Select Harvests (SHV:ASX)

Structurally Broken Supply with Material Impending Cashflow Generation.

Welcome back Tenva Capital readers!

I have a highly compelling idea in store for you today with immense upside potential. Despite its’ highly attractive long-term IRR profile, no one seems to be talking about this stock… at least as of yet.

Thesis Overview

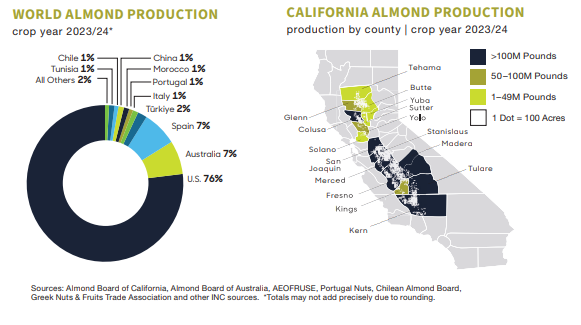

76% of global almond supply is produced in California.

Almonds are one of the world’s most water intensive crops and their production relies heavily on groundwater pumping in California.

Between 68-80% of Californian almond acreage is located in regions with critically over-drafted basins.

California’s Sustainable Groundwater Management Act (SGMA) is a state-mandated groundwater pumping reduction program that will materially hamper the capacity of many producers in accessing much needed water for crop growth.

As such, the ramping of SGMA will have a substantial long-term impact on global almond supply.

Producers outside the U.S. are most likely to reap the benefits.

Select Harvests (SHV:ASX) is the only publicly listed pure play almond producer in the world.

As the almond price responds to this impending structural supply-demand imbalance, I believe Select will generate over 40% of today’s market cap in annual free cash flows.

Let’s dig in.

Industry Dynamics

Almond Orchard Lifespan

The farming of almonds is an incredibly long-duration undertaking.

Almond orchards are usually productive for up to 25-30 years.

Almond trees begin partially bearing fruit after 3 years and only reach full bearing after 7-8 years.

Orchards are usually at their most productive between years 7-15.

Generally, from year 15 onwards, yields and profitability of an orchard decline with age.

Almond production occurs over a seasonal annual cycle.

Annual almond lifecycle

Winter Dormancy

Tree dormancy occurs during winter.

The cool temperatures during this period are necessary for the trees to eventually exit dormancy and bloom successfully.

The blooming process occurs in Spring but is enabled by the cold temperatures experienced during the dormancy period.

Pollination

At bloom time, beehives are tactically dropped into the orchards to pollinate the crop.

The bees also assist in moving pollen between the different tree varieties grown within the orchard.

Poor beehive health can have a dramatic impact on yields for any given crop year.

Heavy rain during bloom – which falls between July and September in Australia - can also negatively affect tree and flower health.

Due to early seasonal bloom compared with other crops, almond trees are susceptible to late season frost.

Maturation

After bloom, almond kernels mature and eventually grow to full size with the shell hardening around the kernel – both of which are protected by a fuzzy outer hull.

As the weather begins heating up and spring rain comes to a halt, farmers commence tactful irrigation of the crop via modern line irrigation methods.

Not long after this the hull splits open, exposing the almond shell.

Harvest Season

Machines are then used to physically shake the trees amongst the orchards. The almonds fall to the ground where they are gathered and taken through a processing facility for further refining and removal of debris.

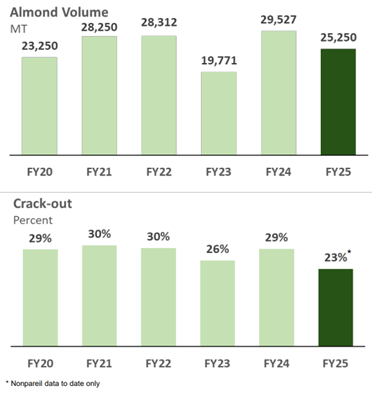

Crack-out

The crack-out rate is a common industry term which represents the percentage of edible kernel weight obtained after removing the almond shell. This is measured as a ratio of kernel weight to total in-shell weight.

A higher crack-out rate indicates a larger, meatier kernel relative to the shell. This is desirable for profitability and quality.

Only 20-30% of almond flowers actually crack-out and develop into nuts.

Water Intensity

An acre-foot is the amount of water needed to fill one acre of land with one foot of water.

Almond orchards require 3-4 acre-feet per acre of water irrigation annually.

This is highly water intensive.

For context, to produce a single almond requires approximately 8 litres of water on average.

Even a single year of water stress can have a material impact on future yields.

To avoid prolonged negative effects from even just one year of water stress requires skilled farmer timing via a methodically crafted deficit irrigation program.

In the case this is done correctly, recovery is possible given normal water supply the following year.

However, multi-year reductions in irrigation significantly amplifies the possibility of long-term orchard damage, potentially leading to substantial yield declines as well as tree weakening and potential removal.

Therefore, a steady, ongoing, long-duration water supply is of critical importance for any farmer that embarks on the 20+ year duration project of farming almonds.

On top of this, almond orchards also require year-round nutrient management and pest monitoring.

Global Almond Supply

As touched on above, almond orchards need warm summers and cool winters to effectively bear fruit.

They are therefore most productive in a Mediterranean climate.

For this reason, global almond production is highly concentrated in certain regions across the globe.

California is the most prominent region for production providing 76% of the world’s almond supply.

The 2nd and 3rd largest producers are Australia and Spain, each with 7% of global supply.

Hence, California is the key driver of almond prices and overarching industry dynamics.

