WM Technology (MAPS:NASDAQ)

2.6x EV/EBITDA with misunderstood take-private optionality.

*Note: (As of 27th of June 2025, this idea is closed).*

Welcome back Tenva Capital readers!

Below I present you a new investing idea with multiple avenues to win from today’s dirt-cheap levels.

If you’re finding my work valuable, please share it with a friend or colleague and subscribe below for more in-depth research on overlooked and undervalued stocks. Your support is very much appreciated!

Thesis Overview

I believe WM Technology (MAPS: NASDAQ) is trading as a widely misunderstood stock.

In December 2024, a non-binding proposal for a potential take-private was tabled by its original founders at $1.70 per share.

The stock today trades at $1.02 – implying little to no chance of a deal going through.

However, a number of meaningful incentives exist for MAPS’ original founders to stall but ultimately consummate a deal.

I believe a drawn-out timeline to closing a deal is fundamentally part of the playbook to purposely manufacture a sense of investor hopelessness and desperation such that upon any definitive bid the chances of deal acceptance by the special committee and shareholders on the cheapest possible terms is maximized without triggering an SEC investigation into potential misconduct.

Weedmaps is the largest online marketplace in the U.S. connecting consumers with licensed cannabis businesses.

WM has stabilized its business despite the major industry woes which continue to plague its clients. I believe today’s entry price of $1.02 – implying an FY25 EV/EBITDA multiple of 2.6x – is far too cheap.

In the event of a deal break, any sign of business growth should at a minimum see the stock retrace in line with a 4-5x EBITDA multiple, as was the case in early December 2024, prior to the announcement of any potential take-private deal.

As such, an investment in MAPS today offers significant upside potential in the form of a definitive take-private deal within the next 6-12 months at $1.70 or higher, whilst also offering an attractive margin of safety for investors.

Historic Trading Dynamics

WM Technology listed publicly on June 16, 2021, after the $1.5B merger with special purpose acquisition company (SPAC) Silver Spike Acquisition Corp. Following the merger, the stock began trading under the MAPS ticker.

MAPS traded as a typical cannabis darling stock during the pandemic. However, mass cannabis oversupply inevitably led to significant price deflation. Following this, post-pandemic normalization saw the crash of any stock even slightly associated with the cannabis industry with both margins and profitability taking a major hit across the board. MAPS - despite representing an indirect offshoot of the cannabis industry - was not spared.

Since trading under the MAPS ticker (post the June 2021 merger), the stock has traded as high as $22 (June 2021) and as low as $0.60 (April 2023).

Average Daily Traded Volume over the last 3 months is approximately ~$850K USD.

Capital Structure

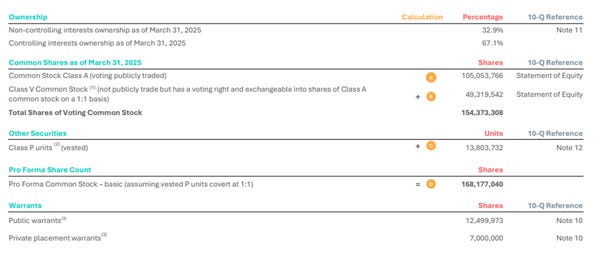

MAPS has a complex cap table due to listing with an Up-C structure.

The company has a markedly clean Balance Sheet with $53M in net cash.

The pro-forma diluted share count is 168.2m shares outstanding.

(Note: there are another 19.5m warrants with a strike of $11 that I exclude from the calculation as they are far too out of the money).

Original founders Doug Francis and Justin Hartfield hold a combined economic interest of approximately 39.5% in the company through their Class A Common Stock and partnership units exchangeable for Class A Common Stock.

Mr Francis, who is also WM’s CEO, controls ~22% of the entity whilst Mr Hartfield controls ~17.4%.

Source: WM Technology 2025 Definitive Proxy Statement

Backdrop

It’s important to now consider and understand the industry backdrop from a legal and recent trends perspective before we dive into company specifics.

