Select Harvests (SHV:ASX) - FY25 Results

Operational Execution. Highly Favourable Backdrop. Stock Remains Significantly Mispriced.

Yesterday, Select Harvests reported extremely solid FY25 results.

Operational execution continues to improve.

Management are increasingly thoughtful about capital allocation as well mitigating any potential operating hurdles.

Critically, yesterday’s results gave the market its first taste of the hugely embedded operating leverage in Select’s business and its capacity to take advantage of the structural LT supply-demand imbalance that is poised to see almond prices go higher for longer given the SGMA backdrop in California.

For new subscribers who missed my original Select Harvests write-up, you can find it here:

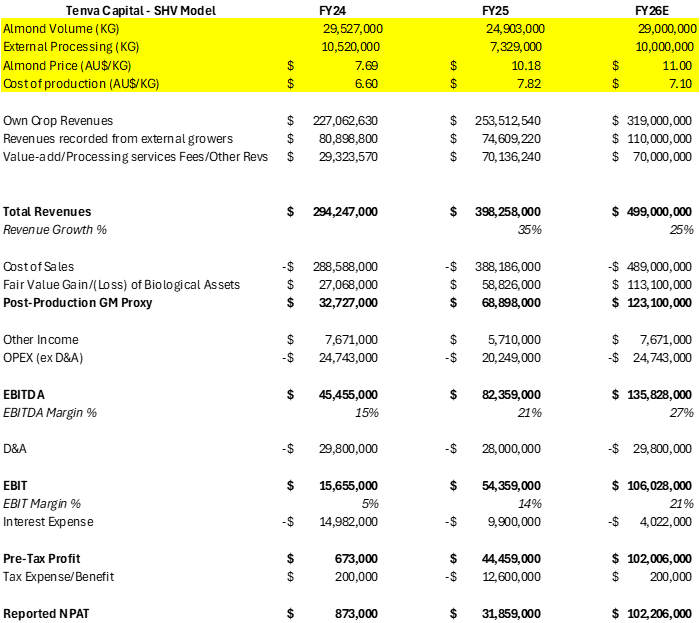

The Numbers

In FY25, SHV’s almond volumes were 24,903 MT, down from 29,527MT in FY24.

The production decrease occurred across the board in Australia and was largely due to weather conditions and frost.

Despite this, the realized almond price for full year FY25 was $10.18/KG, up 32.3% YoY from $7.69/KG in FY24.

Production costs were $7.82/KG, significantly higher than the $6.60/KG achieved in FY24 due to the lower crop size in FY25. Normalized for 29,000MT production, SHV’s costs would have been $6.71/KG for FY25.

Source: Company Announcements

Revenues increased 35% YoY to $398.3M in FY25.

EBITDA increased 81.5% YoY to $82.4M in FY25, a product of the increased almond price and operating leverage despite reduced production.

NPAT increased from $0.9M in FY24 to $31.8M in FY25.

Source: Company Announcements

Operating cashflow came in at $118.6M. $21M was related to a Working Capital unwind from FY24.

Hence Underlying Operating Cashflow was a whopping $97.6M.

Source: Company Announcements

Significant Cost Advantage over California

Moreover, Select retain their significant cost of production advantage over California as can be seen below.

It’s important to note that the above chart represents the cost to produce greenfield almonds in the Sacramento Valley and not the San Joaquin Valley (SJV) which is where the vast bulk of production in California occurs.

A recent UC Davis study noted that the total cost of a greenfield almond orchard investment in the SJV is US$4/lb in today’s environment. (Source: UC Davis).

This is the equivalent of AU$13.51/KG - a far cry from SHV’s AU$6.71/KG cost of production normalized to 29,000 MT and much more expensive than the Sacramento Valley.

Balance Sheet Fortress + Capital Returns

With the halving of net debt down to $79.1M and significant reduction in gearing down to 15.1%, Select are well positioned to build a fortress Balance Sheet over the coming years.