Californian Acreage

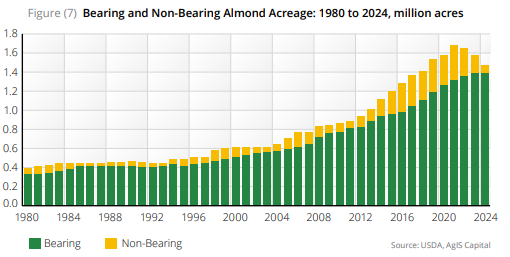

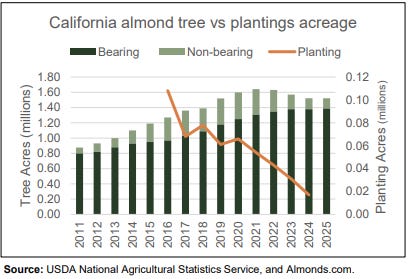

From 1980-1995, Californian acreage remained largely stagnant.

However, from 1995, acreage grew consistently for two and a half decades.

Very strong almond prices from 2010-2015 drove significant investment in new supply.

As a result, bearing acreage growth really took off post-2016, reflecting the ramp up of this supply’s productivity.

This flurry of supply resulted in significantly depressed prices from 2020.

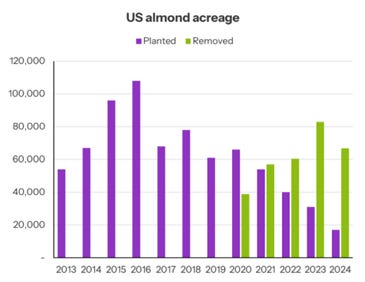

As a result, operators reduced new plantings, increased the removal of non-performing acreage and lowered their emphasis on enhancing yields through costly nutrient management, instead prioritizing a more defensive cash management stance.

In 2022, the industry had its first decline in total acreage for more than 20 years.

Global Almond Demand

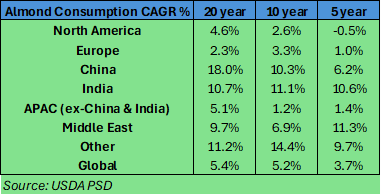

From 2004-2024, global almond consumption grew from 0.6M Metric Tonnes to 1.6M Metric Tonnes; representing a 20-year CAGR of 5.4%.

China and India powered approximately 29% of this 20-year consumption growth, as North America & Europe made up 37%.

In the past 5 years, China, India & the Middle East contributed to 75% of global consumption growth whilst consumption in developed markets largely stagnated.

Production, Price Dynamics & Historic Yields

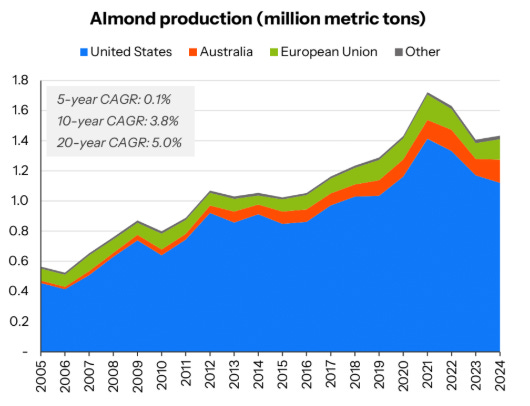

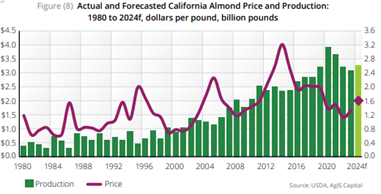

Global almond production has historically grown in line with demand, at approximately 5% per annum.

Source: Somar Global Partners.

However, after a large run from 2016-2021, production in California reduced 3.5% in the last 5 years, offset by growth in Australia and the EU.

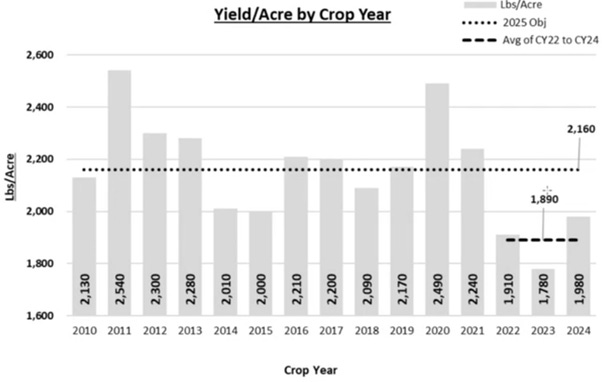

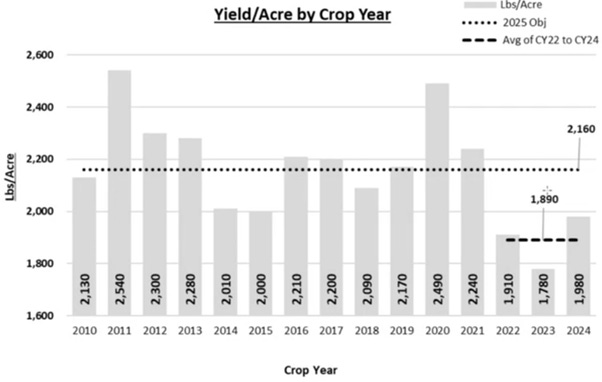

Over the past 15 years, Californian yields per acre in Pounds averaged 2,160.

Almond production = bearing acreage * yield per acre.