Legal backdrop

At a federal level, cannabis is deemed a Schedule I controlled substance under the Controlled Substances Act (CSA) in the U.S.

In practice, this means cannabis is considered among the category of substances most dangerous for human consumption, with a high potential for abuse and zero accepted medical use under U.S. federal law.

Despite recent bi-partisan messaging regarding a reclassification of cannabis to a Schedule III controlled substance, bureaucratic slow-walking ultimately seems to have stalled this process into the foreseeable future.

Despite this, most states across the U.S. have legalized recreational and/or medicinal cannabis use.

As such, in practice, the federal government does not enforce the CSA in these states.

State-legal businesses must get licensed and operate in accordance with their respective state laws.

MAPS only allows licensed operators to advertise products on its Weedmaps platform.

Schedule 280E

Despite this workaround, the tangible economic reality of a Schedule I classification is extremely grim for all state-licensed operators.

IRS Section 280E is a critical provision in the U.S. Internal Revenue Code which prohibits businesses engaged in the ‘trafficking’ of Schedule I or II controlled substances from deducting ordinary business expenses except for their Cost of Goods Sold.

In effect, this means state-legal operators must pay taxes on their gross profit rather than net profit before tax.

This leads to punitive effective tax rates, oftentimes between 70-90% of pre-tax income.

A reclassification of cannabis to Schedule III on the other hand would ultimately invalidate Section 280E.

Recent Industry trends

States with mature legal markets saw a large temporary spike in cannabis demand during the COVID-19 pandemic.

This was predominantly due to a combination of stay-at-home measures and widespread government economic stimulus, which meant that on average, consumers purchased a lot more cannabis than in previous times. For example, in 2020, U.S. cannabis sales surged to $18 billion, a 67% increase over 2019.

This combined with hype of a Schedule III reclassification under the Biden administration resulted in widescale production ramps as well as a rise in new market entrants to meet what industry participants anticipated would be a sustained demand spike.

Yet things quickly turned sour for the industry post-pandemic as cannabis demand waned. Suppliers had overproduced and ultimately were left with far too much product.

As a result, prices took a significant hit. The average retail price dropped 32% from 2021 across U.S. markets, as of late 2024.

As can be expected, revenues, margins and profitability of licensed cannabis operators have therefore taken a major beating in the last few years.

Moreover, the 280E tax burden - alongside other punitive state taxes - have further contributed to the dire situation for state-licensed operators who must also attempt to somehow outcompete the much cheaper black market.

Unsurprisingly, mass consolidation of the industry has taken place, and this process continues to play out today.

All in all, increased competition, excess supply, price deflation and increased costs have left the licensed cannabis industry on its knees. Most listed cannabis stocks have thus suffered majorly impaired equity values since their pandemic peaks.

Weedmaps – The platform

WM technology (MAPS: NASDAQ) operates a leading online cannabis marketplace in the U.S. called Weedmaps.

The platform is simple to understand.

Weedmaps provides a marketplace for licensed cannabis businesses across the U.S. to list, sell and advertise their cannabis products to consumers.

Unlike the clients they serve, Weedmaps does not touch the product in any way, shape or form, and as such, is not subject to the punitive restrictions of Section 280E.

Weedmaps clients are the cannabis businesses who pay a monthly subscription fee to list and advertise their products on the platform.

Founded in 2008, WM has cemented its position overtime as the largest and most recognizable online and legal two-sided cannabis marketplace at scale within the U.S. The platform enables American consumers to discover, learn about and ultimately purchase cannabis-related products in a seamless fashion.

Moreover, businesses can increase their brand awareness via featured deal listings and other ad solutions. These platform offerings provide clients with discount and promotion pricing tools as well as other premium ad solutions.

WM restricts the number of featured listings to a fixed monthly number in each region. As such, it runs a competitive auction process whereby cannabis businesses bid for this premium advertising space each month.

Approximately 70% of WM’s revenues are derived from featured and deal listings, whilst the remaining 30% is derived from flat-rate subscription fees.

As of Q1 FY25, there were 5,179 Average Monthly Paying Clients who inevitably list and advertise their products on the platform. Average Monthly Revenues per Paying Client was $2,871 in Q1 FY25.