Management have implicitly flagged this is their goal, outlining their first and foremost priority is to reduce debt further before then returning capital to shareholders via dividends and buybacks.

Given no issues with the FY26 crop, I expect Select to fully pay off their debt by year-end FY26 and to unlock the capital returns kicker of dividends and/or buybacks. This serves as another impending catalyst on the horizon for a re-rating with the likelihood that Aussie yield lovers will return to the stock in droves upon the re-instatement of dividends.

The outlined long-term capital return framework below is highly sensible and shareholder friendly.

Increasing Input Costs in FY26 - Largely Absorbed by Continued Efficiencies

Management noted their expectation of certain uncontrollable cost increases in water, bees, fertilizer and energy to the tune of $20M.

However, they expect to largely offset this via incremental investments made in capacity, yield recovery, shakers and their Project Management Office (PMO) initiatives.

Varroa Mite Risk Mitigation

The Varroa Mite issue affecting bees across Australia is a clear short-term risk for Select.

In saying that, management appear very thoughtful on dealing with the issue and have so far entirely executed on this front.

Their calculated go-forward plan is to source bees from Western Australia (where Varroa Mite is non-existent).

Increased Processing Capacity

From FY26, Select will have an increased processing capacity of 50,000MT from 40,000MT in FY25.

With ~20MT capacity to process external product at $1/KG, Select’s processing business could hypothetically do $20M in EBITDA over the medium term and serves as a nice diversifying and repeat revenue stream.

Macro Outlook

Management didn’t hide their confidence around the favourable macro environment and expectation for further almond price increases into the future.

The industry now widely expects a 2.6-2.7B pound 2025 crop in California, a significant reduction from the Objective Estimate of 3B pounds.

Recall the significance of the carry-in and the emotive role it plays on the almond price.

The industry targets a carry-out as a % of yearly shipments of 20%.

Management noted their expectation of a 300-something carry-out from the California 2025 crop which implies a 2.6B pound crop assuming shipments are flat YoY.

Putting this in its proper context, assuming California again ships 2.65B pounds from the 2025 crop, this would imply a 13.61% stock to shipments ratio.

As can be seen below, this would be very low historically.

It would undoubtedly signal to the broader market highly stressed levels of global supply, putting significant further upwards pressure on price:

New Plantings

Management specifically outlined hearing anecdotal whispers of only ~3,000 acres for new plantings in California throughout the 2025 crop year.

This extrapolation was likely grasped from data provided by the nurseries themselves.

If the number of new plantings eventuates in such a lowly manner, this would undoubtedly serve as another highly bullish signal for the rest of the market to wake up to the broader LT supply-demand dynamics.

Perpetual Overhang

In his 1934 value investing classic Security Analysis, Benjamin Graham famously said: “In the short run, the market is a voting machine but in the long run it is a weighing machine.”

Situations of persistent non-fundamentals-based selling can be a fertile hunting ground for attractive investments, and I believe we are witnessing this phenomenon with SHV.

On the 24th of November, Perpetual Asset Management filed they had done a block trade and reduced their exposure by approximately 6.5m shares.

Then yesterday an ‘unknown entity’ dumped ~3m shares into the market which I believe was likely Perpetual.

Again today, the volume traded was outsized with ~4.7m shares trading hands – a significant chunk of which was likely Perpetual.

Average Daily Traded Volume over the last 3 months has been 381K shares.

Here is some additional perspective:

This selling is indiscriminate and clearly non-fundamentals based.

They likely have somewhere between ~6-7m shares left to go.

In the short-term, my view is this indiscriminate selling pressure presents investors with a narrow window to buy shares at a clear discount to intrinsic value.

Once this overhang is gone, I believe the stock will likely re-rate significantly.