Source: Spectrum Data Analytics.

The yield weakness of the past 3 years can be attributed to less investment in nutrient management arising from cashflow constraints due to depressed prices and increased operating costs.

In general, any yield improvements tend to lag price increases. This is because it typically takes years for investments in productivity enhancements to be realized.

Pricing

The almond price is inherently cyclical and dictated by overarching supply-demand dynamics.

The strong prices from 2010-2015 saw increased orchard plantings which all came online during the 2015-2020 period. As these came online, prices were increasingly more depressed.

In isolation, recent price action looks to simply imply a reversion to the mean.

Notably, there’s been an approximate 10-year time frame between each cycle peak.

This intuitively makes sense given it takes ~5 years to start meaningfully producing volume for perennial crops like almonds.

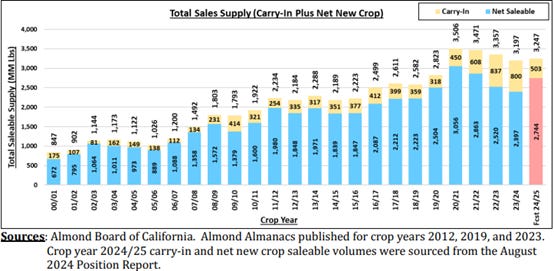

Importance of ‘Carry-in’

The carry-in volume is the volume of almonds that were unsold in the prior year and are thus carried into the next year - usually sold at a slight discount given their older status.

The saleable supply in any given crop year is the combination of this carry-in volume plus the net saleable new crop.

The emotive role of the crop carry-in on price is important to consider and understand.

If the carry-in is low, this may raise prices heading into a new crop year, as there is less perceived supply in circulation.

If the carry-in is too high, then the subsequent crop year may experience an over-supply problem ultimately leading to depressed prices.

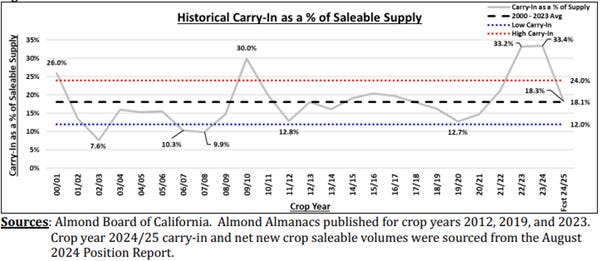

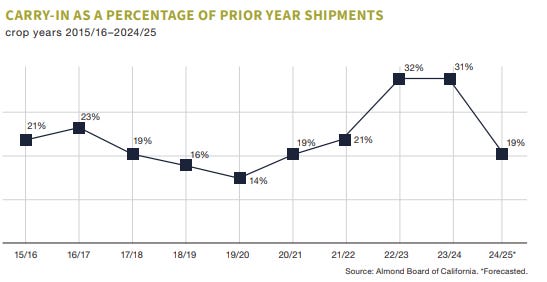

Since the turn of the century, average carry-in as a percentage of Saleable Supply has been 18.1%.

Shipping issues throughout the latter part of the COVID pandemic led to record high carry-in volumes. This put a huge strain on pricing and grower returns.

Another way of looking at carry-in is by taking it as a % of prior year shipments. The industry targets approximately 20%.

The 2024 crop was the first time excess COVID inventories were cleared with the industry returning to levels slightly below target.

The difficulties of this COVID era for Californian growers cannot be overstated. Reports indicate almond farmers have incurred significant negative annual returns since 2020 with many under serious financial strain, amplified by recent land value declines.

As a result of these record-high carry-in numbers, buyer behaviour shifted to ‘hand-to-mouth’ purchasing.

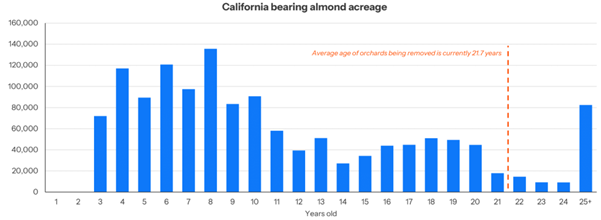

Californian Acreage Age Profile

Even though orchards can bear fruit for up to 30 years, the average age of removal in California is currently 21.7 years.

The earlier than necessary removal is due to escalating operating costs and increased water stress as we will shortly get to.

Approximately ~15% of bearing acreage – roughly 200,000 acres – will surpass this average removal age within the next 5 years.

At the end of a tree’s life, yields materially decline and therefore experience a reduction in cash generation. This is of course absent any significant uplift in prices, in the case of which removal may be postponed.

56% of California’s almond acreage is less than 10 years old, the result of significant planting after the last market peak in 2014/2015.

Sources: Somar Capital Partners, LandIQ, California Almond Board.

SGMA – The Game Changer

Herein lies the crux of this thesis.

The supply of water for farming almonds has historically relied heavily on the use of both surface and groundwater.

In Californian drought years, 70-80% of an almond farmers’ water supply has historically been procured from groundwater. In normal years groundwater pumping is usually around 30-40%.

Prior to 2014, Californian farmers had completely unrestricted access to groundwater aquifers.

However, long-term excessive pumping has put the aquifers into significant over-draft. This means they are being emptied at a rate much faster than their capacity to be recharged.

This overuse of the State’s groundwater resources has resulted in land subsidence and deterioration in water quality in many areas throughout the State.