Founded in 2008, WM Technology listed publicly on June 16, 2021, after the $1.5B merger with special purpose acquisition company (SPAC) Silver Spike Acquisition Corp during the COVID SPAC craze.

The company has taken advantage of the first-mover ‘winner takes most’ dynamic of a typical two-sided marketplace.

The nature of this powerful virtuous cycle means that as more consumers browse the platform, the offering for WM’s clients becomes more attractive. As WM’s clients grow, the platform becomes more content-rich with increased products, featured listings and discounts that fundamentally better the offering for prospective Weedmaps consumers.

In 2024, WM clocked $184.5M in sales, whereas it’s closest competitor, Leafly, did $34.6M. Leafly has subsequently been relegated from the NASDAQ to the OTC markets.

The pertinent reality for Weedmaps is that traditional digital advertising players have posed limited competition to date due to the scheduled nature of the substance at the federal level. In future, these brands are highly unlikely to venture near any advertising of Scheduled substances - whether that be Schedule I or Schedule III - which ultimately further embeds the moat Weedmaps already has operating in the licensed cannabis space.

The lack of standardization means a significant variation in product quality and safety profile of cannabis products exists. As such, a platform which enables informed purchasing decisions via up-to-date product descriptions and reviews ultimately fulfils a pivotal need for cannabis consumers from both an information and health and safety standpoint.

SEC Issue and Management

Weedmaps was recently caught up in a scandal whereby previous management falsely inflated its Monthly Active Users (MAUs) by counting non-engaged visitors redirected from pop-up ads, skewing performance metrics and indicating platform user growth to the market that was highly misleading.

In the second quarter of 2022, an internal complaint regarding the calculation, reporting and definition of their MAUs was received by WM’s BoD. A special committee was formed to conduct an internal investigation.

It was at this point where original founder Doug Francis stepped back in and returned to Weedmaps in an operating role as the Executive Chair.

In 2008, Mr Francis co-founded Legacy WMH, the predecessor company to WM Technology. He served as the Company’s President from 2009-2016 and as CEO from 2016-2019. Mr Francis was appointed Chairman in 2019, serving in that role until 2021 when he became a member of the WM BoD.

In August 2022, the company’s BoD - now led by Mr Francis – voluntarily reported the internal complaint and subsequent internal investigation to the SEC. Following this, the SEC commenced their own formal investigation into the matter.

Not long after, the CEO at the time Chris Beals stepped down in November 2022, whereby Mr Francis officially commenced as temporary CEO. On June 30, 2023, the CFO at the time Arden Lee also resigned.

Upon charges laid by the SEC in September 2024 for making negligent misrepresentations regarding the MAUs of Weedmaps, both Mr Beals and Mr Lee each paid a $175,000 fine and accepted three-year bans from serving as public company officers. The company paid a $1.5M fine which was received by the SEC in October 2024 and thus settled the matter in its entirety.

Sources:

https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26127

https://www.sec.gov/files/litigation/admin/2024/33-11309.pdf

As of Q3 FY22, the company elected to no longer report its MAUs.

Mr. Francis officially became the permanent CEO in November 2024 – citing “the great long-term opportunities that would come with federal legalization” as the reason for shifting from a temporary operating role to a permanent one. Today, Mr Francis is also chairman of the board.

Reading between the lines, it appears Mr Francis stepped back into an operating role at Weedmaps to rehabilitate the reputation of the company he founded in 2008, has long been involved with ever since and has a ~22% economic interest in (with more potentially on the way as we will soon get to).

Financials

Despite the shambolic nature of the manipulated MAUs, the company crucially disclosed that the issue has had no impact on any GAAP or non-GAAP financial metric reported.