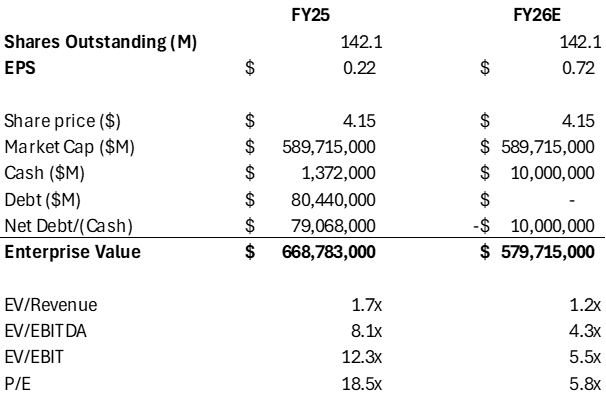

Financials and Valuation – The Takeaway

The significant step change in profitability and cashflow generation should awaken the market to Select’s embedded operating leverage.

These results were achieved with an average price of $10.18/KG and significantly muted production.

It’s important to note that on a normalized basis for production of 29,000MT, Select would have generated $118M in EBITDA this year, against an EV of just $668.7M. This puts them on a normalized LTM EV/EBITDA multiple of just 5.6x.

Despite management flagging that it’s too early to forecast the FY26 crop, they crucially indicated that they have not encountered any frost issues that were seen in the FY25 crop.

They also outlined that they have nothing negative to report on the FY26 crop to date.

Recall also that the 2026 crop will be the first full year of Select’s improved horticultural approach.

On top of this, the California crop is tracking 7-8% below receipts from this time last year and well below the Objective Estimate of 3B pounds.

Given these significant supply constraints, I believe Select are well positioned to realize an even greater almond price in FY26 than FY25.

With the latest Stratamarkets report indicating an AU$ equivalent almond price of AU$10.91/KG and the reality that Aussie almonds generate a significant tariff premium over Californian almonds, Select could easily achieve an average almond price of at least AU$11/KG or higher for FY26.

Assuming they have no production mishaps and a conservative AU$7.10/KG cost of production, Select would have a net cash balance sheet next year and generate $135M in EBITDA.

As you can see below from my model, this would put them at just 4.3x next year’s EV/EBITDA and 5.8x P/E.

With the backdrop of SGMA’s impact on global almond supply as well as anecdotal whispers of next to no new Californian supply being planted in 2025, it is clear to me that this is simply far too cheap.

If Select can execute operationally in FY26, Californian supply remains constrained and we do indeed get confirmation of no new plantings from the nursery reports in April, it is my view that the broader market and many institutions will awaken to the highly attractive medium to long-term IRR opportunity that Select presents investors.

In this scenario, once the Perpetual overhang is gone, I would not be surprised to see the stock re-rate in line with 8x NTM EV/EBITDA, or ~$8 per share.

Currently, the market refuses to price in Select’s capacity to generate meaningful Free Cash Flows into the future. This is evidenced by the discount of SHV’s stock price to the market value of its NTA.

Despite already generating meaningful Free Cash Flows in FY2, the stock still trades at just 0.8x the market value of NTA.

Concluding thoughts

All the data we have seen so far reaffirms the supply constrained backdrop coming out of California as global long-term annual demand remains at a 5-7% CAGR.

At 4.2x NTM EV/EBITDA and 5.8x NTM P/E with a net cash Balance Sheet coming out of FY26, Select are on the cusp of achieving significant earnings and free cash flows that the market has simply yet to price in.

Given continual supply constraints in California and Select’s continued operational execution into FY26, I believe the stock will re-rate significantly from today’s levels.

Disclaimer

Tenva Capital, its associates and/or entities controlled by its associates hold shares in the company referred to in this post.

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

I don’t do agriculture stocks, but as a subscriber I must say your write-up’s on Select Harvests are some of the most comprehensive I’ve seen on Substack. Looking forward to more!

Never in my life would I have guessed I'd be this interested in almond farming. Great writing and thank you for sharing!