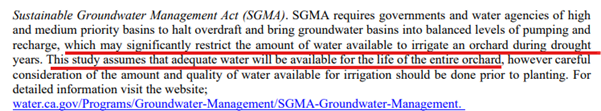

The Sustainable Groundwater Management Act (SGMA) was enacted in 2014 by Californian Governor Jerry Brown to halt over-draft and bring basins into ‘balanced levels of pumping and recharge’ by 2040.

SGMA requires existing local agencies to form Groundwater Sustainability Agencies (GSAs) in critical, high and medium priority basins and to develop and implement Groundwater Sustainability Plans (GSPs).

GSAs are therefore held responsible by the State for achieving long-term ‘sustainable management of their groundwater basins’ and must achieve sustainable groundwater management within 20 years of implementing their GSPs.

These GSPs must avoid the following issues from groundwater use within the GSA:

1. Significant and unreasonable declines in groundwater levels

2. Reductions in groundwater storage

3. Intrusion of seawater

4. Degradation of water quality

5. Subsidence of land

6. Depletions of interconnected surface waters

Groundwater basins experiencing the most severe over-draft are labelled critically over-drafted basins. These basins must achieve groundwater sustainability by 2040.

GSAs in critically over-drafted basins were required to submit GSPs by January of 2020. Implementation followed submission, with annual reporting and five-year updates mandated.

As of 2025, 23 GSPs (corresponding to 6 basin areas) have been deemed inadequate, leading to state intervention or probation by the State Water Resources Control Board to ensure compliance. 9 are still under review. Source: AllenMatkins.

The overwhelming concentration of critically over-drafted basins within the San Joaquin Valley (SJV) directly correlates with California's most productive agricultural regions, including the vast majority of almond acres.

21 basins are classified as critically over-drafted with ~84% of this acreage located in the San Joaquin Valley. (Source: California Department of Water Resources).

Notably, it is estimated that between 68-80% of California’s almond acreage is situated within these critically over-drafted regions. (Sources: Almond Board of California & AcreTrader).

This means that 52-61% of the world’s global almond supply is grown in Californian regions with critically over-drafted groundwater basins.

Californian growers heavily rely on groundwater access to adequately maintain their almond crop yet are faced with state mandated pumping reductions all the way through until 2040 in which ‘sustainability’ must then be achieved.

The implications of this on future almond supply will be drastic.

White Lands

Land atop basins with no access to surface water and sole reliance on groundwater for irrigation are known as ‘white lands.’

Approximately 143,000 almond acres are atop these white lands with critically over-drafted basins.

To achieve sustainability in these basins, the stone-cold reality is this: groundwater pumping must be reduced to a range of 0.25-0.8 acre-feet (AF) per acre per year depending on the specific location within the San Joaquin Valley. (Source: AgIS Capital).

Recall that almonds require a sustainable annual water supply of 3-4 AF per acre annually.

If we assume a reduction to 0.55 AF per-acre, then logically approximately 7 of 8 of these acres will be extracted by the time SGMA is fully enacted in 2040. This alone represents 9% of the world’s global acreage. And this is just the ‘white lands.’

Access to Both Surface and Groundwater

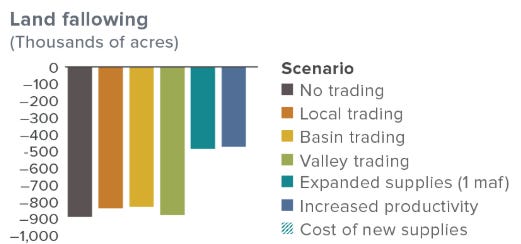

Turning our attention to areas in the SJV which use both surface and groundwater, the Public Policy Institute of California (PPIC) estimates the very best-case scenario is that 500,000 acres of farmland will need to be fallowed by 2040 to be SGMA compliant. However, this scenario assumes one million acre-feet of new water supplies. (Source: PPIC).

The only problem is that ‘new supplies’ are expected to come from recharge technology. Yet, contested water rights mean there are few incentives for farmers to front millions of dollars to make this investment. This is because the water that sinks below one person’s farm becomes available for others to pump. Without a detailed accounting and crediting system, farmers have no way of knowing they will recoup their investment, let alone see any return.

“When someone recharges, they’re mainly benefitting their neighbors. The recharge is local, but the benefits are regional” - Graham Fogg, a UC Davis professor emeritus of hydrogeology.

The PPIC study goes on to estimate that up to 900,000 acres of irrigated farmland may need to be removed by 2040 in a ‘worst-case scenario’.

Source: PPIC

Given 700,000 acres of irrigated farmland are fallowed by 2040 and that half of this will be almond acres – a reasonable inference given their prevalence and water intensity - then this implies 350,000 bearing acres of almonds will be removed from the SJV.

This scenario represents an additional 207,000 acres or 15% of global almond acreage that will be taken out of the ground, on top of the expected acreage removals in white land regions.

Thus, inclusive of the removal of the white land acres, we could see ~24% of global almond acreage effectively removed by 2040, whilst demand for this healthy, plant-based, protein-rich food keeps surging.

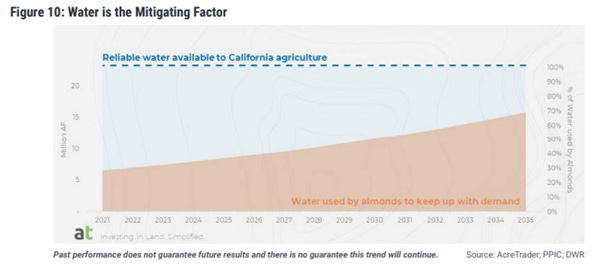

Almond Agricultural Water Share

Another telling data point is in assessing the water supply used by almonds in Californian agriculture as is and then extrapolating the % of water supply that will be needed to meet future demand. The results of which are simply staggering:

The % of water intensity used by almonds to meet historic demand would need to double to ~70% of just today’s Californian agricultural water availability, noting this doesn’t even consider the vast water reductions mandated by SGMA to bring aquifers back into balance!

