tendon). These are extremely serious wounds and oftentimes require immediate surgery with the potential for loss of limb and loss of life.

The patient was at a top hospital in Florida and being treated under the old school standard of care. That is, the removal of a necrotic mass from the back of his hand, dipping a bunch of gauze in antiseptic, putting it in that hole in his hand, covering it with a dressing and wrapping it up. The treatment plan was to give it 3-4 months and hope the swelling will come down such that surgery could be performed on the wound and the patient would hopefully get most of his hand function back.

The image on the far left is what the original wound looked like once the necrotic mass was removed.

Instead, the patient was brought home and treated with UltraMIST in the comfort of his own home.

Remarkably, the wound was healed entirely with exclusive UltraMIST treatments within just 6 weeks. The treatments were entirely pain free and the patient is rapidly regaining full use of his hand.

The other 3 photos show the patients’ progression throughout his UltraMIST treatment plan.

Mr Frank touches on this situation aptly:

“People always ask what's your key competition? And our key competition is wound care the way it was done in your grandparents’ time. Changing that is an enormous opportunity and that's what gets us really excited about this."

This treatment is incredibly attractive for patients.

The historic standard of care for treating a wound like this is to take a sharp and forcefully scrape the edges of the wound until all the dead tissue has been removed – an extremely unpleasant and painful reality for patients.

UltraMIST, on the other hand, offers the patient a pain free alternative which doesn’t require any surgery and makes the patient feel better immediately after each treatment.

Physician Economics

UltraMIST is backed by strong IP, boasting a broad portfolio of over 140 patents and is the only system backed by clinical evidence for non-contact ultrasound in wound care.

The wound care space has an ugly history of fraud, particularly in the skin substitutes, grafts and hyperbaric treatment realms.

As such, payors are increasingly focused on ensuring they only fund evidence-based treatments.

CMS has reduced or terminated reimbursement for numerous controversial modalities, whilst upping reimbursement for energy-based treatments backed by clinical evidence, such as UltraMIST.

UltraMIST is reimbursed under the limited CPT code 97610: “low frequency, non-contact, non-thermal ultrasound, including topical application(s), when performed, wound assessment, and instruction(s) for ongoing care, per day.”

The reason this code is extremely limited is because almost all ultrasound devices are contact and no device apart from UltraMIST has done non-contact clinical studies which show efficacy. In fact, the code itself cites “MIST therapy,” which was the precursor device to UltraMIST.

Today, physicians using UltraMIST get reimbursed between $400-$700 by CMS with 100% Medicare reimbursement. Note that the average reimbursement is $420. (The $700 reimbursement is just a California outlier).

Since Sanuwave acquired UltraMIST in 2020, CMS reimbursement for UltraMIST has increased from $120 to $180 to the average of $420 that we now see today.

UltraMIST systems are sold to the medical facility for a list price of $35,000.

The average procedure takes 6 minutes. Procedures can be done by a nurse practitioner or physical therapist. One can be taught via telephone instruction how to use the device within 30 minutes.

The medical provider purchases a consumable applicator for $100 (list price) from Sanuwave for each UltraMIST procedure conducted.

As such, only 85 procedures are needed to achieve payback on the purchase of an UltraMIST device (420*85 = ~$35,700). These are highly attractive economics for the physician. To put this in its proper context, payback becomes a matter of weeks for mobile providers who see 10-15 patients per day.