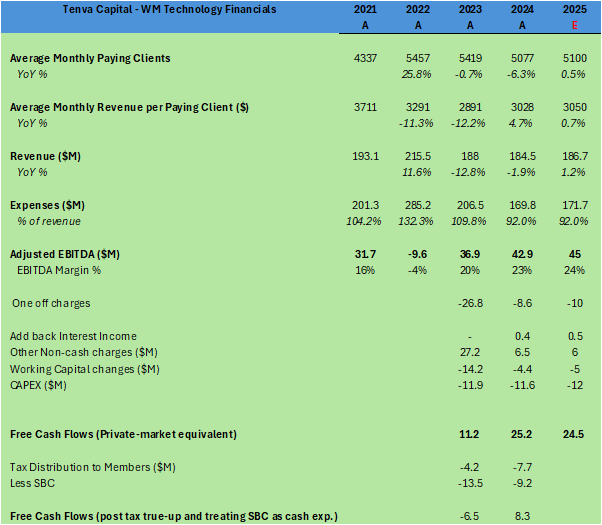

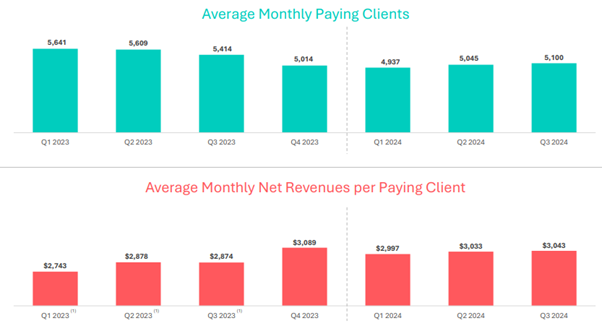

From late 2022, the number of Weedmaps paying clients began to steadily decline due to a combination of forces driving industry consolidation and Weedmaps choosing to clean up its client-base, prioritizing cashflow collection from delinquent clients and the removal of businesses from its platform that were unable to pay its dues.

Average Monthly Paying Customers fell from 5,689 in Q4 FY22 to as low as 4,937 by Q1 FY24.

Average Monthly Revenue per Paying Client fell from a peak of $3,810 in Q1 FY22 to as low $2,997 in Q1 FY24, before recovering for the rest of the year on a sequential basis.

Crucially, the number of Average Monthly Paying Clients began to sequentially tick up again from Q1 FY24 for the remainder of the year.

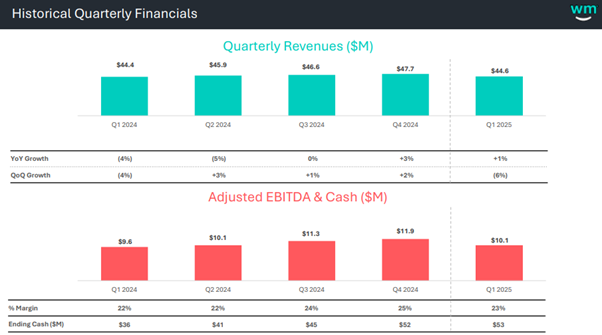

Despite weaker Average Monthly Client Revenues in Q1 FY25, this was more than offset by the increase in Average Monthly Paying Clients to deliver higher Revenues and Adj. EBITDA on a YoY basis.

Therefore, despite the beaten down share price, MAPS is today operating as efficiently as it has since it publicly listed, exhibiting expanding YoY EBITDA margins on what looks to now be a stabilized revenue base.

The company continues to beat heavily sandbagged guidance and has recently been doing >$10M Adj. EBITDA quarters.

WM has no debt and has consecutively added to its cash stack for the last 7 quarters. As of Q1 FY25, MAPS had $53M in cash.

Moreover, Adj. EBITDA on a yearly basis has continued to sequentially increase since FY22 and the company continues to generate significant underlying Free Cash Flows.

WM looks on track to generate around $45M in Adj. EBITDA for 2025, with a strong Q1 result of $10.1M that it should build on for the rest of year.

Despite all this, Weedmaps today trades at disturbingly cheap levels of 2.6x EV/EBITDA or 4.7x EV/FCF (~6.8x post the tax true-up to original founders).

Despite harsh industry conditions, this is far too cheap for any SaaS company that is not in terminal decline, let alone one that spits out annual Free Cash Flows to the tune of greater than 20% of the present EV.