Psychological Effect of SGMA

Notably, we haven’t even considered the psychological effect that SGMA is bound to have on prospective almond growers.

A greenfield almond orchard investment in 2025 would have the following characteristics:

1. Material capital outflows for the first 5 years. The orchard would produce its first fruit in 2028.

2. Significant operating losses would be carried for each of the first 5 years with the prospect for annual breakeven only in 2029/2030 in the best case.

3. From years 2030-2040, the orchard would be in ‘cash generation’ mode.

4. Real economic return to the farmer would only occur post 2040. Critically, this means all capital outlay has been returned, and the farmer would only be earning a real return post 2040.

Thus, it seems highly unlikely many Californian farmers will jump at the prospect of embarking on a 20+ year almond orchard investment when the farmer would only see a real economic return after ~15 years given the mandated environment of heavy reductions in groundwater pumping – a mechanism growers heavily rely upon for the maintenance and survival of their crops over the long-term.

When there are simple alternatives in terms of crop rotation, I find it difficult to fathom that many Californian farmers would embark on this journey with full awareness of the material capital impairment risks posed by this known lack of steady water supply to maintain a healthy almond orchard long-term.

Cost of a Greenfield Almond Orchard in Today’s Environment

It’s important to note that nearly 70% of Californian almond farms are 100 acres or less. (Source: USDA 2017 Census of Agriculture).

Hence, the recent UC Davis study examining the sample cost of establishing a greenfield almond orchard on 100 acres in the San Joaquin Valley is incredibly useful to consider. (Source: UC Davis).

Notably, the study assumes adequate water supply throughout the life of the orchard, meaning no water premium has been considered.

Despite this, the study noted that the total cost of a greenfield almond orchard investment is $4 USD/lb in today’s environment, significantly above current prices of $2.64 USD/lb (Source: Stratamarkets). To reiterate, this is absent any water premium.

Today’s all-in cost of almond production at $4 USD/lb is 54% higher than in 2019 when the price was $2.60 per pound in the Northern SJV.

Cash costs accounted for 32.5% of this increase while the remainder is attributable to higher non-cash costs such as capital recovery costs for farming equipment, largely driven by higher interest rates.

The last bull cycle saw a $4 USD/lb top before quickly falling off a cliff as orchards planted between 2010-2014 started bearing fruit.

The bottom line here is this: Pricing will need to go significantly beyond $4USD per pound (equivalent of $13.73 AUD/KG) before we see any meaningful Californian supply response in this SGMA environment.

Structurally Broken Supply

After 30+ years of almond acreage growth, water scarcity, increased breakeven costs and suppressed almond prices have reduced total almond acreage in California since 2021.

Even if prices increase from today’s levels, the associated lack of clarity surrounding long-term water access, its effect on land values combined with the hefty up-front capital investment required for a greenfield project renders any significant new orchard developments highly unlikely into the foreseeable future.

Proof in the Pudding

New plantings are already in systematic decline as removed acres have also begun to tick up.

Source: Company Announcements.

Source: Somar Capital Partners.

California Almonds Summary

Given the above almond industry dynamics in California, I believe it’s highly likely we see a meaningful long-term decline in global almond acreage and volumes.

Inevitably, this will put significant upwards pressure on global almond prices.

I believe producers outside California are best positioned to take advantage of this dynamic and generate material free cash flows.

Select Harvests (SHV:ASX)

Company Background

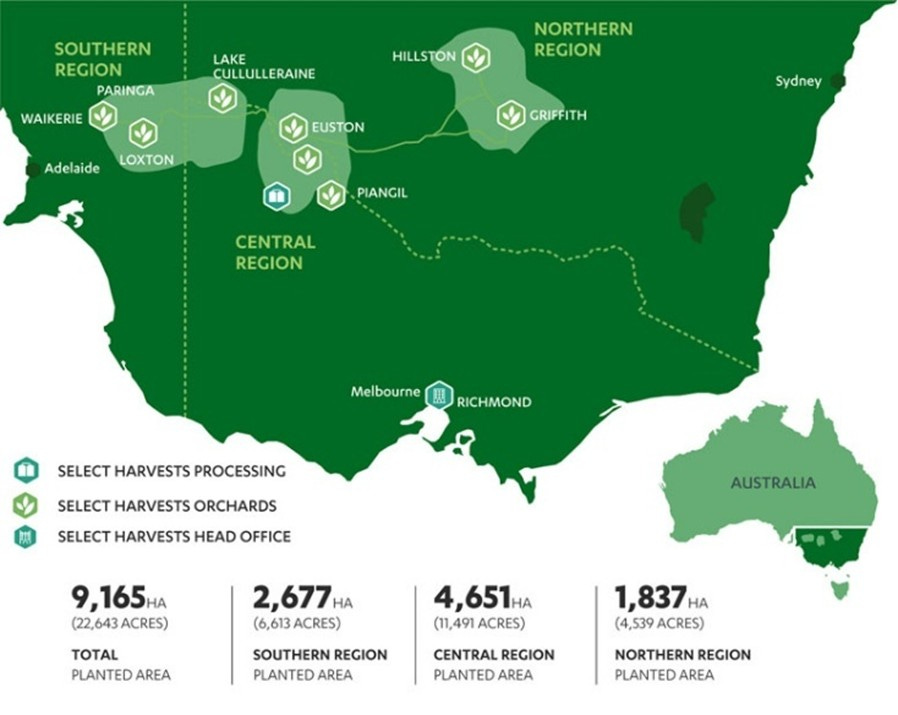

Select Harvests is the only pure-play listed almond producer anywhere in the world.