Payor Economics

The primary concerns for a payor offering reimbursement for any medical product in the wound care space are simply:

1. Does this work?

2. Do we save money on this and is the treatment less expensive than other treatment alternatives?

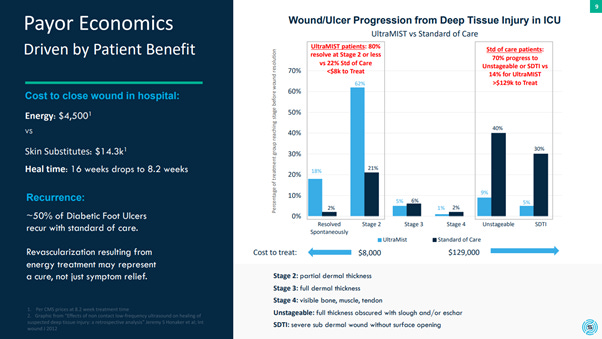

With regards to UltraMIST, we have answers to these questions thanks to an intensive study performed in the ICU at Mayo Clinic comparing UltraMIST against the standard of care (SOC) for patients with deep tissue injuries.

The results were staggering.

Recall a Wagner stage 4 means no skin is left and one can visualize the underlying bone, muscle and tendon.

Well, 70% of wounds treated under SOC progressed beyond a Wagner Stage 4. On the other hand, 80% of patients treated with UltraMIST saw their wounds resolve at a Wagner Stage 2 or less. (Wagner Stage 2 is a partial thickness wound such as a bed sore).

80% bed sores versus 70% visible bone.

This is inevitably how UltraMIST became the standard of care at the Mayo Clinic ICU.

Wounds develop exponentially such that treating a wound early is easy and cheap whereas treating a late-stage wound is hard and expensive. In this way, the payors’ concern of spending less is highly aligned with ensuring the patient gets treated early and subsequently recovers quicker, avoiding the complexities associated with late-stage wounds. The mobile and highly portable nature of an UltraMIST device ensures patients can be treated earlier, the payor spends less overall and optimal patient outcomes are achieved.

As can be seen in the below image, the cost of treating a Wagner Stage 2 wound or below is a maximum of $8000 on average whereas once a wound reaches a Wagner Stage 4, the cost is considerably higher with an average minimum spend of $129,000.

This is why a pain free treatment solution such as UltraMIST which offers immediate relief and can help to avoid surgeries is not only incredibly important for the patient, but equally so for the payor.

Sanuwave Economics

The piece on the right of the image below is the wand of the UltraMIST system and the piece on the left is the single use disposable applicator.

Sanuwave sells each UltraMIST system for $35,000 at list price.

Sanuwave also sells a single use applicator for $100 at list price.

The company has disclosed they sometimes offer discounting on these list prices, but a lot less than it used to.

Gross margins currently sit in the high seventies, with room to boost this even higher due to manufacturing changes which I touch on further below.

Manufacturing

Sanuwave dual sources their UltraMIST devices from 2 domestic manufacturers. One is based in Salt Lake, the other in Minneapolis.

A third provider makes the applicators which is also based in Minneapolis. The company is in the process of standing up a second domestic source on their applicators.

Almost all components that go into manufacturing are domestic too.

As such, the company doesn’t expect any material affect on its supply costs or availability due to the unfolding tariff and trade situation.

Additionally, Sanuwave is in the process of making a small change to the assembly process of the applicators such that it removes some complicated UV cure adhesive steps and replaces this with processes that are faster and easier to automate. Importantly, the company expects this will result in lower defects, easier assembly and lower cost for their applicators. Sanuwave expects to be live with the new model in Q4 FY25. The company believes this will push gross margins on the applicators above 80%, putting further upwards pressure on total company margins as Sanuwave continues to sell exponentially more applicators against a growing installed base of UltraMIST systems.

Production Capacity

As of March 2025, the company had capacity for 10,500 applicators per week. The company expects this to grow to 24,000 by December 2025.

On the systems side, the company currently produces approximately 25 systems per week. On this Mr Frank notes the following:

“To a certain extent, we got sort of lucky in that I had pushed the ops team to be able to go to our contract manufacturers and to double that production number within a 60 day period and to do that we actually stockpiled some of our long lead time components and so we’re actually sitting on quite a lot of inventory in both systems and components right now and so we’re in a great spot and don’t foresee any impending disruption.”