The bid

There are indeed other factors at play here, however.

On December 18 2024, Mr Francis, alongside co-founder Justin Hartman, launched a non-binding proposal for a take-private at $1.70 per share.

Recall that combined, these founders have an economic interest of 39.5% of the company.

It’s important to understand a few key dynamics before we can fully digest the circumstances of the offer and what this subsequently means for the MAPS stock into the future.

Equity Compensation Package

As touched on earlier, Doug Francis first stepped back into the arena as Executive Chairman at Weedmaps in mid-2022, taking on the role of temporary CEO in November 2022. It was then announced he would transition to a permanent CEO role in November 2024.

Interestingly though, in November 2024, Mr Francis was granted what could in no uncertain terms be classified as an extremely bullish Equity Compensation Plan.

The potential reward granted was ~8.7m shares, or approximately 5.2% of the company. Half of this grant was tied to achieving a 30 day VWAP in excess of highly bullish strikes of $3.25 and $5.

Source: Form 4 - Douglas Francis - 12 November 2024

Reading between the lines by framing this compensation package within the context of MAPS’ corporate governance policies, one is left to ponder whether there were indeed ulterior motives at the time of this grant?

After all, the firm has extremely friendly Change-in-Control (CiC) provisions which mean these shares would all vest up-front for Mr Francis in the event of any CiC.

Below is an excerpt from the company’s 2021 Equity Incentive Plan which outlines this:

Source: WM Technology 2021 Equity Incentive Plan

Moreover, Mr Francis and Mr Hartfield changed their 13D filing status in May of 2024 - prior to the said equity compensation grant to Mr Francis – which explicitly stated they were now evaluating a potential transaction for the company:

Source: Schedule 13D Update - May 31 2024

Then in December 2024, an amended 13D was filed which disclosed a confidentiality agreement had been struck between the original founders and the company on October 29 – crucially prior to the equity compensation grant – which stipulated “a possible negotiated transaction with or involving WM Technology.”

Source: Updated 13D - December 18 2024

Mike/Nongaap Investing wrote a brilliant piece in Dec ‘24 putting these pieces together in-depth and I highly recommend giving it a read:

To summarize this chain of events:

A May 2024 13D filing indicated Mr Francis and Mr Hartfield were looking into a potential transaction for WM.

Mr Franics then became permanent CEO in November 2024 and promptly gets issued an incredibly bullish compensation package with extremely friendly CiC terms that would ensure all these shares vest up-front, upon any potential CiC transaction.

After this, we learn that a confidentiality agreement was struck in October – critically taking place prior to Mr Francis’ equity compensation grant and his appointment as permanent CEO - regarding a “possible negotiated transaction.”

To spell out the obvious, it seems abundantly clear that Mr Francis was highly conflicted upon commencing his role as permanent CEO such that his equity grant - which makes up 5.2% of current shares outstanding - comes across as a clearly pre-meditated attempt to expropriate shareholder value from minorities, given we now know that a potential transaction was being discussed prior to the commencement of his new role and prior to this highly contentious equity grant.

Highlighting Weedmaps’ latent embedded value

It is now time to turn our attention to how incredibly valuable a take-private transaction would inevitably be for Mr Francis and Mr Hartman in the long run.

To illustrate, let’s consider the scenario where at some point in the future a reclassification of cannabis to Schedule III occurs. The tax savings from clients no longer needing to abide by 280E would undoubtedly free up a plethora of incremental marketing dollars that could now be allocated towards further advertising on the platform. After all, Weedmaps essentially monopolises the U.S. online licensed cannabis marketplace.

It would also enable Weedmaps to charge a take-rate on the Gross Merchandise Value (GMV). Note, management have completely acknowledged this is their long-term opportunity upon a rescheduling. From their most recent 10Q:

“We also have a significant opportunity to monetize transactions originating from users engaging with a retailer on the Weedmaps marketplace or tracked via one of our Weedmaps for Business solutions. Given U.S. federal prohibitions on plant-touching businesses and our current policy not to participate in the chain of commerce associated with the sale of cannabis products, we do not charge take-rates or payment fees for transactions originating from users who engage with a retailer on the Weedmaps platform or tracked via one of our Weedmaps for Business solutions. A change in U.S. federal regulations could result in our ability to engage in such monetization efforts without adverse consequences to our business."