Select trades under the ticker SHV on the ASX.

The company started out as a small-time grower near Mildura, Australia in the 1970’s yet has become a significant operation overtime.

Today, the company runs the 2nd largest almond production by acreage in the country and the 5th largest in the world with 22,643 planted acres across three primary locations.

Operating at three distinct locations limits exposure to the weather, spread of disease as well as insect infestation whilst bolstering the availability of labour.

The company owns and operates a 40,000-tonne processing facility, with expansion to 50,000-tonnes soon to be complete. The facility is used for both its own as well as third-party processing and production.

SHV owns a large portfolio of water rights which include both permanent entitlements as well as medium term leases.

The company strategically paid down debt via a $80M capital raise in November 2024 and is now adequately capitalized to take advantage of the impending market opportunity.

In 2022, new CEO David Surveyor joined the group. Mr Surveyor was formerly CEO of Alliance Group - a red meat co-operative in New Zealand with annual turnover of NZ$2.2B.

In FY23, management instituted a project management office (PMO) to enhance orchard efficiency, yields and cash generation.

The company has $43.9M of tax losses, meaning SHV will not be subject to tax payable on their next ~$146M in profits generated.

Strategy

Sales are primarily exports to China, India & the Middle East.

In 2024, 65% of the group’s exports were direct to China.

In recent years, Select have increased their focus on key markets in China and India, whereby Australia has a significant tariff advantage over the U.S given respective trade agreements with both countries.

In FY24, Select increased sales to China by 30%. These sales made up 65% of the groups’ exports.

As part of the PMO and under new leadership, the company has evolved its’ farming strategy and from August 2024 has increased fertilizer applications under a refreshed horticultural program.

Productivity

Select targets approximately 29,000 Metric Tonnes (MT) of almond crop production per annum.

In 2025, the crop will come in lighter at ~25,250MT due to lower crack-out percentages and a weaker bloom than previous years.

This weaker crop position is consistent across all Australian growers. (Source: Australian Almond Board).

Source: Company Announcements.

It’s important to note that the FY25 crop was grown under the old horticultural strategy and the company expects FY26 to be the first year where we should see the newer horticultural practice benefits translating to a stronger crop yield.

The delay in the effects on yields of the new horticultural practice is due to almonds’ two-year reproductive cycle.

“The '25 crop was grown under the old horticulture strategy, and that may have seen tree resources overextended without enough fertilizer, resulting to nonpareil variety produced less fruit and a lower crack-out rate. We lost some 500 tonnes to frost and ultimately had a bloom that did not quite deliver.

Whilst the 2025 crop has been an off year, the new horticulture strategy has largely been deployed.

The tree health is positive, and 2026 is the first year when we should see the horticultural practice benefits manifest in a better crop yield.” – CEO David Surveyor – 1H25 Earnings Call

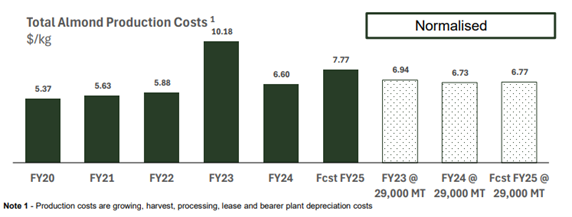

Cost of Production

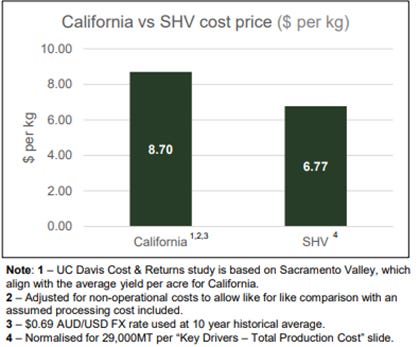

On top of the tariff advantage Australia boasts, Select are lower cost producers than Californian producers on a normalized production basis.

Source: Company Announcements.

In saying this, the salient reality is that production costs exhibit operating leverage and therefore depend on the amount of saleable crop produced for any given year. Given the weaker crop in 2025, production costs are expected to come in at $7.77 AUD/KG.

Source: Company Announcements.

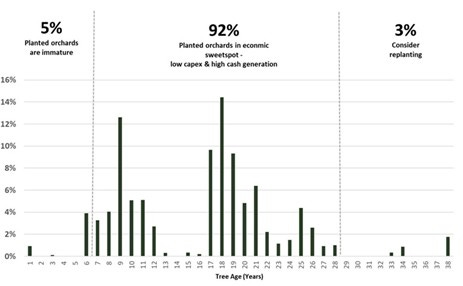

Orchard Age Profile

Select’s average weighted orchard life is 13.5 years.

As of December 2024, 100% of SHV’s current planted acreage is cash generative.

92% of planted orchards are within the economically mature sweet spot of low CAPEX & high cash generation.

11% of planted orchards will be considered for replanting over the next 5 years. This decision may be delayed by higher commodity prices.

The company has 10 years before ~40% of its orchards will be considered for replanting.