Rapid Growth

UltraMIST has been rapidly penetrating the wound care market. As of the end of Q4 2024, there were 1,047 systems in the field of which 135 were only sold in Q4 and 374 sold just in 2024 alone (71% growth YoY).

In other words, as at year end 2024, 36% of all UltraMIST systems were sold in the prior 12 months and yet the company has not even hit 1% total market penetration.

There remains a plethora of white space here for the company to continue to grow into.

Financials

Today gross margins are in the high seventies. Further upwards margin pressure will arise with the new mould for applicators in Q4 25’ which should push gross margins into the eighties.

Revenues have grown 50% YoY for the last 2 years and the company is executing on its mantra of ‘rapid profitable growth.’

In FY24, the company did $32.6M in revenues. In Q4 alone, the company did $10.6M in revenues.

Sanuwave has guided for another impressive 50% increase in revenues for 2025 at $48-50M.

Operating leverage is huge. The company expects 50% of incremental revenue growth to trickle down to EBIT moving forwards.

Operating Income for Q4 24’ was $2.5M at a 24% margin.

Since the recap, the company still has $26M in debt but expects to have fully paid this off over the next 12-18 months.

The company has NOL’s in excess of $200M.

Valuation

Given, the operating leverage dynamics, I expect operating margins to continue to expand.

$50M revenues for FY25 at a 25% margin lands us at $12.5M EBIT for FY25.

If we assume the same absolute $ growth continues into FY26 then revenues for FY26 would be $67.4M with EBIT coming in at $21.2M. This is a forecast I deem as conservative given the recent changes in the sales team dynamic which I touch on further below.

Given debt paydown occurs over the next 12-18 months, Sanuwave is today trading at a meagre 12.7x FY26 EV/EBIT.

This rapid growth profile should command a premium multiple of at least 20x EV/EBIT in my view. As the company continues to execute on its guidance, I suspect the market will rapidly re-rate this to a multiple that appropriately values Sanuwave’s incredible growth prospects.

At 20x FY26 EV/EBIT, and assuming debt paydown, Sanuwave stock is worth $50, a 58% premium over the prevailing share price of $31.55.

Continued execution into FY27 at the same absolute $ growth rate valued at 20x EV/EBIT implies a $70 stock price.

If Sanuwave continues to execute over the medium to long term at the same 40-50% revenue growth rate it has executed in line with over the last 2 years with 50% of this incremental growth trickling down to the bottom line, there is no reason its stock shouldn’t command an even greater multiple than 20x EV/EBIT.

At today’s price of $31.55, I believe Sanuwave is trading far below its intrinsic value. Given Sanuwave only uplisted to the NASDAQ in March and has yet to report an official quarter of earnings whilst being listed on a major public exchange, I suspect investor awareness has yet to properly sink in. I believe continued execution will serve as the catalyst for a re-rating from today’s levels as investors digest the extremely rare organic growth opportunity facing Sanuwave today.

Sales Team Dynamics

It is even more impressive to consider than Sanuwave only started 2024 with 2 salespeople and ended it with 9. That is, Sanuwave executed 50% revenue growth with an undercooked sales team for a large chunk of 2024.

CEO Morgan Frank has since brought on a new calibre of highly experienced sales personnel.

Board member Jeff Blizzard was formerly head of sales at Abiomed and the company recently brought in Tim Wern as Head of Sales. Tim was Jeff’s number 2 at Abiomed. Jeff and Tim took Abiomed from $15M to $400M in Sales before selling the company to J&J for $16.6B.

The company plans on bringing on another 3-4 highly experienced sales personnel.

With the former Abiomed band back together, Sanuwave is now focussing its efforts on making more ‘consultative sales.’ This means selling to customers who can be long term partners and buy more devices.

Mr Frank puts it best:

“We used to say (about our potential customers) ‘wow they could buy 4!’ Now it’s like ‘wow they can buy 400!”