Source: 10Q - Q1 2025

A back of the napkin estimate of GMV can be conducted.

The last time Weedmaps reported their MAUs was in Q2 FY22. At this time, 17.4 million MAUs were recorded. As per the Q2 FY22 results release, we know that 65% of this figure was distorted and represented non-engaged visitors redirected from pop-up ads. Hence, only 6.09 million true MAUs.

Let’s assume this has fallen to only 4 million MAUs today – in line with the cannabis industry downturn. Conservatively assuming just a $50 spend per user per month would imply $200M in monthly GMV or $2.4B in GMV per year. Assuming Weedmaps clipped just a 2% take-rate would land us at an additional $48M in revenues that would fall straight to the bottom line.

This hypothetical exercise does not imply any incremental marketing dollars being allocated towards increased listings on the Weedmaps platform which would undoubtedly be meaningful.

Clearly, this a majorly accretive long-term opportunity for the Weedmaps brand, and whoever happens to own it.

Considering WM did $42.9M in EBITDA just last year in FY24, and given all of the above, I believe an annual EBITDA figure of $100M would be a conservative starting point for how to think about MAPS’ earnings power if a reclassification to Schedule III were to take place.

A conservative 8x EBITDA multiple on this earnings power would equate to an equity value of ~$5.07 per share.

However, even at just a $2 share price, Mr Francis’ recent equity compensation package is worth an extra $17.4M in his pocket, rather than that of minority shareholders, upon any CiC transaction.

Avoiding an SEC Investigation

It would be well within the SEC’s jurisdiction to thoroughly investigate the particularly sly set of circumstances surrounding the conflicted nature of the CEO appointment and equity compensation grant.

The SEC has only recently concluded an enforcement action with respect to the conduct of WM and previous executives. This is something Mr Francis (and Mr Hartfield) would clearly want to avoid being caught up in themselves in the event of another potential investigation.

But most importantly, I believe they have the strongest incentive to avoid any issues with the SEC due to how incredibly valuable the company would be worth to them long-term, as stipulated above, if they are able to successfully consummate a take-private transaction whilst the company still generates trough level earnings and free cash flows.

Moreover, shareholders are rightly extremely frustrated with the conduct regarding the circumstances of this equity grant. As such, I am increasingly unsure whether Mr Francis and Mr Hartfield would get the votes they require in a ‘majority of minority’ vote scenario given they do indeed lob a definitive take-private bid of just $1.70 per share.

As such, what is the best way to navigate this slippery slope of a situation?

How do they ensure the special committee approves a deal, that shareholders vote to accept this said deal, that the SEC stays off their back and most importantly that they get to retain all the significant long-term upside to themselves?

Well, I for one can think of only one way.

That is to bump your eventual definitive bid in excess of the non-binding proposal of $1.70 per share, which would ultimately go completely against the grain of investor expectations manufactured by the dragged-out deal timeline.

This would inevitably weaken any possibility of an SEC investigation into a potential manipulated equity compensation grant– as the founders could therefore argue that they had a genuine belief of attaining these strikes in due course - whilst also ensuring shareholders vote to accept the proposal as the special committee has requested a ‘majority of minority’ shareholder vote would be needed for any deal to close.

Deal timeline

Upon launching their non-indicative take-private bid for $1.70 per share, founders Doug Francis and Justin Hartman went out of their way to indicate that they “expect to be in a position to execute a definitive agreement in 3-4 weeks.”

Source: WM Technology Press Release

Yet here we are 6 months later, and still no definitive take-private offer has been tabled.

Drawing out the deal process well in advance of the initial indicated timeline does indeed serve the founders in a multitude of ways.