In mitigating any volatility from this, a targeted and balanced replanting schedule is likely to be initiated by management over the next decade.

Source: Company Website.

Australia’s Water Rights System

Water rights are ‘unbundled’ or separated from land ownership in Australia, allowing them to be traded and owned independently.

The heart of almond growing in Australia occurs in the Murray-Darling Basin (MDB). This is governed by a nationally coordinated framework under the Murray-Darling Basin Plan.

Types of Water Rights

The strongest water rights are known as Permanent Water Entitlements. These provide an ongoing right to a share of available water for any given year but are tied to specific zones within the MDB.

A recent strategic decision was made by management to increase Selects’ permanent water entitlements. Select will also rebalance its’ water portfolio to more closely align water entitlement locations with farm locations.

Leased Water Rights occur when an entitlement holder leases their water entitlement to another party for an agreed period.

Temporary Allocations are annual volumes that are assigned to entitlements but vary based on seasonal availability due to rainfall and dam storage. These are often traded on spot markets to meet shortfalls and are subject to the same location-based rules as permanent entitlements.

Select have a balanced portfolio of permanent, leased and temporary spot market water allocations.

Government Buybacks

The Australian government's water buyback program in the MDB refers to a system whereby the federal government purchases permanent water entitlements from irrigators.

Buybacks reduce the total volume of water available for irrigation and other productive uses by permanently transferring purchased entitlements to the Commonwealth Environmental Water Holder (CEWH), who use these for ecological benefits rather than agriculture.

Australia’s system is market-driven, voluntary and ensures adequate compensation for entitlement sellers, thereby minimizing market disruption.

When comparing this to SGMA, Australia’s buyback system is far less disruptive to farmers.

California’s SGMA is mandated by law, decentralized and causes significant disruption through direct pumping restrictions and fees. Its’ long-term implementation brings about a sense of major uncertainty for farmers. Notably, SGMA has also already contributed to quite significant land value plunges that are as high as 25-50% in some areas of the SJV. (Source: farmprogress.com).

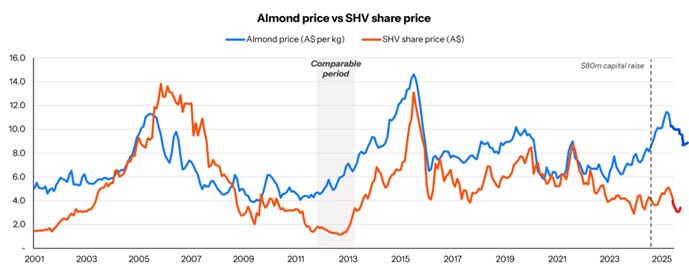

Almond Price Impact on SHV Share Price

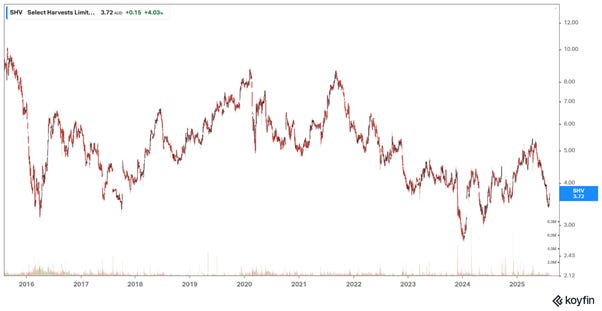

Despite a strong correlation between almond prices and equity values, there are periods of significant disconnect which can and do occur.

Somar Capital ran a fantastic long-term analysis on this – showcasing that between Oct 2011-Oct 2012 the almond price surged by ~60% with very little response in SHV’s share price.

However, over the ensuing 6-months, SHV’s share price experienced a meaningful 140% re-rating to effectively re-establish this correlation.

Source: Somar Capital Partners, Tenva Capital 2025 adjustment to reflect impact of Objective Estimate on prices.

The recently depressed SHV share price suggests that a similar disconnect between the almond price and SHV’s equity value has occurred.

July 2025 Objective Estimate

Each year the USDA National Agricultural Statistics Service (NASS) conducts what is termed an ‘Objective Estimate’ to garner the size of the incoming crop in California.

This is done via sample collections from orchards and taking a view on yields.

In July 2025, the industry was absolutely rocked by what proved to be a much larger objective estimate than anticipated at 3B lbs.

Consider that if the 3B lbs proves out with a 550M lb carry-in to the 25’ year, then net saleable supply would be 3.55B lbs for the ’25 crop year. Given 2.7M lbs in total shipments, this could feasibly lead to the highest carry-in on record heading into the ’26 crop year of 850M lbs; a highly bearish signal for near-term price and Californian growers.

As such, this news resulted in the single greatest weekly Stratamarkets almond price reduction on record – a $0.45 USD/lb weekly reduction. At this point, prices had fallen $0.87 USD/lb from the peak price in May of $3.34 USD/lb down to $2.47 USD/lb.

Prices have since found a floor and have started to creep back up again with the latest Stratamarkets update detailing a price of $2.64 USD/lb.

Immediately after the July Objective Estimate, SHV’s share price took a beating, with slight recovery in recent days.

However, there remains industry scepticism over the procedural methods for how NASS arrived at a 3B lb Objective Estimate.

For example, in this Australian Almond Board Webinar, Professor Abe Padilla argues that NASS simply took a 15-year average of yields to land at a 2160 lbs/acre figure, instead of considering the cash-strapped conditions farmers have been dealing with over the past 4-5 years in California. Mr Padilla - alongside other industry experts - argue that lower fertilizer applications as a result of these harsh economic conditions means it will be very difficult for yields to meaningfully recover from the last 3 years’ average. (Source: Almond Board of Australia).