Given the former debt and cap table issues, Sanuwave was laser-focussed on proving to their customers that they could get their cashflow generation to the point where their customers could clearly see they will be around to sell them applicators and devices in multiple years’ time. Sanuwave only recently turned this corner in October 2024 and as such, I expect even greater opportunities to partner with larger customers are now on the horizon that weren’t realistic prior to sorting out their cap table.

Why did this take so long to get moving?

Despite being FDA approved since the early 2000’s, UltraMIST has never taken off until recently.

Sceptics would rightly ask why it has taken this long for the product to gain traction.

UltraMIST was created by Celleration. The company was made up of brilliant engineers, but they did not prioritize marketing the product and developing customer relationships. They were not well capitalized, ran into trouble on that front and were forced to sell to another thinly capitalized company called Alliqua Biomedical.

Alliqua were then also forced to sell due to their financial woes and as such sold the product to Celularity. However, Celularity’s focus was not on UltraMIST. They were a company focussed on cellular research and were spending hundreds of millions of dollars on that front. UltraMIST was treated as an outside the box, non-core product.

Hence, by the time it was sold to Sanuwave in 2020, UltraMIST had only ever passed through thinly capitalized or unfocussed companies that never invested the necessary time and resources into the products’ development.

Risks

A big risk is the CMS reimbursement being cut. To be frank, this is a risk that will never go away and as such, investors should position themselves accordingly. In saying that, the CMS are increasing their focus on evidence-based medicines and Sanuwave continues to prioritize further clinical studies surrounding the effectiveness of UltraMIST as a standalone and complimentary wound care treatment.

On the competition front, there is only one other player using the same reimbursement code as Sanuwave called Arabella, with a far inferior product and annual sales of under $2M.

Debt: The refinancing of Sanuwave’s remaining $26M of debt serves as another key risk. The noteholders have been very accommodating to date via several modifications and extensions. Now that Sanuwave can pay the debt back via their normal course of operations, the noteholders have expressed a willingness to be flexible and work with Sanuwave. On top of this Sanuwave has entered into an IP option agreement on a former product which could bring in some up-front cash which the company indicates it would use to immediately pay down debt.

Manufacturing delays could materially harm the company especially with a growth profile as rapid as Sanuwave’s. However, Mr Frank is laser-focused on ensuring everything is domestically dual sourced and that Sanuwave doesn’t bite off more than it can chew in terms of contracting beyond its manufacturing capacity.

Summary

Sanuwave is a rapidly growing medical device company operating in the U.S. wound care space.

Today Sanuwave trades at a ~13x FY26 EV/EBIT multiple.

I believe that continued earnings execution combined with increased investor awareness will lead to a re-rating in line with an appropriate multiple that reflects their long runway for organic profitable growth.

Thanks for reading! Let me know if you have any thoughts, pushback or questions in the comments below.

Also, if you have any suggestions on other names I should look into, drop me a line at info@tenvacapital.com or @TenvaCapital on X.

This is a reader-supported publication so if you enjoyed this write-up, please consider subscribing below, sharing this with a colleague or friend and hitting the like button. Your support is always appreciated! Thanks for reading!

Lastly, I would like to thank to Ian Cassel for making me aware of this business. He and his team over at MicroCapClub.com offer fantastic resources for investors!

Disclaimer

Tenva Capital, its associates and/or entities controlled by its associates hold shares in the company referred to in this post.

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

Thanks for the write-up. What fcf do you expect at the end of 2027? Around 20 million usd? I’m trying to come up with a reasonable valuation myself.

Enjoyed this write-up. Question re my basic match. E.g. Q4, Revenue breakdown was ~$4.75M from machines sold (135 x $35,000) and the remaining was from applicators (~$6M). With $100 revenue/applicator (assuming no discounting) and ~1,000 machines active (on avg throughout the quarter), that's only ~65 applicators/machine for the quarter, not even 1 procedure/applicator per day in the quarter for each machine. Is my math correct? If so, why such low utilization?