Firstly, it contributes to optics of a deal-break. This inevitably contributes to a manufactured sense of hopelessness and desperation amongst remaining shareholders, which predictably has a negative impact on the share price, the likes of which we’ve seen recently, as investors have dumped the stock upon suspecting a deal-break.

This manufactured negative investor psychology, which has shares currently trading at $1.02, ensures it is eminently more probable that a deal gets accepted by the special committee and shareholders, if and when it is eventually tabled, as opposed to had the stock still been trading in the $1.30-$1.40s region that it was in the first few months following the non-binding take-private announcement on December 18 2024.

It is not at all within the interests of the founders to have issues with either the special committee or shareholders with regards to any potential definitive take-private offer for the company. This is because of the chain of events that led to Mr Francis becoming permanent CEO and being granted his extremely CiC friendly equity compensation package that, if pursued, would probably result in grounds for another SEC enforcement matter.

As such, for a deal to be accepted by shareholders – a bumped bid that is closer in line with the strike prices of Mr Francis’ equity compensation package would be the only acceptable means to ultimately ensure the avoidance an SEC investigation, whilst also ensuring a deal gets accepted by shareholders.

In summary, I believe a purposely drawn-out timeline for closing this deal has fundamentally been part of the playbook all along in order to manufacture a sense of investor hopelessness and desperation which negatively affects the stock and subsequently increases the chances of deal acceptance on any future definitive offer by the special committee and shareholders on terms that will ultimately avoid an SEC investigation, yet will be acceptable to shareholders, such that the deal inevitably closes.

As such, my view is that the market has got this wrong and I believe a deal will be tabled in the next 6-12 months, most likely at terms higher than a $1.70 share price.

I believe any definitive bid 25% or more than the initial non-binding take-private bid of $1.70, would most likely be high enough to satisfy deal acceptance from both the special committee and frustrated minorities in a ‘majority of minorities’ vote scenario.

Prior Trading Dynamics

To understand the margin of safety embedded in MAPS at today’s share price of $1.02, it’s important to consider fundamentals and understand how the stock traded prior to the announcement of the non-binding take-private proposal.

In Q3 FY24, MAPS announced a third consecutive quarter of growth and stabilization in key metrics.

As such, the stock traded at a low of $0.72 in November 2024 straight through $1.40 in early December, just a month later, before re-tracing back down to $1.11 by December 16, in what was a difficult month for small caps across the board.

Upon the announcement of the non-binding take-private on the 18th of December the stock traded as high as $1.63, before settling between a $1.30-$1.40 trading range for the next 3 months.

After this, investor fatigue sunk in, given most expected a definitive deal to have already been finalized. As such the stock has recently retraced back down to the $1-$1.10 range, with last close at $1.02.

Should a deal no longer be pursued, Mr Francis and Mr Hartfield would have to file an updated 13D – of which to date, there has been no update filed.

On the downside, in the instance that I am wrong about the nature of this take-private deal, I am comfortable with the margin of safety at a share price of $1.02, which ultimately implies a 2.6x EV/EBITDA multiple – far too cheap for any stock not in terminal decline.

MAPS will also be entering new Hemp markets in the back half of FY25. This incremental investment which has mostly already been made has yet to hit the income statement and should ultimately serve as another potential earnings booster for the company.

As a result of the above, I believe there is a hugely baked in margin of safety with the stock trading at today’s levels of $1.02. Given the cheapness of the stock today, versus where MAPS traded independent of any potential take-private deal, I don’t believe any deal break price would land much lower than 10% from today’s levels. I believe the fatigue in the share price mostly stems from the actions of the board/management and the lengthy drawn-out deal process that most had expected to be finalized by now.

Risks

A key risk in the short-term is any scenario whereby a full deal-break occurs. The stock would most likely trade lower. However, as stated above, I believe we are already trading at levels today that indicate close to 0 chance of a deal going through and as such don’t believe the stock would trade much lower than 10% below the last traded price of $1.02, absent any unfavourable news with regards to the fundamentals of the company.