Source: Spectrum Data Analytics.

Admittedly, I hold no strong views as to whether the 3B lb estimate will prove accurate.

However, I believe the fallout from this estimate is largely priced in and therefore that its optics have created the conditions for a highly attractive entry point into Select’s equity.

In the chance the 3B lb estimate does prove correct, I believe this will only serve to further bolster the long-term thesis.

The higher carry-in into the 26’ crop would further depress prices and result in another year of horrendous economic conditions for Californian farmers.

These conditions would only serve to accelerate the removal of almond acres and solidify the trend of a lack of new plantings into an environment with unknown access to critical water resources.

Hence, in the long run it would only perpetuate the cycle of almond prices being bid up, enabling Select to earn material profits.

SHV Valuation

Free Cash Flow potential

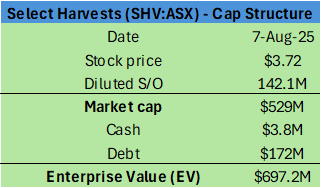

Today, SHV’s market cap is $529M.

Assuming SHV reach their normalized 29,000 MT target in the coming years due to enhancements in its horticultural program, its’ cost of production would be $6.77 AUD/KG.

Capex in FY24 was ~$22M and in FY23 it was ~$27.6M. Let’s conservatively bake-in $30M in annual capex on a normalized basis.

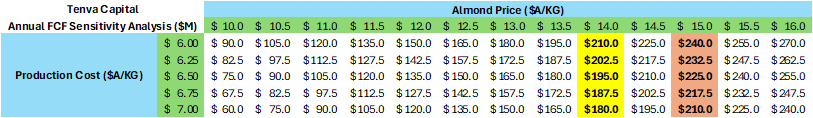

The below Free Cash Flow sensitivity analysis is telling:

In yellow is the previous cycle high prices.

In red is the minimum of where I believe prices need to go for greenfield investment to even be considered in California. This is the equivalent of $4.40 USD/lb.

Under this scenario, assuming a $6.75 AUD/KG cost of production, SHV will generate $217.5M in annual free cash flows. This is a 41.3% FCF yield to today’s market cap or a 2.4x P/FCF multiple.

Whilst it’s impossible to predict exactly when this price response will happen, I ultimately believe the market is completely asleep at the wheel here, fixated on short-term irrelevant data points like the Objective Estimate which inevitably has no relevance to the long-term overarching thesis.

In a world where SHV does ~$217.5M annual Free Cash Flows, slapping a conservative 8x multiple on this – i.e. in line with previous cycle highs - would see the stock would trade at $12.24 per share – 229% higher than the last traded price of $3.72.

While we may not reach this price for years, the only thing that really matters here is that new supply is already meaningfully being hampered.

Thus, so long as this supply-demand imbalance continues, we should still see positive pricing pressure long-term.

Granted, the 3B lb Objective Estimate poses a very real risk for lower almond prices in the short-term.

Despite this, I am more than happy to hold through this fallout – however it may look - and have treated the lower prices it has induced as a buying opportunity into what is a wonderful long-term set-up.

For further context, Selects’ FY25 crop was already 75% covered prior to the objective estimate release. As such the pain felt by any market volatility will be minimal compared to Californian growers due to annual crop timing differences.

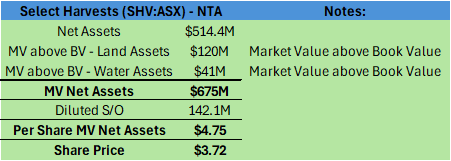

Market Value of NTA

Today, SHV trades conservatively below the market value of its Net Tangible Assets of $4.75 per share. As such, limited free cash flow generation is being priced in by the market. This inevitably highlights the wide margin of safety at today’s share price of $3.72.

EV/Acre

EV/Acre has averaged ~$38k over the last 10 years.

During the last cycle high, EV/Acre peaked at ~$75k.

Given 22,643 planted acres, if we trade at the same ~$75K EV/Acre level in the next upswing then the stock would trade at $10.38 per share. This represents 179% upside from the last traded price of $3.72.

Risks

Agricultural assets are prone to environmental factors and risks that are completely outside of the company’s control which could have a material negative impact on annual crop yields and orchard health.

Conclusion

If you’re able to hold a 3-5+ year view, then whichever way you look at it, an investment in Select Harvests today poses a highly attractive IRR profile with a wide margin of safety attached.

As demand growth for almonds remains steady, SGMA groundwater pumping restrictions will result in structurally diminished global almond supply.

I believe this dynamic will materially boost the price of almonds, resulting in Select generating over 40% of today’s market cap in annual Free Cash Flows.

Despite this, today’s market remains solely focussed on short-term noise which is completely irrelevant to the overarching long-term thesis.

Thanks for reading! Let me know if you have any thoughts, pushback or questions in the comments below.

Also, if you have any suggestions on other names I should look into, drop me a line at info@tenvacapital.com or @TenvaCapital on X.

This is a reader-supported publication so if you enjoyed this write-up, please consider subscribing below, sharing this with a colleague or friend and hitting the like button. Your support is always appreciated!

Disclaimer

Tenva Capital, its associates and/or entities controlled by its associates hold shares in the company referred to in this post.

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

Very detailed and great reading.

Great article. Do you have any concerns about the impact of the 'tax summit' being held next week by the government? In particular the impact of the proposed 5% cashflow tax.