The founders’ inability to obtain financing to put forward a definitive bid presents as another key risk factor. However, the initial confidence in their capacity to obtain financing indicated in the non-binding take-private proposal letter whereby Mr Francis and Mr Hartman stated “We expect to be in a position to execute a definitive agreement in 3-4 weeks” gives me confidence that this is unlikely to be the case. In saying that, the macro environment has most certainly changed a lot since December 2024 and continues to evolve in unprecedented ways. As such, this remains a real risk, especially given the somewhat controversial nature of cannabis.

Successful shareholder class action lawsuits with regards to the former manipulation of the MAUs which could eat into the company’s net cash position.

Over a longer time horizon, in the event of a deal break, one could make the argument that Mr Francis and Mr Hartman would be more aligned with keeping the stock price depressed such that they can later attempt to take it private on the cheap again. There are 2 key facets which make this situation unlikely in my mind:

1. Evidence that the industry has already bounced from trough levels and is slowly undergoing a recovery such that even if they wanted to do this, they would miss the boat.

2. The former SEC case means this company and its office holders are already subject to heavier scrutinization than a typical company and antics which go against the fiduciary duty of the board and management would clearly increase the chances of another SEC enforcement action – an overhang which makes it highly unlikely that the original founders would try something like this on.

Summary

The chances of a definitive take-private offer are being miscalculated by the market. There are meaningful incentives for a purposely delayed deal process that will ultimately enable the founders to take the company private on the cheap whilst avoiding an SEC investigation.

I believe the stock is today trading at dirt-cheap levels. An EV/EBITDA of 2.6x is far too cheap for any company not in terminal decline, let alone a SaaS company generating substantial Free Cash Flows.

In the event of a deal-break, further evidence of stabilization or growth in earnings should see the stock trade in line with at least a 4-5x EBITDA multiple at minimum over the medium term.

Thanks for reading! Let me know if you have any thoughts, pushback or questions in the comments below.

Also, if you have any suggestions on other names I should look into, drop me a line at info@tenvacapital.com or @TenvaCapital on X.

This is a reader-supported publication so if you enjoyed this write-up, please consider subscribing below, sharing this with a colleague or friend and hitting the like button. Your support is always appreciated!

Disclaimer

Tenva Capital, its associates and/or entities controlled by its associates hold shares in the company referred to in this post.

The information contained in this article is not investment advice and is of general nature only. All communications made by Tenva Capital and/or its associates are for informational and/or entertainment purposes only. This article has been prepared without taking into account your particular circumstances, nor your investment objectives and needs. This article does not constitute personal investment advice and you should not rely on it as such. This article does not contain all of the information that may be required to evaluate an investment in any of the securities featured within. Before making any investment decision, you should do your own work and/or consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement.

Forward-looking statements are based on current information available to the author, expectations, estimates, projections and assumptions as to future matters. Forward-looking statements are subject to risks, uncertainties and other known and unknown factors and variables, which may affect the accuracy of any forward-looking statement. No guarantee is made in relation to future performance, results or other events.

Tenva Capital and its associates make no representation and give no warranties regarding the accuracy, reliability, completeness or suitability of the information contained in this document. Tenva Capital and its associates will not be responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of this post or any communications made by Tenva Capital and/or its associates.

Tenva Capital Pty Ltd (ABN: 37 685 431 690) is a Corporate Authorized Representative (AR: 001314552) of New Horizons Financial Services Pty Ltd (ABN: 63 638 4701 117) which holds an Australian Financial Services License (AFSL: 522392).

Thank you for the in depth analysis, very helpful.

I also wrote about $MAPS a while ago. Feel free to check my substack (https://substack.com/@swissiechad/p-162543932) and X account. I challenge you on valuation, I think headline numbers look better than they actually are. Still think the set-up is a good one.

In any case, I am still long with unchanged sized (c. 2.5% NAV).

$LFLY currently trades OTC on the pink sheets. However, they are going private and cashing out via a 1:500 reverse split. One could make $60 per account at $LFLY's current price (less any trading for OTC stocks) if one were so inclined. They filed to de-register with the SEC and the transaction is imminent.

Long $MAPS. Agree with your thesis generally 👍